The combined effect of inflationary pressure, resulting interest rate hikes, the war in Ukraine and disrupted trade flows have raised the prospect of an economic slowdown. What might a demand slowdown mean for the metals & mining sector, where supply has been struggling to keep up with demand buoyed by a post-pandemic bounce and new demand for metals and mined commodities associated with the needs of the energy transition?

Rampant demand and supply chain constraints mean that commodity prices are currently significantly above incentive or marginal cost levels across the metals and mining complex. Lower or negative growth in demand in keeping with recession would reduce the need for investment in future supply. At the same time, falling prices and margins can make the ability of miners and metals producers to greenlight projects more challenging.

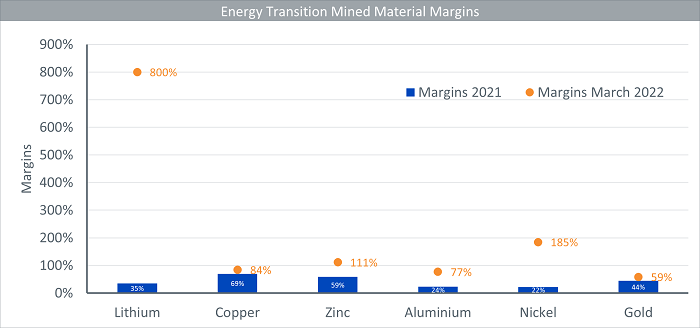

Source: Wood Mackenzie, Argus Media Group Ltd and LME, 2022 Margins as of 10th March 2022

Historical performance is not an indication of future performance and any investments may go down in value

Producers of mined commodities argue that their ability to greenlight projects is not necessarily a feature of a lack of investment capital but rather the inability to obtain permitting, as well as the pace of issuing permits. Others argue that prices and returns need to be fundamentally sustained to trigger investment. Both points have merit.

There is also a narrative that prices will be higher because supply growth isn’t happening quickly enough, leading to a ‘new equilibrium’ of markets being perpetually undersupplied. That argument is also plausible with cost inflation and supply chain issues disrupting existing developments.

The length of any downturn is critical. Here, past downturns offer useful perspective on what to expect from commodity markets. There are grounds to expect energy transition commodity price recessions to be short-lived.

Past experiences show the supply response in a downcycle tends to be more elastic than upswings. In the end, it is easier to turn supply off than on.

At the same time, while demand can decline markedly, recovery can be quick, with absolute demand back to ‘normal’ in a year or two. It is notable that China, which accounts for around 50% to 60% of global demand for most commodities, is not anticipating recession. As a result, absolute levels of demand could recover within a year.

For energy transition commodities, demand will likely continue to rise despite an economic slowdown. The response of many governments to the war in Ukraine has been to double down on energy transition commitments. Against the backdrop of lower prices and tighter margins during a slowdown, project funding decisions will become more problematic. In short, there’s no real respite from the challenge of supply development.