China’s growth is slowing as policy makers adopt a framework that aims to achieve a more equitable society. The common prosperity goal will still present attractive opportunities for investors. Despite increased domestic policy uncertainty, the country’s rising economic and market dominance over the long term still warrants a standalone allocation to China.

At the point of writing1, China’s economy is in the midst of recovering from the impact of a number of regulatory crackdowns on selected sectors including the internet platforms, private education and real estate. The crackdowns are part of a new common prosperity policy which aims at improving “equality and equity”.

Achieving common prosperity

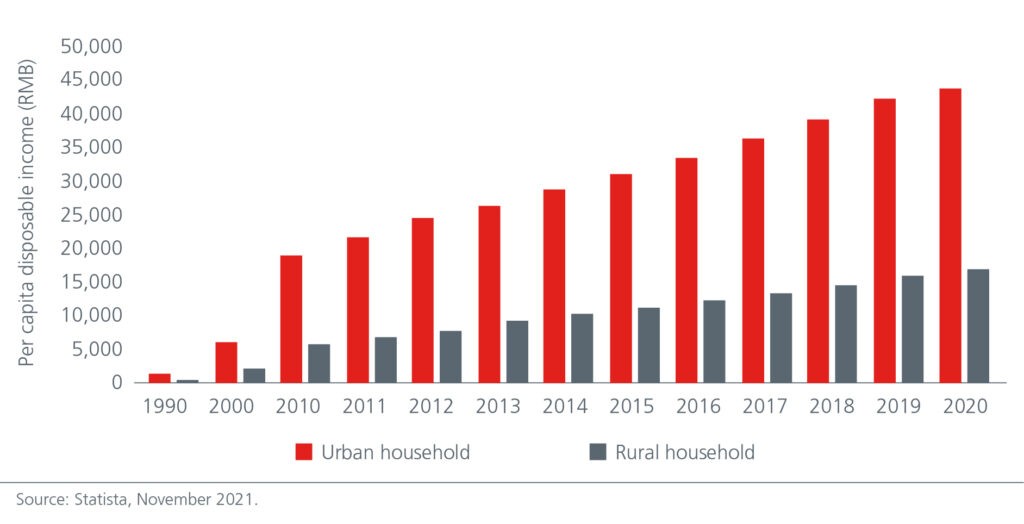

Common prosperity became a new policy priority since it was put forward by President Xi in August 2021. At the start of the COVID pandemic in early 2020, global central banks including the People’s Bank of China injected massive amounts of liquidity into the market to underpin economic growth. Asset prices including the stock and housing markets rallied strongly as a result, worsening the inequality in China. The new common prosperity framework aims at improving “equality and equity” by expanding the middle-income population and enhancing the living standards of the lower-income groups. Besides the regulatory crackdowns on selected sectors, taxation may also be used to help redistribute income.

China’s income inequality has widened

We expect the common prosperity policy to have significant impact on the healthcare, consumer and technology sectors. For example, access to basic medical services and drugs will likely be enhanced. Further expansion of the centralised procurement of pharmaceutical drugs could exert more downward pressure on drug prices. Consumption could be boosted as income is more equitably distributed. Nonetheless, the possibility of a higher consumption tax may hurt high end products such as Baijiu (Chinese liquor).

While China has cracked down on some technology sectors, we believe that policymakers are cognisant that technology can level the playing field and will continue to contribute to the country’s progress. The emergence of the Internet for example has eliminated information asymmetry and promoted rapid development. Financial innovation has increased efficiency and lowered the cost of financial intermediation. Artificial intelligence and the rising usage of robots in manufacturing have reduced costs while raising manufacturing flexibility. This has benefitted consumers. Even in new energy vehicles, technology played an important role in lowering the costs of new power systems, while enhancing the user experience.

Rebalancing China’s growth

The regulatory crackdowns in 2021 have hurt the earnings of China’s internet giants and weighed on their share prices. The real estate sector, which accounts for 15% of China’s GDP, also experienced severe strain as developers struggled to gain access to credit while home sales and property investments fell. If ancillary industries such as furniture sales, building materials, home appliances, etc. are included, this figure may amount to nearly 25%. These developments are likely to cause a marked slowdown in China’s 2022 GDP growth towards the 5% level. Meanwhile, producer prices as measured by the Producer Price Index are likely to have peaked in Q4 2021 while consumer prices would probably remain stable in the 1.5-2% range, helped by price controls and softening demand.

As a result of the slowdown, China’s policy makers may ease policy by cutting the Reserve Requirement Ratio (RRR), inject liquidity or provide targeted credit support. The government may also accelerate infrastructure spending. While the government is likely to maintain its stance that “homes are meant for people to live in and not for speculation”, some marginal easing on the property sector such as a reset of quotas on mortgage loans cannot be ruled out.

China’s slower GDP growth is expected to have a relatively limited impact on the developed markets such as the US and Europe given their sizeable domestic economies. China’s slowdown would largely be felt by countries that export significantly to the mainland or rely on it for capital inflows. This would include Singapore, South Korea, Malaysia and Vietnam where China is a significant export destination. Meanwhile, Australia, Chile and South Africa also export large amounts of commodities to China. China’s foreign direct investments to South America and Africa could also moderate. Although China’s slowdown could weigh on the emerging and Asian economies, we believe that the economic drag can be offset by fiscal pump-priming. On balance, China’s slower growth will weigh on global growth but is unlikely to derail the global recovery.

Investment Implications

Despite the recent road bumps in China’s growth trajectory, the dominance of China’s economy and markets in Asia and the Emerging Markets (EMs) is likely to continue over the next decade. This warrants a standalone allocation to China.

China equities – Under the common prosperity policy framework, an expanding middle-class population will lift consumption and especially benefit companies that can offer goods and services which appeal to the millennials, Gen Z and young families. Technology companies in the hardware, Artificial Intelligence and New Energy segments should also fare well. Local healthcare companies which can offer high quality and low-cost products and services may also benefit. On the other hand, the education and real estate sectors are unlikely beneficiaries as the government seeks to reduce unnecessary expenses for consumers.

As China’s share of the MSCI Emerging Markets Index is expected to reach 50% in the coming years, investors who want a more diversified exposure to the other EMs can include an Emerging Markets ex China strategy. We believe that the often-ignored stocks in the other EMs also present exciting opportunities and substantial upside potential for value investors.

China offshore bonds – The Asian High Yield bond market experienced significant volatility in 2021 on the back of an unprecedented liquidity squeeze in the China property sector. The volatility even extended to healthy investment grade issuers.

We believe that the speed and extent of the market sell-off are inconsistent with the improvement in the leverage ratios of the property developers since Aug 2020 as they moved to comply with the three red-line framework. We expect further policy fine-tuning to be underway to help ease the liquidity squeeze and the sector may bottom in Q1 2022. A key event to monitor is when the property developers are able to tap the onshore bond market again. Given the broader economic implications of a hard landing of the property sector, the Chinese government would be inclined to prevent further contagion. As such, we view the market sell-off to be excessive and believe it presents an attractive entry point into China property credits that can weather the current challenging market conditions.

In the longer term, we expect the China property sector to emerge stronger with companies that have healthier balance sheets and greater financial discipline. Funds that have a significant exposure to the China property sector but with a good track record of avoiding defaults may be better positioned to benefit when the sector rebounds.

China onshore bonds – Amid slower economic growth and stable inflation in China, monetary easing and policy support should help to underpin the China onshore bond market.

The funding conditions for Local Government Funding Vehicles (LGFVs) and State-Owned Enterprises (SOEs), which are the key issuers in the onshore bond market, have improved since April 2021 as the central and local governments sought to avoid systemic financial risks. We expect this policy stance to continue into 2022 although the weak property sector may affect local governments’ finances. We do not expect large scale defaults in this segment, but do not rule out negative headlines concerning LGFVs with heavy financing burdens. Credit differentiation and detailed fundamental analysis remain key.

Contributors:

Andrew Cormie, Director, Global Emerging Markets and Regional Asia Equities, Eastspring Singapore

Boon Peng Ooi, Head of Eastspring Portfolio Strategies, Eastspring Singapore

Michelle Qi, Head of Equities, Eastspring China

Wai Mei Leong, Portfolio Manager, Fixed Income, Eastspring Singapore

William Xin, Head of Fixed Income, Eastspring China