Agricultural commodity prices have been buoyed higher by rising grain and oilseed prices. At a time, when global equities have sold off by nearly 13.88%1 amidst soaring inflation and tightening liquidity conditions, agricultural commodities are up 26.8%2. There are a plethora of supply side issues emanating from the war that are likely to continue to drive prices higher – the rise of protectionism, higher fertiliser costs, changing biofuel mandates and adverse weather conditions to name a few. The Russia-Ukraine war has had ripple effects from disrupting supply chains to raising fertiliser costs.

Source: WisdomTree as of 7 June 2022

Rising protectionism buoys agricultural commodities higher

The war-related disruptions have also given rise to protectionism. To cite a few examples in 2022– India, the world’s third largest wheat producer, announced3 it would restrict wheat exports to manage domestic supplies of the grain, which led to a sharp rise in wheat prices. Indonesia also announced an export ban on palm oil on April 28, but the ban was lifted on May 19 after hundreds of farmers rallied to protest the move. In a tight oil-seeds markets, the initial announcement led soybean oil, an alternative to palm oil, sharply higher.

Higher biofuel blending mandates to bolster demand for corn and soybean oil

Changes in the biofuel blending mandates are also poised to increase demand for agricultural commodities. The US is home to the world’s largest biofuel market. The Biden administration is ordering refiners to boost the use of biofuels such as corn-based ethanol. The US Environmental Protection Agency (EPA) is requiring refiners to mix 20.63 billion gallons of renewable fuels into gasoline and diesel this year, marking a 9.5% increase over last year’s target. This will put pressure on refiners to blend more biofuel into their gasoline production this year, resulting in a net positive impact on the biofuels industry. Grains such as corn stand to benefit owing to their high starch content and relatively easy conversion to ethanol. Amidst waning stockpiles of diesel, Brazil is also considering increasing the biodiesel blend to 15% from 10% (i.e. the amount of soybean oil blended into trucking fuel). This has the potential to bolster demand for soybeans at a time when soybeans are already in short supply due to droughts in South America and US plantings trail last year’s pace.

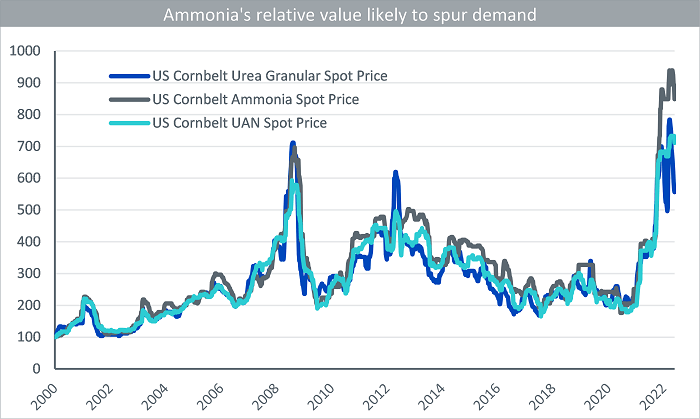

Rising fertiliser costs are weakening demand, in turn lowering yields

The Russia-Ukraine conflict has caused disruptions in fertiliser production and material price increases, which has put farmer margins and agricultural yields at risk elsewhere, driving the prices of most agricultural commodities higher. Russia and Ukraine account for a significant share of the global fertiliser trade. Russia produces 9% of global nitrogen fertiliser, 10% of global phosphate fertiliser, and 20% of global potash fertiliser4. It exports more than two thirds of its production of each product. Belarus produces an additional 17% of global potash and exports most of it5.

Owing to its high soil quality, Argentina tends to use less fertilisers, but Brazil (the world’s largest importer of fertilisers) of which 85% of its needs are imported, is likely to feel the impact more. Russia alone accounts for 25% of Brazil’s total fertiliser imports. Farmers can also plant more soybeans, which require less fertilisers than corn. The US and global corn balance are set to continue to tighten, which suggests that the current high price environment is set to linger. The high prices and low availability of fertilisers is making farmers reduce usage and is also resulting in lower fertiliser prices similar to the trend witnessed back in 2008.

Source: Bloomberg, WisdomTree as of 27 May 2022.

Historical performance is not an indication of future performance and any investments may go down in value.

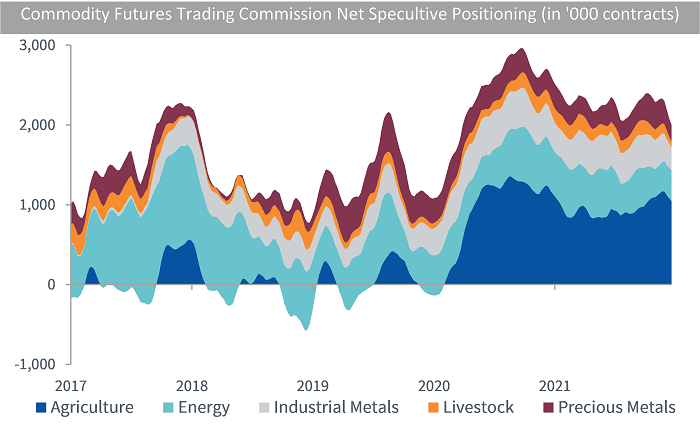

Speculative positioning garnering momentum among agricultural commodities

According to data from the Commodity Futures Trading Commission (CFTC), net speculative positioning in agricultural commodities has risen considerably since the covid pandemic. Tighter supply coupled with stockpiling by national governments concerned about food security has led to a rise in agricultural commodity prices. Not only has net speculative positioning on agricultural commodities risen versus its own history but also in comparison to other commodity subsectors, as illustrated in the chart below:

Source: WisdomTree, CFTC, Bloomberg as of 25 May 2022.

Historical performance is not an indication of future performance and any investments may go down in value.

Adverse weather conditions impact agricultural commodities

El Niño and La Niña are the warm and cool phases of a recurring climate pattern across the tropical Pacific—the El Niño-Southern Oscillation, or “ENSO” for short. The pattern shifts back and forth irregularly every two to seven years, and each phase triggers predictable disruptions of temperature, precipitation6. The current La Niña has been around since October 2021. It has been responsible for the South American droughts, milder weather in Southern parts of US and heavy rainfalls across the Pacific Northwest. There is a 51% chance La Niña could continue into the December to February period, with those odds down from last month’s forecast of 58% according to the US climate prediction centre. The waters across the equatorial Pacific Ocean are expected to stay cool or be close to normal between June and September, which means the influence on weather patterns won’t be enough to disrupt tropical storms and hurricanes in the Atlantic.

Conclusion

Agricultural commodities have posted a strong performance in 2022. Yet there remain plenty of factors that could drive the performance of this commodity subsector even higher. Agricultural commodities are unique owing to their high dependence on weather conditions that make them volatile but also offer diversification benefits.

Sources

1 Bloomberg – MSCI World Index from 31 December 2021 to 9 June 2022

2 Bloomberg – Bloomberg Agriculture Subindex from 31 December 2021 to 9 June 2022

3 India’s Directorate General of Foreign Trade as of May 13, 2022

4 Bloomberg Intelligence

5 Bloomberg Intelligence

6 Climate.gov