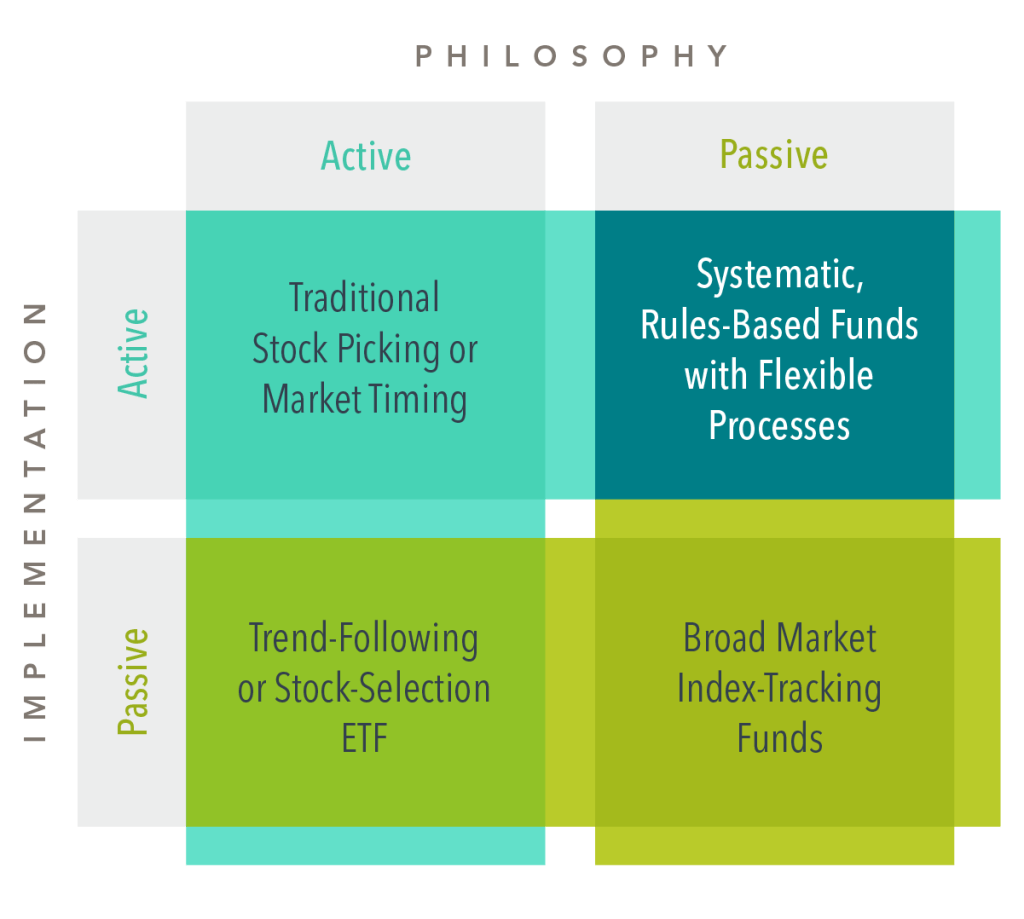

Our last two installments focused on why index fund assets should not necessarily be characterized as passive. An important corollary of this lesson is that traditional definitions of “active” and “passive” have diminished in relevance.

The genesis of index funds originated from a tacit admission that active investing strategies predicated on identifying mispriced securities were not consistently successful. In other words, investing in index funds was a way of expressing a belief in the power of markets.

Fast-forward a few decades, and the link between index funds and an embrace of markets is less clear. The rise of thematic ETFs—which allow one to magnify exposure to everything from millennial investing to pet care services—opens the door to using index funds as market timing tools. Clearly, this is antithetical to the spirit of embracing market prices.

On the flip side, active investing no longer means questioning market prices. Non-index strategies can deviate from the market in a systematic fashion based on rigorous academic research using what market prices tell us, rather than trying to outguess those prices.

In terms of implementation, any strategy not tracking an index is active. But an active strategy based on a belief in markets may be more in the spirit of the original intent behind “passive investing” than many of the index funds saturating the market.

EXHIBIT 1