Yields Spike, Costs Lag

Markets can reprice JGBs overnight, but the real fault line between volatility and vulnerability is...

The US dollar is lower against most currencies so far this year. Some extreme commentary has dubbed it the ‘debasement’ trade. Others say it is...

Markets can reprice JGBs overnight, but the real fault line between volatility and vulnerability is when the effective interest rate surpasses growthJapan’s ultra-long-bond sell-off has been dramatic enough to revive...

Markets can reprice JGBs overnight, but the real fault line between volatility and vulnerability is...

The Fed held rates steady as competing inflation and labor market risks gave most policymakers...

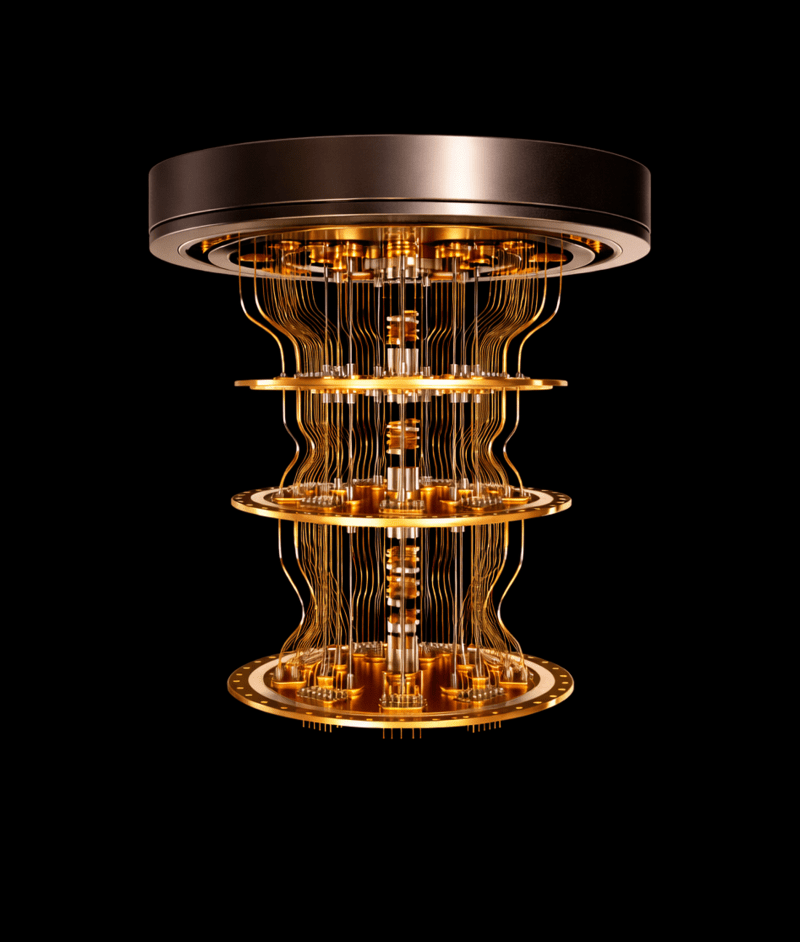

In this insight, we outline what quantum computing is – before examining its most promising...

DDQ Invest chats to Simone Mallardi, Senior High Yield Analyst

M&G Special Situations Podcast

The CIO’s view of the week ahead. The week in review Last week...

Entering 2026, clearer fiscal and monetary signals support a more risk-on outlook, as...

Silver’s New Playbook:AI, Defence and the Power Build-Out Shifting Demand (and Risk) Profile...

Inflation in China accelerated at its fastest pace in nearly three years in...

This lunch event will bring together leading fixed income experts, portfolio managers, and...

Hôtel Métropole Genève

This lunch event will bring together leading fixed income experts, portfolio managers, and...

Mandarin Oriental Savoy, Zurich

The week in review US jobs growth slowed more than...

“When machines begin to understand, reason and act in the...

Investors had a brief reprieve from geopolitical surprises at the...

In a recent meeting I was asked if I was...

Some of the most popular Tags on DDQ Invest right now

We organized the 2021 GIS Geneva Conference which took place at the Beau Rivage Hotel, Geneva. The event kicked off with an intriguing Global Macro CIO discussion comprising Guy Kohemun, Annelise Peers, Norman Villamin (韋立民), and hosted by the wonderful Carolin Roth. Thank you to our fantastic sponsors Eurizon SLJ Capital, Federated Hermes – International, […]

We organized the 2021 GIS London Conference which took place at the Hotel Café Royal. To recap, we started off the day with a very insightful Global Macro CIO discussion including Alan Higgins, Caroline Simmons, Chris Iggo, Sir John Redwood, Haydn Jones, Charles McGarraugh and hosted by the wonderful Carolin Roth. Thank you to our […]

We organized the 2021 GIS Zurich Conference which took place at the Marriott Hotel Zurich. To recap, we started off the day with a very insightful Global Macro CIO discussion including Dr. Burkhard Varnholt, Dan Scott, Philipp Bärtschi, Thomas Wille, and hosted by the wonderful Carolin Roth. Thank you to our fantastic sponsors Eurizon SLJ […]

We organized the 2021 GIS Zurich Conference which took place at the Marriott Hotel Zurich. To recap, we started off the day with a very insightful Global Macro CIO discussion including Dr. Burkhard Varnholt, Dan Scott, Philipp Bärtschi, Thomas Wille, and hosted by the wonderful Carolin Roth. Thank you to our fantastic sponsors Eurizon SLJ […]

DDQINVEST talks to Larry Hatheway, Founder of Harbor Advisors about Inflation with Carolin Roth.

DDQINVEST talks to Christina Church, Head of Sustainable Investments, Lombard Odier about the ESG Investment Funds with Carolin Roth.

DDQINVEST talks to Andreas Wosol, Head of Value, Amundi Asset Management about the shadow of growth investing with Carolin Roth.

A chance to capture the essence of the GIS Conferences organised by DDQ INVEST in Switzerland since 2008

DDQINVEST talks to Steve Kenny, Director of Wholesale Business about Client Services.

The weekend’s operation in Venezuela and the capture of Maduro have further heightened geopolitical tensions. The development has led to...

This commentary covers the key takeaways for the listed commodities. Click the (x) next to the sectors to see the...

Following a recent research trip to Taiwan and South Korea, Naomi Waistell, Co-Fund Manager of FP Carmignac Emerging Markets, highlights...

How to assess our approach to technology sector equities since the launch of Carmignac Portfolio Tech Solutions? 2024 was a...

Disclaimer: Professional Investors Only

This website is intended exclusively for professional investors as defined under applicable laws and regulations. It is not designed for retail investors or members of the general public.

By accessing this site, you acknowledge and agree to the following terms:

The content provided is strictly for informational purposes and does not constitute financial, investment, legal, or tax advice.

Any investment decisions based on the information contained herein are made at your own discretion and risk.

The operators of this website are not responsible for any losses or damages resulting from reliance on the provided information.

If you do not qualify as a professional investor, please refrain from accessing this website and exit immediately.

Accept & Continue Exit Website