The Federal Open Market Committee (FOMC) hiked its federal funds rate target by 0.75% at its July meeting, as expected. The target for the lower bound is now 2.25% while the upper bound is 2.50%. In its policy statement, Federal Reserve (Fed) officials acknowledged that economic growth has slowed but indicated that without signs of inflation ebbing, they feel they need to keep hiking. Unfortunately, when it comes to calibrating policy for the economy, the Fed is kind of flying blind.

Economists have all sorts of models and measures to gauge the current health of the economy and to anticipate how that health might change. Sadly, most of the models, at best, are rough approximations of reality. Many of the measures have wide error bands, and on top of that, they’re often delayed, which hinders their use as real-time indicators of what’s actually going on.

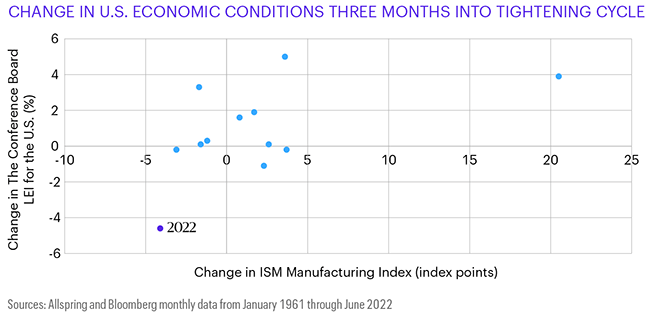

The problem, then, is that while the Fed has a lot of power in setting monetary policy, it has little control over when the effects of policy changes will be evident—or even over what the magnitude of those effects will be. Take, for example, the initial conditions of the economy when the Fed started tightening monetary policy in the past. Based on the Institute for Supply Management® (ISM) Manufacturing Index and the year-over-year percentage change in The Conference Board Leading Economic Index® (LEI) for the U.S., the economy was in a good place in March 2022. Comparisons with data going back to 1961 show that these indicators were roughly in line with where things were at other points when the Fed started hiking.

But oh, how things have changed since the Fed started hiking in March! It’s been four months since that initial hike, but we only have data for the first three of those months. The chart below shows the change in the ISM Manufacturing Index and the change in the LEI over the first three months of each hiking cycle going back to 1961. Compared with other times when the Fed has hiked, things have deteriorated much more quickly this time than ever before at the three-month point in a hiking cycle. The economy in 2022 didn’t have as much positive momentum as the Fed might have hoped when it embarked on this tightening journey.

In 2004 and 2015, the Fed took a slow and steady “tortoise-like” approach to hiking rates, much like in “The Tortoise and the Hare” (Aesop’s Fables). But this time, the Fed is using a hare-like fast and furious approach. While slow and steady wins the race, it seems like Fed officials feel they have to make up some lost ground—perhaps because they kept the federal funds rate frozen in 2021 despite rising inflationary pressures.

Whether this catch-up policy will work remains to be seen. We’re optimistic about picking good stocks and bonds for the long term, yet we’re also mindful that the fog of uncertainty may not lift soon. We don’t know what the Fed will do next. Heck, the Fed probably doesn’t even know what it will do next. That’s why we’re staying vigilant in monitoring conditions to see whether growth will slow too much or too fast.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.