Frank Häusler, Vontobel’s Chief Investment Strategist, believes that emerging markets can be a real playground for active investors. “Emerging markets are certainly an investment universe, but not one for a passive approach,” said Häusler at a Vontobel investment conference in Zurich.

In the past, choices were essentially restricted to sectors such as commodities or energy, but nowadays stock markets in emerging markets resemble those in the US. “They have technology, they have consumer goods, and they have companies with massive brands, some of which barely operate in our countries,” said Häusler, referring chiefly to China. At the same time, it is important to separate the wheat from the chaff within sectors, which in turn implies actively selecting portfolio positions and not, for example, buying a global index fund, added the investment strategist.

Emerging market equities and certain bond segments as drivers

An investment firm such as Vontobel with a long-term horizon works on the basis of seven to 10-year forecasts. Based on these estimates, emerging market equities are likely to generate the highest returns, even when translated into other currencies, such as Swiss francs. In the fixed income area, the highest returns also come from emerging markets securities, especially bonds denominated in hard currencies such as the US dollar and the euro, as well as corporate bonds in emerging market currencies, Häusler explained.

Risks in fact rather moderate

Investors interested in emerging markets always inquire about the risks, but these in fact seem rather moderate. Emerging market equities have experienced significant declines eight times in the last 30 years. The correction, measured by the high before such an event and the low afterwards and known as the drawdown, averaged 41%. Over the same time period, western stock markets corrected seven times with average drawdowns of 42%. In addition, emerging market equities also recovered again quickly and mostly returned to pre-crisis levels after about 12 months.

Emerging market investments are generally efficient from a risk/return perspective, added Häusler. This is true of equities and bonds generally, but especially for the emerging markets corporate bonds segment.

In the past, emerging market equities always generated better returns than their counterparts in the west when economic development in emerging market countries eclipsed that of the west. Given the expectation that emerging markets will likely experience more rapid growth than industrialized countries, it seems possible that emerging market stock exchanges will outperform in the next five to seven years.

Emerging market bonds are performing similarly dynamically, with the government bond index denominated in hard currency – which in 1994 was dominated by four countries – now containing a wealth of issuers from a whole range of backgrounds. The same pattern can be seen for corporate bonds. Corporate bonds from the largest individual provider, China, account for almost 7.5% of the overall market.

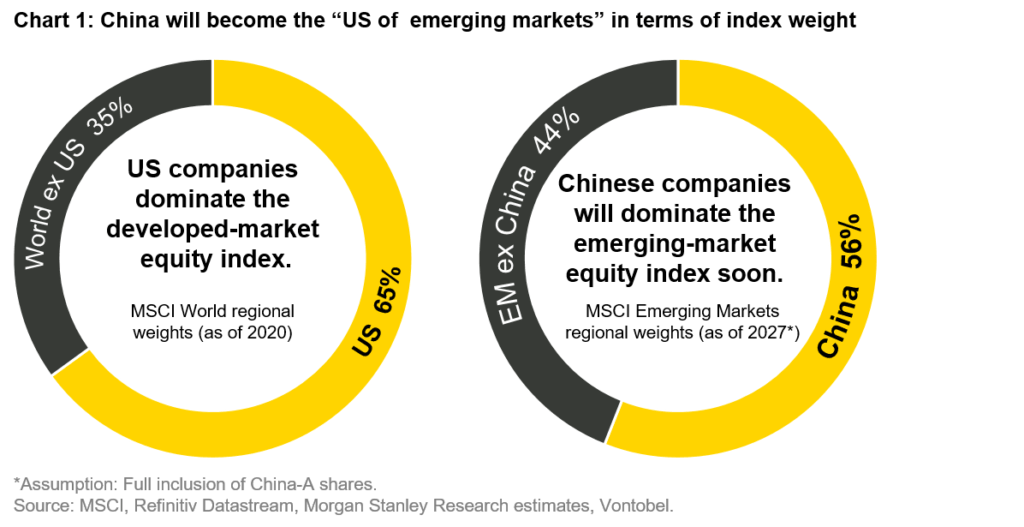

Various estimates assume that Chinese companies could make up about 56% of market capitalization in the MSCI Emerging Markets Index in 2027, explained the investment strategist. For reference, the US equities market accounts for 65% of the developed-market index (see chart 1).

Not just China

Reducing emerging markets to just China is a mistake. “China helped emerging markets grow, but something that is often forgotten is that emerging markets excluding China also grew more quickly than developed countries, with one exception in the late 1990s,” said Häusler. Despite all this euphoria about growth, however, it is important to keep things in perspective. The United States remains the world’s largest economy and even the European Union is far larger than, for example, India. Regardless, China’s share of the global economy will continue to increase even if its growth rates become more modest.

One of the problems facing China is known as the “middle income trap”, where many people successfully attain a moderate level of income but not much more. Furthermore, China’s working population will shrink over the next few decades, as Japan’s did in the 1980s, which in turn will depress the potential growth of the Chinese economy. The only way the country will be able to counter this is by increasing productivity. In light of economic concerns, a more aggressive foreign policy could act as a sort of outlet for the Chinese government, although this path would likely lead to conflict with the United States.

At the moment, however, focus remains on domestic policy. This aims to ensure that the population at large continues to share in the country’s growing prosperity. Preventing a widening gap between rich and poor requires fairer education and healthcare systems. It is in this context that the case of the indebted real estate developer Evergrande is interesting. To set an example, the Chinese government is not coming to the company’s assistance but at the same time it is painfully anxious to avoid a real estate crisis in the country.

Emerging markets shine in terms of inflation

While inflation has suddenly become a nightmare haunting developed countries, emerging markets have seen inflation rates of between 3% and 4% in recent years. “What is interesting here is that inflation in emerging markets has in some cases been less volatile than in industrialized countries,” said Häusler. In this respect, China has even proved a stabilizing factor. This can partially be explained by the fact that central banks in many emerging markets are truly independent and act accordingly.

Which sustainability aspects to consider?

Environmental, social and governance standards (known as ESG) that companies are required to comply with to attract capital are increasingly important to investors, including in emerging markets. Emerging markets have a vested interest in getting a handle on environmental issues, explained Häusler. There is less of a focus on the “social” aspect, but especially in China – where the government has implicitly promised growth – it is playing an increasingly important role. He believes the greatest challenge is corporate and state governance, as numerous issues remain unresolved here in a centralized country such as China.