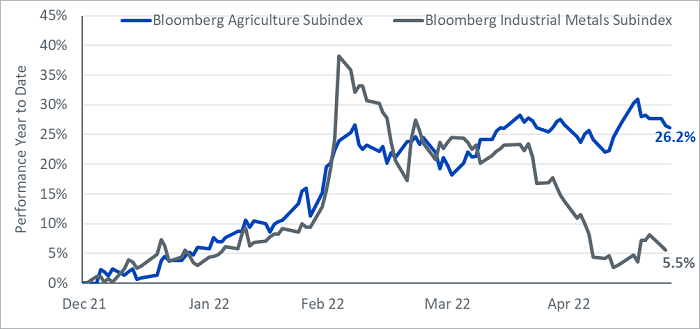

A dichotomy has emerged within the commodity complex, evident from the divergent performance of agricultural commodities versus industrial metals. Over the short term, we expect this divergence to widen as the catalysts powering agricultural commodities performance continue to strengthen while the headwinds holding back industrial metals performance remain firmly in place.

Figure 1: Performance of Agricultural Commodities versus Industrial Metals (Year to Date)

Source: Bloomberg, WisdomTree as of 25 May 2022.

Historical performance is not an indication of future results and any investments may go down in value.

Agricultural commodities buoyed by rising protectionism

Protectionism is on the rise. Driven in part by the disruptions from the war in Ukraine, countries have been more tempted to withhold flows of locally grown crops to the global market. One such example has been India which is set to cap sugar exports at 10 million tons this year. It appears to be very precautionary, given domestic supplies are abundant. India, the world’s third-largest wheat producer, also announced1 it would restrict wheat exports to manage domestic supplies of the grain. This announcement came as a surprise to the market as India had previously indicated a push for higher exports in response to the supply losses from Ukraine that resulted in higher wheat prices in the global market. Russia and Ukraine are known to be the breadbasket of the European region, accounting for 28.5% of supply in global wheat markets. The United States Department of Agriculture (USDA) also forecasted a major decline in the US winter wheat production for 2022/23 due to the Southern Plains’ drought. According to agriculture analysis firm Gro Intelligence, the world has only ten weeks’ worth of wheat consumption in reserve, marking the lowest level since the 2008 financial crisis.

Russia and Ukraine also account for 80% of sunflower oil shipments. So, disruptions to the sunflower oil trade have squeezed supplies on the edible oil market, prompting buyers to seek alternative oils such as palm oil and soybean oil. However, Indonesia announced an export ban on crude and refined palm oil on April 28, boosting demand for soybean oil, the second most-produced edible oil. Fortunately, the Indonesian ban on palm oil was lifted on May 19, after hundreds of farmers rallied to protest the move. Nonetheless, soybean oil prices are also being impacted by restricted exports from South America owing to ongoing drought conditions.

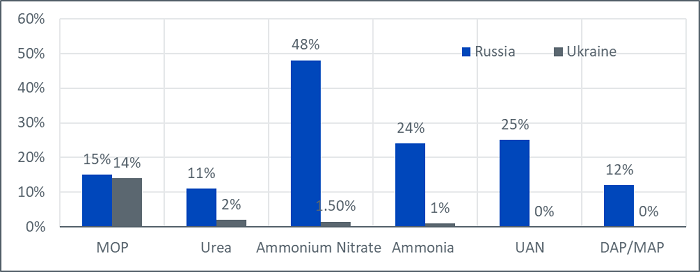

Russia and Ukraine account for a significant share of the global fertiliser trade. The sanctions on Russia alongside the war in Ukraine have constrained nitrogen, phosphate, and potash exports. The rally of natural gas prices had a material impact on fertiliser prices before the invasion. As the energy price rally continues to rally on, we expect the uptrend in fertiliser prices to continue, which could result in a reduction of farmers’ usage, which could place global agricultural yields at risk, causing further supply pressure. Historically grain prices have followed the rally of fertilisers after supply disruptions.

Figure 2: Russia and Ukraine’s share of global key fertilizer trade (%)

Source: Bloomberg, WisdomTree as of 30 April 2022.

Historical performance is not an indication of future results and any investments may go down in value.

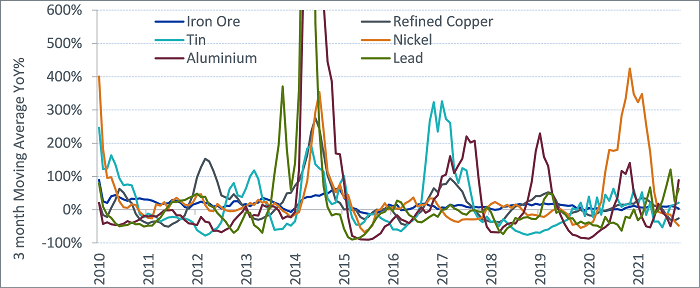

China’s slowdown remains a headwind for Industrial Metals

Owing to their cyclical nature, the industrial metals complex has come under pressure in the face of a slew of weak global macro-economic data alongside a strong US dollar. In May, the US, China, Eurozone, UK, and Japan reported weaker than expected manufacturing Purchasing Managers Index (PMI) data, weighing on growth concerns. China’s strict adherence to its zero COVID policy has hit metals consumption harder than production, thereby weakening sentiment towards the metals complex.

Figure 3: Chinese imports of Industrial Metals

Source: Bloomberg, WisdomTree as of 30 April 2022.

Historical performance is not an indication of future results and any investments may go down in value.

As the world’s biggest importer and consumer of industrial metals, the slowdown in the Chinese economy has had a significant impact on industrial metals’ performance. What we thought was supposed to be a relatively short-lived quarantine in Shanghai now appears to be a more drawn-out reopening of key cities in China. This was confirmed in a bearish speech2 by Premier Li Keqiang in which he said China’s economy in some respects is faring worse than in 2020, with current growth at 2.3%, a far cry from this year’s 5.5% growth target. By virtue of being the most China-centric commodity sector, industrial metals prices are likely to remain weak until we see a renewed pick up in demand from China.

However, it’s important to be mindful that industrial metal prices will eventually find a floor from the renewed demand from infrastructure and the energy transition over the long term. In China, infrastructure capex has been elevated to a national policy focus to address both structural and cyclical problems3. Europe’s vulnerability to Russian energy supply has exacerbated its need to power ahead in the path towards energy transition, which is commodity-intensive.

Sources

1 India’s Directorate General of Foreign Trade as of May 13, 2022

2 On 25 May 2022

3 On April 26, 2022 – Meeting of the Central Financial and Economic Affairs Commission – China’s highest economic policy body