Does the market action and outlook resemble early 2016 or late 2018? Let’s recap those time periods to help the reader at home:

2016: Economy in mid-cycle

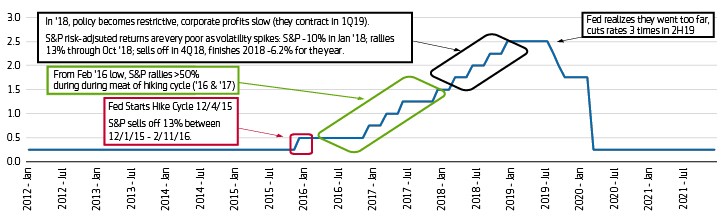

The Fed did its best Grinch impersonation by starting its post-global financial crisis (GFC) rate hiking cycle on Dec 5, 2015. Sniffing out the rate hike a few days before, the S&P 500 started selling off, ultimately resulting in a -13% decline over roughly a two month stretch. However, the equities market rallied the rest of the year, recouping the January and February losses and finishing up 9.5% on the year (11.9% total return), according to the S&P 500. In 2017, the market posted a total return of 21.8%.

Side note: After a dismal performance for roughly 2.5 years post taper tantrum, emerging market equities outperformed posting a total return of over 80% from early ’16 – early ’18, according to the MSCI Emerging Markets Index. We believe the asset class is worth watching after dismal ’21 performance.

2018: Economy in late-cycle

In 2018, monetary policy turned restrictive as the Fed was on the backside of nine hikes (peaking at 2.5%). The economy started feeling the effect, with GDP only growing 1.4% in the second half of 2018. Corporate profits slow sharply in the second half of the year and contract in the first quarter of 2019. Equity markets post a decline of -6.2% for the year (-4.3% total return), according to the S&P 500, and risk adjusted returns were very poor.

Exhibit 1: Fed Funds Target – Upper Limit

Yes, every cycle is different. But to us, the macro backdrop is much more aligned with 2016 than 2018. Specifically because:

- Unless something changes drastically in the macro picture it is still supportive for risk assets. The economy is slowly normalizing, currently in mid-cycle, consistent with central banks starting their policy tightening.

- The market is already discounting four rate hikes this year and three next year. We believe it will take a lot to raise that bar higher.

- Earnings should be decently higher a year from now while ramped up buybacks and M&A will likely add support. Also, the credit markets aren’t sending any warning signs of impending doom.

- Technicals show the crowd is very fearful right now; the Ned Davis sentiment indicator went into extreme pessimism (bullish) for the first time since the start of the pandemic; put/call ratio is off the charts (people very fearful, buying protection).

- Frankly, what we see is a rotation trade out of the frothy speculative stuff (bitcoin-related, non-profitable tech, IPOs, etc.) into quality (hello FTSE 100), which echoes our Global House View: ‘The Beta trade appears to be over, prefer quality assets that are levered to above-trend nominal growth, but are price sensitive given mid-cycle. This ‘grind phase’ of the markets tests patience and nerve, returns more pedestrian, utilize pullbacks.

- This pullback was long overdue, but unless the 10-year Treasury is going to zoom to 3%, we would caution extrapolating too far under current conditions (i.e., that this is a much larger/longer cycle ending correction).

Important disclosures

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon AM is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon AM nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, the following wholly or partially owned affiliates may also conduct certain business activities under the Aegon Asset Management brand: Aegon Asset Management (Asia) Limited (Aegon AM Asia).

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM US is also registered as a Commodity Trading Advisor (CTA) with the Commodity Figures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon AM Asia is regulated by the Securities and Futures Commission of Hong Kong (CE No. AVR688) to carry out regulated activities in Dealing in Securities (Type 1) and Advising on Securities (Type 4).

©2022 Aegon Asset Management or its affiliates. All rights reserved.

AdTrax: 4234537.1.GBL

Exp Date: March 31, 2024