The Swiss franc is on an appreciating trajectory versus the euro. What can the central bank do to stem the rise?

Key takeaways:

- The Swiss National Bank has made its displeasure at the overvaluation of the franc clear, yet it continues to strengthen, most recently in light of the military conflict in Ukraine.

- The Swiss economy has fared better coming out of the pandemic and while full year inflation forecasts for 2022 have been inching higher in the country, they pale in comparison to that of the European Union.

- Having the lowest interest rate in the world, at ‑0.75%, the central bank’s options to fight a strengthening currency are limited. However, we believe there are three strategies it could adopt to tame the currency.

The recent geopolitical volatility has upended asset markets across the globe. From commodities to bonds and equities, recent price moves have been of an historical scale. As uncertainty prevails, assets known for their haven qualities have received unprecedented interest. Among those, the swiss franc is an outlier, appreciating significantly versus most currencies but especially versus the euro – Switzerland’s biggest trading partner.

An appreciating trajectory

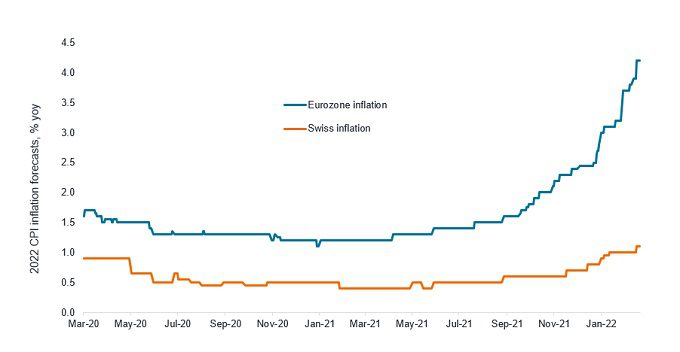

The Swiss National Bank (SNB) has expressed its displeasure with the overvaluation levels of its currency on numerous occasions. The central bank and many economists put the fair value of the currency between 1.08‑1.12 versus the euro; yet, due to recent events the currency continues to strengthen. The SNB has intervened repeatedly to stop the franc from appreciating but it has only managed to slow the trajectory, rather than stop or reverse it. In the past month alone, the currency has appreciated 5% versus the euro, at its lowest point intraday (chart 1).

Chart 1: Swiss franc briefly breaks below parity

A distinctly different inflation path

The Swiss economy has fared better coming out of the pandemic compared to other global competitors; it has been successful in keeping costs down, while wage growth remains restrained. The relative independence of the country from fossil fuels has also shielded the country from the volatility in energy prices over the last few months.

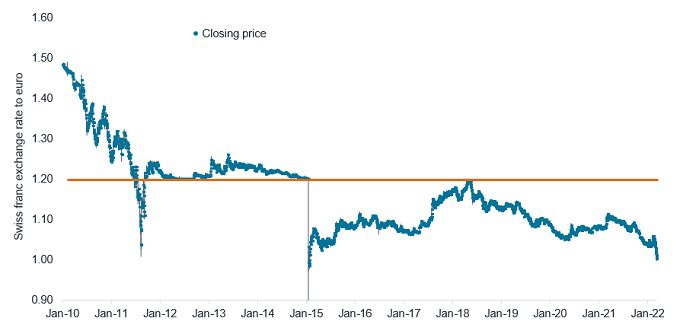

Thus, as Switzerland’s inflation is fairly insulated from global price changes, recent price spikes in commodities do not impact the country as much as its neighbours. While full year inflation forecasts for 2022 have been inching higher in Switzerland, they pale in comparison to the European Union on the same metric (chart 2).

Chart 2: Swiss inflation paints a placid picture

How can the currency be tamed?

As Switzerland has the world’s lowest interest rates at -0.75%1, and the SNB is already active in intervening in the foreign exchange (forex) markets, the central bank’s options are limited to reduce the lure of the currency for investors. However, there are three options that it can undertake to try and stabilise the currency, outlined in order of likelihood below.

Reassure markets on a lot more of the same

The SNB can send a strong signal to the markets that it will continue – and increase – its intervention in forex markets; that interest rates will remain anchored at -0.75% for the foreseeable future; and liquidity will continue to be loose for local banks. This approach may help slow the currency’s appreciation but its success will depend on geopolitical risks subsiding meaningfully.

Minimum exchange rate

In the aftermath of the European sovereign debt crisis, due to the rapid appreciation of the Swiss franc, the SNB instituted a minimum exchange rate versus the euro and enforced it to an unlimited amount. From 6 September 2011 to 15 January 2015, the SNB committed to bid all available euros on the market at a rate of 1.20 francs per euro (effectively selling Swiss francs in order to buy foreign currency denominated assets to maintain the peg). While it resulted in a significant expansion of the central bank’s balance sheet and led to many political concerns, it proved effective at stopping the franc from sudden appreciation (see chart 3). The SNB could enact a similar policy now, this time with a reference rate of 1.00 or 1.05 francs per euro.

Chart 3: time to set a new peg for the Swiss franc?

Further reduction in interest rates

Lowering interest rates, which already stand in deeply negative territory at -0.75%, may seem farfetched at first, but for Switzerland it is still an option on the table. The country’s banking system is properly equipped to deal with such negative interest rates, and a number of exemptions/tiering mechanisms ensure that the profitability of local banks does not suffer too heavily from further cuts. A recent example of such a move can be seen in Denmark, where interest rates were cut by 10 basis points from an already historical low of -0.50% to -0.60%, to reduce currency appreciation2.

A brief, final thought

The SNB was already voicing its discomfort with the level of currency appreciation before the recent geopolitical events, which accelerated that trend. As such, bar a significant unwinding of these pressures, we would not be surprised if the Swiss central bank were to announce, in the coming weeks, measures to contain the speed and level of appreciation of its currency.

1Trading Economics, as at 10 March 2022

2Danmarks Nationalbank, as at 10 March 2022

Glossary

Swissie: a casual term for the Swiss franc in foreign exchange markets.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.