Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise.

The Liontrust Japan Equity Fund returned -1.2% over the first quarter, versus the TOPIX’s -3.7% and the IA Japan sector average of -5.7% (both comparator benchmarks). This performance places the Fund in the top quartile of its sector for the period under review.*^

The Fund’s equity portfolio outperformed due its overweight exposure to some more cyclical areas such as the energy, industrials, and materials as well as being underweight in the consumer related, healthcare, information technology and communications sectors. In addition, the Fund’s overall return was hindered by holding no utilities or telecoms stocks.

For the third quarter in a row, the larger and mid cap stocks held up better by falling only -1.7% and – 2.6% respectively. Again, it was the smaller category Mothers and JASDAQ indices that lagged, falling by -20.0% and -6.6%. In turn largely because of the threat from higher interest rates which impacts longer duration investment assets such as growth stocks.

TOPIX, having closed 2021 at the 1992 level, almost reached 2,050 before hitting its low of 1,755 on the 9th of March after successive declines due firstly to general rising inflation and interest rate concerns and then the start of Russia’s Ukraine invasion at the end of February. Then, despite the oil price’s sharp concurrent share price rise to above $120 per barrel, TOPIX regained its composure, rallying to close to 2,000 before ending the month at just below 1,950 as the fallout from the war in the Ukraine did not turn out to be as expected.

As usual, individual stocks showed disparate performance often strongly contrary to the underlying sector’s returns. For instance, consumer staples in aggregate fell by -2.9% with Seven & I, the convenience store operator, rose by 15.9% on a total returns basis.

Similarly, relative outperformance within the virtually unchanged industrials sector was shown by Mitsubishi Heavy Industry that rose +52.6% upon management announcing restructuring plans and in the materials sector JFE, the steel producer, rising by 21.9% on news of successful product price hikes.

By contrast in industrials, Daikin (air conditioning), a big gainer the previous quarter, declined by -13.8% on profit taking whilst Fanuc, the leading automation and robotics firm, fell -10.5% after machine tool orders were deemed to have likely peaked for this cycle. Likewise in materials, Sumco, the ultra-pure Silicon supplier to the global semiconductor industry, declined by -13.5% on expectations that demand may have peaked and Kansai Paint dropped -20.6% on higher input costs (oil) and therefore compressed profit margins.

Financials overall gain of 9.1% for the quarter saw our holding in the property firm Mitsui Fudosan climb by 16.2%, whist our monies invested in JAFCO, a venture capital firm, depreciated by -13.2% given the current global uncertainties and likely interest rate rises would lessen both the opportunity and the valuation of any firms that it tried to list upon the public markets.

As previously stated, our investment thesis remains that we expect Japanese equities to do relatively well based on their balance sheets and balance of operations tilted towards the non-OECD and the more cyclical sectors. We expect inflation’s stickiness to become more apparent and force central banks to raise rates further and faster than generally expected. As a result, given the generally no/low debt condition of most Japanese firms and given increased tax burdens are likely to be imposed on US firms, the relative improvement in profitability should encourage investment into the Japanese stock market.

Also, the emerging trends of near-shoring and de-globalisation have already been embraced by Japanese firms who began to de-emphasise their Chinese operations and relocated elsewhere should place them at a structural competitive advantage. The renewed demand for capital equipment should also benefit the many Japanese firms in these sectors.

In the meantime, the government, having approved in December a record for the new financial year as well as restated its intention to keep Japanese interest rates at their current levels whilst other OECD nations raise theirs, suggests the yen will succumb to widening interest rate differentials and will help underwrite a multi-year recovery in Japanese corporate profits. As such, the Fund will remain overweight in large, well-financed, industry dominant Japanese multinationals that are set to benefit most from the currency’s likely weakening.

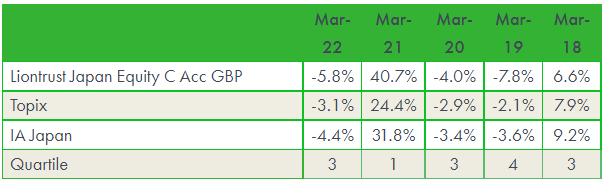

Discrete years’ performance (%)**, to previous quarter-end:

*Source: FE Analytics as at 31.03.22

**Source: FE Analytics as at 31.03.22. Quartiles generated on 05.04.22

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested. The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term. Investment in funds managed by the Global Equity (GE) team may involve investment in smaller companies – these stocks may be less liquid and the price swings greater than those in, for example, larger companies. Investment in funds managed by the GE team may involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates.The team may invest in emerging markets/soft currencies or in financial derivative instruments, both of which may have the effect of increasing volatility. Some of the funds managed by the GE team hold a concentrated portfolio of stocks, meaning that if the price of one of these stocks should move significantly, this may have a notable effect on the value of that portfolio.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.