Key takeaways

Strong economic recovery and generous federal aid put state and local governments on solid footing.

Many municipalities have undertaken prudent debt management. We believe this should help them navigate through a period of higher interest rates.

Local authorities with weak pension funding levels, onerous debt burdens or weak liquidity will likely be the most vulnerable in the current environment.

US inflation has gained significant momentum as 2022 begins. We expect a rate hike at every Federal Open Market Committee (FOMC) meeting this year, with some rate hikes likely to be 50 basis points.

What does potentially higher inflation and interest rates mean for US municipal issuers?

Strong economic recovery and generous federal aid put state and local governments on solid footing

State and local governments are most likely to feel the impact of inflation and higher interest rates through their revenues and expenses. The potential impact can be divided into three main revenue and expenditure channels: debt service costs, pension assets and liabilities and tax collection.

We believe state and local governments are generally well-prepared for the volatility in revenues and expenditures that might result from price and interest rate increases.

Several factors are likely to support credit resilience among municipals:

- The substantial influx of federal funds under recent legislation

- Prudence in managing debt service levels in recent years

- Manageable levels of aggregate pension funding

Governments with strong debt management, favourable pension funding policies, and sufficient reserves will likely be the most prepared to manage the impact of long-term inflationary pressures.

We believe many states and local governments meet these conditions. This means they could be well-positioned to navigate a higher inflation, higher interest rate environment in the near term.

Below, we highlight how inflation and rising interest rates are likely to impact municipals through their three main revenue and expenditure channels:

Debt service: Many municipalities have undertaken prudent debt management. We believe this should help them navigate through a period of higher interest rates.

Higher interest rates likely mean higher municipal borrowing costs, but we believe short-term interest rate pressure is manageable. A general trend toward deleveraging over the past decade has provided some room to absorb higher interest rates.

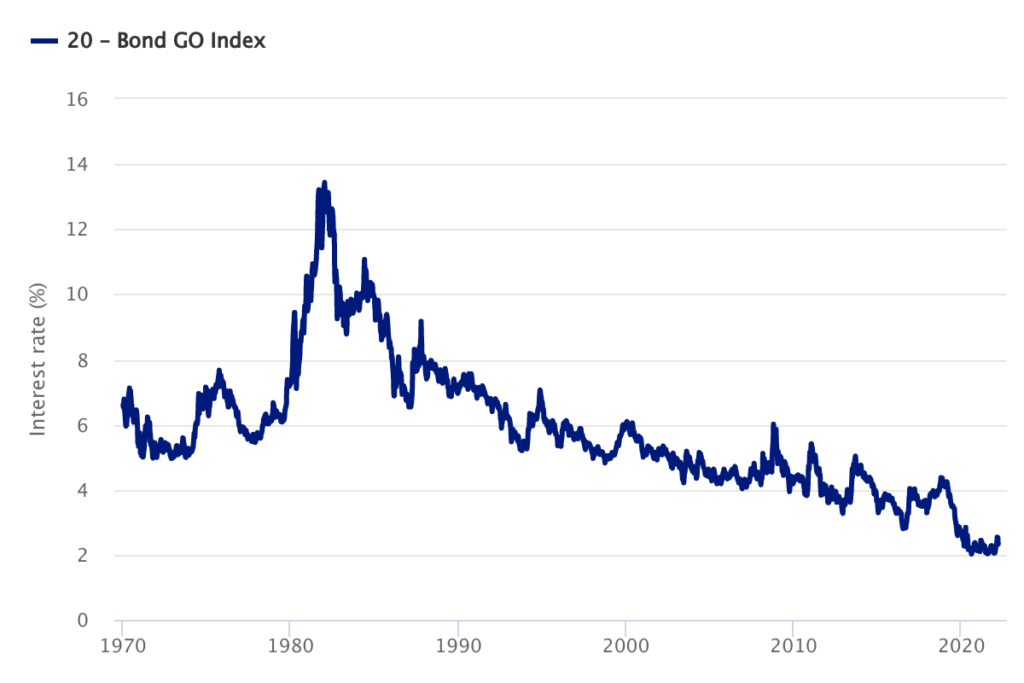

For the past few years, state and local governments have put more emphasis on paying for projects on a “pay-as-you-go” basis. This means funding projects from available revenues instead of debt issuance. It is also important to point out that interest rates still have a long way to go before becoming expensive in historical terms (Figure 1).

Pension assets and liabilities: Strong pension asset performance in 2021 may help offset growing pension liabilities

Strong pension returns realised in 2021 should help limit the effects of a widening funding gap. But persistent inflation or market volatility could have negative impacts on funding levels and pension expenses.

Overall, we believe pension expenses represent a manageable portion of budgets. That’s because governments maintain a degree of budgetary flexibility to cover unexpected rises in pension costs.

In general, rising inflation and wages could lead to growing pension liabilities. About three quarters of state and local governments have some form of automatic link between pension benefits and inflation through cost-of-living adjustments1. As a result, rising wages could affect final compensation levels – a major determinant of governments’ pension liabilities.

Tax collection: Key sources of revenue may continue to grow, but momentum could slow compared to the last couple of years

The largest source of revenue for most local governments is property taxes. The housing market’s sharp appreciation in the past year will likely translate into higher property tax collections for many municipalities going forward.

This is largely because the impact of home price appreciation on tax receipts tends to lag by one to two years.

Sales tax collections could be volatile if consumption trends shift, such as higher prices discouraging spending. But income taxes have been bolstered by wage growth and low unemployment.

States also built-up record levels of reserves in fiscal year 2021. They are projected to be even higher in fiscal year 2022, this could provide a substantial liquidity cushion to manage potential revenue volatility.2

The hope is that the prospect of revenue volatility might be offset in the short term for two reasons:

- Federal legislation delivered direct funding to states and local government during the pandemic

- Additional stimulus measures were created to provide relief and support infrastructure development

But, just like for private businesses, labour and materials costs for municipal projects may become more expensive. Federal stimulus earmarked for these projects may not stretch as far as previously planned.3

Higher expenditures on these inputs will likely offset some revenue gains currently being enjoyed by governments, which points to a stable near-term budget outlook.

A positive outlook

State and local governments are riding the tailwinds of growing fiscal revenues and substantial federal aid. This could give them the resources to manage any unfavourable short-term effects of inflation.

Governments will need to be careful to temper future revenue expectations in case inflation persists. Local authorities with weak pension funding levels, onerous debt burdens or weak liquidity will likely be the most vulnerable in the current environment.

It is positive that most municipal governments enter this period with favourable cash reserves. They also have prudent pension funding practices and budgetary flexibility. We believe these factors prepare them to navigate the potential effects of inflation and rising rates.