This month’s UKEI Bulletin highlights a strengthening domestic outlook, with firmer retail sales, improving PMIs, rising consumer confidence, and a better-than-expected fiscal position. Combined with attractive UK valuations, improving fundamentals, and early leadership rotation, this suggests meaningful domestic upside potential. Global signals remained mixed: US consumer confidence weakened, while Europe showed early signs of improvement.

Economic Developments

We highlighted last month that early signs suggested the UK November Budget may have acted as a clearing event for confidence and activity. Further evidence this month suggests this was indeed the case. Retail sales by volume grew 0.4% month-on-month and by 2.5% year-on-year, ahead of expectations. Retailers’ Christmas trading updates suggest this strength held despite a soft start to December. The GFK consumer confidence survey reported its strongest reading since August 2024 (just before Kier Starmer’s infamous rose garden speech). Notably, the measure of willingness to make a major financial purchase reached its highest level in five years. The S&P UK PMI survey, a reliable forward indicator of economic activity, rose sharply from 51.4 to 53.9 – its highest level since April 2024 – driven by stronger readings across higher value-added services, including the financial sector and technology.

UK inflation rose modestly to 3.4% in December from 3.2% the month before but was still lower than the 3.6% in October with the latest reading driven higher by tobacco and air fares. Markets had expected a modest rise before inflation starts to fall again in 2026, particularly in Q2, when the base effects of the National Insurance increase last year drop away. Encouragingly, the December Budget Deficit was materially lower than expected, falling from £18.7bn a year ago to £11.6bn in 2025. This was driven both by tax receipts being +8.6% year-on-year and Government spending only rising 1.0% year-on-year, compared to double digit increases over the summer. From April to December, the £140.4bn deficit was slightly lower than a year earlier, despite earlier speculation by some commentators that it would rise sharply in 2025–26.

Given these stronger economic indicators and better finances, it was no surprise to see Sterling strengthen over the month, by around 2% vs a weakening US Dollar. Two-year bond yields were flat, but expectations for further Bank of England rate cuts in Q1 2026 have eased slightly given the evidence of a strengthening economy. However, a couple of rate cuts still look likely during the year as inflation fades towards 2%.

Whilst much of the commentary around the US, focused upon President Trump’s erratic behaviour, indicators from the real economy remain mixed. Corporate confidence remains relatively high with the composite PMI still well above 50, helped by the AI data centre capex boom. Employment markets look to have stabilised too, with monthly layoffs close to a two-year low. Consumers, however, appear to have become more unsettled by Trump’s constant aggressive rhetoric on trade and territory, as well as signs that inflation has become somewhat sticky around 3%. Consequently, the Conference Board’s US consumer confidence survey recorded the weakest reading since 2014, even lower than immediately post Liberation Day in April 2025. The new Fed Governor will have some difficult decisions to make over the next few months. As mentioned above, the USD was particularly weak during the month, driven by both the political uncertainty, the mixed economic news, as well as an admission from Trump that he was happy with a weaker currency.

Bond yields in Japan rose sharply during the month, with both 10- and 30-year yields up more than 20bp. This move was smaller than earlier in the month, when talk of intervention and a watering down of fiscal priorities began to circulate. Despite sharp falls at the end of the month, gold and silver still rose 13-20% during January as fears of currency debasement continued. In Europe, German activity indicators are showing early signs of improvement, following the easing of fiscal constraints. The book-to-bill ratio for manufacturing rose to its highest level for three years and is likely to strengthen further as funds are released progressively during 2026.

Performance

The UK market began the year strongly. The FTSE All-Share Index rose 3.14% in January. The Fund significantly outperformed the market during the month, returning 4.86%.

January has seen a broadening out of performance from a market cap perspective with the FTSE 250 outperforming the FTSE 100. This has benefited the Fund, which has a roughly a 50/50 split between FTSE 100 and FTSE 250 / small cap holdings. Looking at the peer group, the Fund ranked 1st decile in the Equity Income sector over the month. On a longer-term basis, the Fund ranks in the 1st decile over 3-, 5- and 10-year periods. The Fund remains the best in the sector since its inception in 2004, and over the last 10 years. (Source: Lipper as at 31 December 2025)

The theme of positive updates that we saw through most of last year continued in January with a majority of the Fund clearly on the front foot. The Fund’s relative outperformance during the month was primarily driven by this theme:

First, we had a number of positive trading updates from our asset management names (c. 7% of the Fund). Ashmore (up 33% relative), a specialist Emerging Markets investment management, reported its first quarterly net inflow since 2021. Flow dynamics also continued to improve at Rathbones and Polar (+11% and +9% relative respectively), with the latter also announcing its first share buyback programme.

In addition, the turnaround at Schroders (+8% relative) continued to gain traction with the re-focused company reporting strong operating profit growth, cost control, and net flows.

Second, our retailers also delivered another set of strong results. Currys (+12% relative) peak trading update prompted further upgrades on top of those already announced in December. DFS (+10% relative) reported further market share gains and raised profit guidance, whilst Marks and Spencer (+12% relative) has now firmly regained momentum following the disruption caused by a cyber-attack last Spring. These companies continue to trade at highly attractive valuations on a normalised earnings basis whilst growing revenue and taking market share. Together, our retail exposure accounts for c. 7% of the Fund and we would expect this positive operating momentum to continue as the macro backdrop improves.

The Fund’s mining and industrial exposure performed well. Glencore returned +25% relative as shares responded positively to both higher copper prices and the potential merger with Rio Tinto (+10% relative). We discuss this in greater detail in the activity section. Vesuvius shares rose strongly (+14% relative) on the back of an improving outlook for European steel. The stock remains a classic case of trough earnings on trough valuation.

On the theme of corporate activity, Picton (+10% relative) announced it was undertaking a strategic review and formal sale process. As discussed in previous editions, the Fund saw very little M&A activity in 2025, suggesting it may be due a catch-up move in that area.

Partly offsetting the above positive trends was Aviva (-10% relative) which fell on market concerns over the motor insurance premium cycle. Recruitment stock PageGroup (-15% relative) was weak, although we are seeing early signs of improvement in their end markets and although Ibstock reported earnings in line with guidance, the stock fell 12% relative, as RMI markets remain subdued. We believe the upside is significant on a normalised basis and it will – along with the broader RMI sector – benefit from lower interest rates and government policy.

Lastly, the Fund also benefited from weakness in a number of void stocks in the ‘quality compounder’ bucket including Experian (-20%), RELX (-13%) and Sage Group (-10%). We continue to believe this part of the market is vulnerable to further multiple contraction.

Portfolio Activity

We sold three stocks in the Fund in January.

As we noted last month, we had been selling Sainsbury’s into strength purely on valuation grounds. Operationally, it has been one of the best performers in the Fund over the last two years, but on a 13-14x PE it is expensive, relative to the rest of the Fund. We also sold our position in Central Asia Metals. We have been frustrated by the operational performance at its Sasa zinc mine. Other factors behind the decision include governance issues, questions over capital allocation decisions and the lack of any transaction to diversify the business, given the finite life of its current copper operations. The recent rise in the copper price created share price momentum that we sold into. The copper price move will also make it strategically more difficult to execute a diversifying M&A transaction. Across the life of the Fund’s ownership, Central Asia Metals made a small contribution to relative performance.

We also exited Drax as it made new share price highs. Above 925p it falls below the Fund’s dividend yield criteria. Drax quadrupled across the life of the Funds ownership, and has been a material contributor to Fund performance.

We added two new stocks to the Fund.

Early in the month, Rio Tinto announced it was in talks to effectively acquire Glencore. As noted above, this accreted Fund performance in the near term. We would view this transaction positively if it consummates. In our view, it would create significant value — c. 50% upside to the combined market cap. This would be driven by synergies and balance sheet capacity, but more materially a re-rating from a low pro forma valuation of c. 5x EBITDA to 7x EBITDA. The latter would be justified, as the combined group would rank among the world’s largest copper producers, offering the strongest copper growth and one of the best free cash flow profiles in the industry. The combine would be the go-to miner globally from an investment perspective and would also become the 3rd/4th largest stock in the FTSE 100. Our overweight position in Glencore would have been neutralised by the void in Rio Tinto in a potential all-share combination. We created an overweight position in the combined business, via the purchase of Rio Tinto on the day the discussions were announced, exploiting initial weakness in Rio Tinto. As the positives of the transaction were more widely appreciated, Rio Tinto added c. 10% over the residual part of the month. The Fund is c. 75bps overweight the potential combination.

The second new stock added in January will be profiled in due course once, and if, a full position is established.

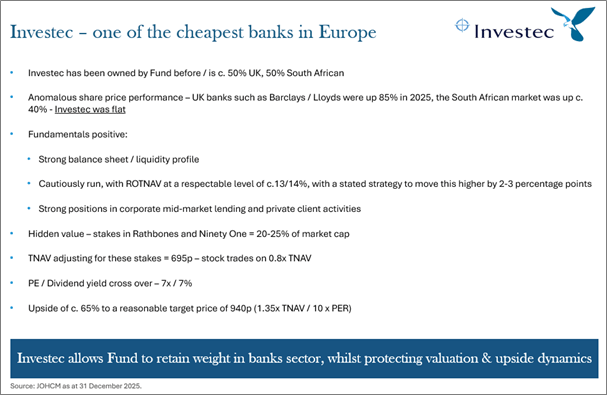

We also continued to add to recent addition Investec. Below is a copy of a new slide which articulates the rational for owning it. It is now c. 125bp of the Fund. We also continued to slowly increase our position in GSK, which weakened across the month.

Other additions included stocks that were also weak. As noted above, PageGroup weakened post its full year update. The stock is now on an extremely distressed valuation with a net cash balance sheet. As noted there are initial signs that the business is troughing, e.g. 38% of its sales by geographic market are growing. Other stocks added to over the month were Aviva, Whitbread, Zigup and NewRiver Retail. Despite the strong performance over the last couple of years and year to date, we are still skewed to the buyside, with very little to sell.

Other reductions included International Personal Finance where we are waiting for the now confirmed bid to consummate and marking Ashmore, which was strong as discussed above, to 100bp.

Outlook

One of the features of 2025 was narrow leadership and the outperformance of the FTSE 100. The two charts below show this. The chart on the left shows ten stocks in the FTSE 100 generated c. 80% of the total performance and on the right the degree of outperformance of large caps over small- and mid-caps.

2025 UK Market Leadership – Unprecedented Concentration

The Fund is void some of the names that dominated last year (e.g. defence and Astra Zeneca) as they don’t meet our dividend yield or valuation criteria. It is also underweight the FTSE 100 by c. 35%, with a 50% large cap and 50% mid/small cap tilt. Despite these headwinds, the Fund slightly outperformed the market last year, with its main performance drivers also being narrow — the banking and insurance sectors.

These observations are important because the Fund exited last year with significant elements of it still languishing on wide valuation discounts, leaving the portfolio in aggregate with what we view as meaningful upside potential. This is evident on an absolute, stock-by-stock basis, as illustrated by some of the examples above, and on a relative basis in the chart below. The chart shows the price-to-book of the Fund (the bottom line) vs. the price to book of the market (the top line). The gap between the two lines is the widest it has been since we started the Fund 21 years ago, with the exception of one month, which was early in Q4 last year. This position has been created by the narrow leadership last year and the underperformance of mid- and small-cap stocks. The valuation architecture of the Fund remains very attractive.

Narrow Leadership Leaves the Fund Near Historical Lows vs. UK Market

It is interesting to see that some of last year’s trends are reversing at the start of this year. Size leadership has shifted, with the FTSE 250 up c1% more than the FTSE 100, and several previously dominant index constituents have begun to roll over. Given the large valuation differentials, we would expect these trends to continue, which should be supportive of the Fund’s relative performance.

The other key trend is the continued strong operational performance of the majority of the Fund’s holdings. As we note above this was again very evident in January, with broadly strong updates, positive dividend surprises, and additional evidence of boards pursuing actions to unlock value, as seen at Picton and Glencore. We have noted before that c. 85% of the Fund is on the front foot in this regard. The confluence of low valuations and this strong fundamental picture was the other key driver of returns in January. The other 15% of the Fund is moving through the bottom of the cycle e.g. UK housing-related stocks, the recruitment sector, and engineers. There were glimmers of positivity in certain names in this bucket during January, which given the ultra-low valuations, were met with material share price moves. The stocks in these areas have material upside, so if these glimmers become more enduring, these stocks will also drive significant Fund outperformance over the next 18 months.

As we said last month, equity markets have continued to perform more strongly than many commentators expected, particularly since Liberation Day. While US valuations look rich, the AI-related capex boom has provided a narrative to justify higher multiples. That narrative appears unlikely to be challenged in the short term but represents a risk as the year progresses. Investors must remain vigilant given the high level of AI-related optimism already reflected in valuations. The valuation differential between the US and UK, alongside the emerging positive developments noted in this update, should encourage a broadening of asset allocations and help narrow this gap.