The massive infusion of tight policy in ‘22 should start to really take hold of the economy in ‘23

Vanilla recession is mostly likely outcome, with symmetrical risks

Don’t confuse a Fed pause with pivot

Remain cautious on risk-adjusted returns and still prefer higher-quality assets

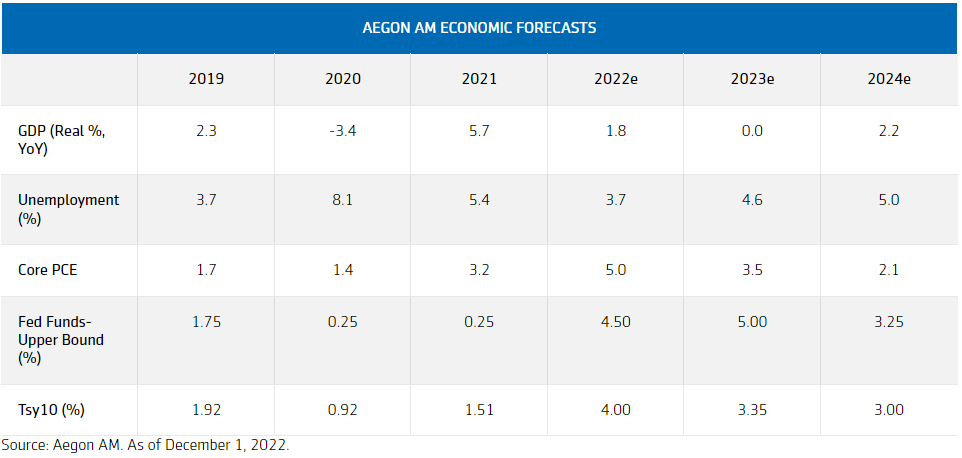

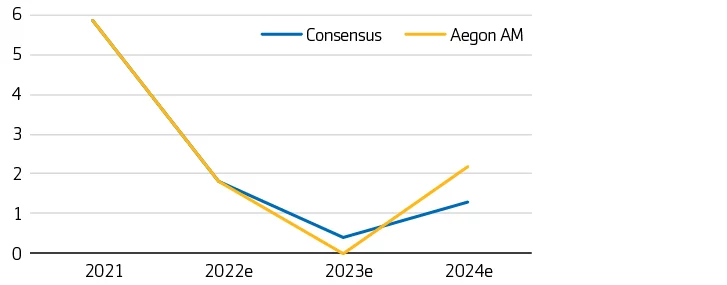

Following significant monetary tightening in 2022, we expect the cumulative effect of a higher cost of capital to work its way through the economy in 2023, slowing both inflation and growth. Therefore, the overarching theme of 2023 is that restrictive monetary policy should cool inflation but likely at the cost of creating a recession. Note, this is more negative than the current consensus which calls for a soft landing/growth recession. The upshot for our forecast is that washing the deck clean faster should allow for a larger rebound, illustrated by our ’24 forecast ahead of consensus.

Exhibit 1: Annual US GDP growth

As investors look to the Fed for signals of a potential policy shift, it will be important to not confuse a pause for a pivot—the Fed is likely to pause and leave rates at a sufficiently restrictive level for a lengthy period of time before it contemplates a rate cut. What’s more, before pausing, the Fed is expected to slow the pace of rate hikes as it attempts to evaluate the impact monetary tightening has had on the economy.

The Fed has consistently recognized elevated, persistent inflation as one of the greatest near-term risks to the economy. Like the Volcker Fed of the 1980s, the Powell Fed is primarily focused on fighting inflation in this tightening cycle. This “Volckerized” Fed mode is different from previous tightening cycles where inflation was subdued, and the primary driver of policy was moderating growth to prevent a boil-over from occurring. The main implication of this difference translates into a policy rate that is “higher for longer.”

2023 is where the ‘rubber’ of this Volckerized policy rate meets the ‘road’ of economic activity. The result is demand destruction which will ultimately bring aggregate supply/demand back into equilibrium and rectify the recent broad price pressures; however, in a $25 trillion economy, this re-balancing takes time.

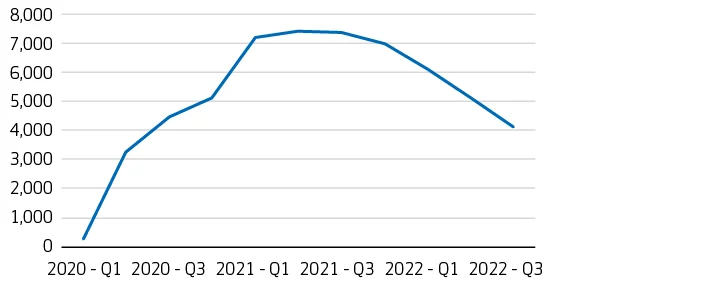

We have already seen the consumer being squeezed. Faced with higher interest rates, lower real incomes, lower household net worth, and waning fiscal support, households have increasingly drawn on excess savings built up during the pandemic in order to sustain their consumption patterns. If these drawdowns continue at their current pace, excess savings will be depleted by mid-2023 and, in the process, expose the contraction in real purchasing power.

Exhibit 2: Cumulative excess savings (Baseline Q1 20 in billions)

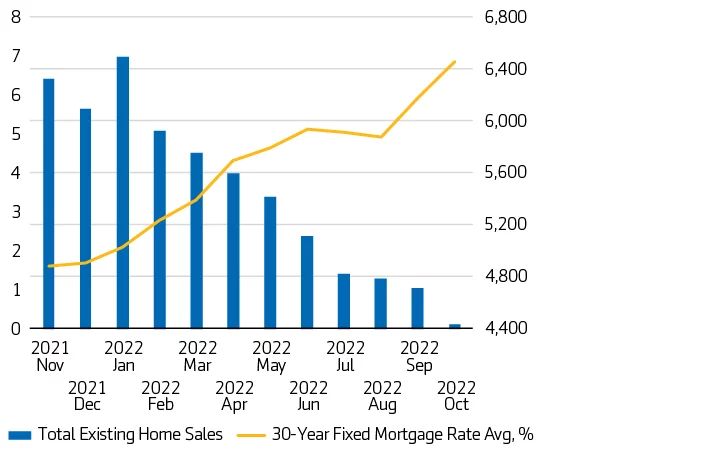

The impact of higher interest rates has clearly been seen in the housing market, where a rapid surge in mortgage rates has sharply reversed the pandemic-driven housing market boom. Through September, home prices have declined for three consecutive months. Housing’s contribution to GDP is already down 15% from the cycle peak last year. We project this slowdown to continue into 2023 as higher rates hurt demand.

Exhibit 3: Total Existing Home Sales Avg, % (LHS)

NAR 30-Year Fixed Mortgage Rate Avg, %, United States, SAAR, Thous (RHS)

The Fed pausing rates at a restrictive rate will also be contractionary for businesses. More specifically, on the investment side, we expect the higher cost of capital to curtail capital investment in 2023 as there is typically a 9- to 12-month lag between a business’s capital investment decisions and their impact on the real economy.

By definition, this demand destruction will prove to be dis/deflationary. We have already started to see an easing of good pricing on the heels of the Russian energy shock passing and supply chains unclogging. That said, as we head into 2023, concerns remain that a tight labor market will continue to result in sticky services inflation. Therefore, if the Fed is to reach its stated inflation target of 2%, unemployment will likely need to increase to approximately 5.5% over the coming quarters. This would be roughly a 2% reduction in the employment base and is a key driver of our recession call.

Overall, the initial outlook for corporate earnings power is not very optimistic over the coming quarters. In fact, there has never been a recession in which EPS has not declined. Yet, the consensus is for the earnings of the S&P 500 to be +4-5% in 2023. Even if the earnings only decline by 10%, low by historical recession standards, that boosts equity multiples by over 2.5 points to an expensive 20x. We believe this puts downside risk to equities (or at least caps the upside) until greater clarity of sustainable earnings growth unfolds. This conclusion dovetails with our recent paper exploring asset class returns following curve inversion.

Risks: The main risk to our call is that inflation recedes faster and thus the Fed can pivot mid-’23 (i.e., the consensus view). For this to occur, unemployment would have to move up quickly; a Fed pivot with an unemployment rate sub-4% would likely lead us back to an overheated situation pretty quickly (déjà vu Arthur Burns’ Fed). Given the current strength of the labor market, the requisite steep climb in unemployment might be difficult, though we acknowledge the risk.

Asset Allocation: There is a growing disconnect between our views and the market, the latter of which is pricing in a soft-landing scenario that avoids recession. From an asset allocation perspective, our view translates into a strategy that still favors a defensive tilt towards (1) fixed income over equities and (2) prefers high quality over low-quality bonds. While investment grade credit may widen out a little bit more in a recession, we still think its risk adjusted returns should be more viable than equities and high yield credit in this environment. If our forecasts prove correct, sometime in 2023 there will likely be an opportunity to shift sizably into lower-quality high yield credit and equities. Typically, this happens once you are in the throes of the recession and can start to see the end game. As a result, we recommend maintaining dry powder that can be deployed to take advantage of the opportunity.

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders. This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes. The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon AM is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon AM nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above. Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein. The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co, Ltd., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand. Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only.