The China A share market is poised to benefit from the unfolding recoveries in China’s economy, property sector and earnings. The market’s tilt towards manufacturing-oriented companies gives investors an opportunity to take part in the multi-year transformation of China’s manufacturing sector, at undemanding valuations.

The challenges faced by China’s economy in the last 12 months are well documented. Heading into the second half of the year, we believe that there is a compelling case for China A equities. Contained inflation is likely to keep financing costs low, a sharp contrast to the rate hikes taking place in many other economies. The Chinese government is also likely to announce more stimulative measures to support the economy. Meanwhile, China continues to enjoy a robust current account surplus, a rarity within the Emerging Markets amid rising inflation and commodity prices.

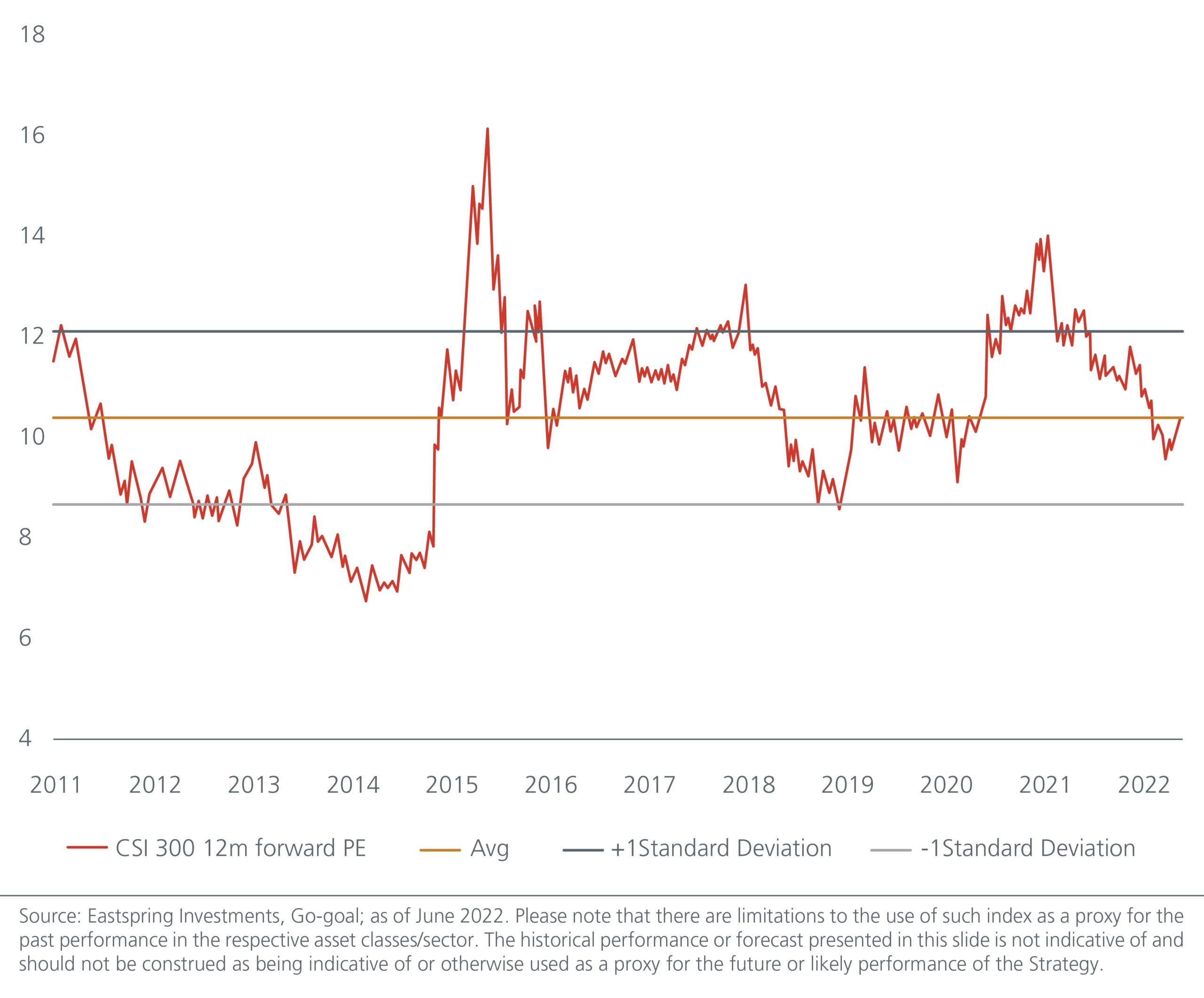

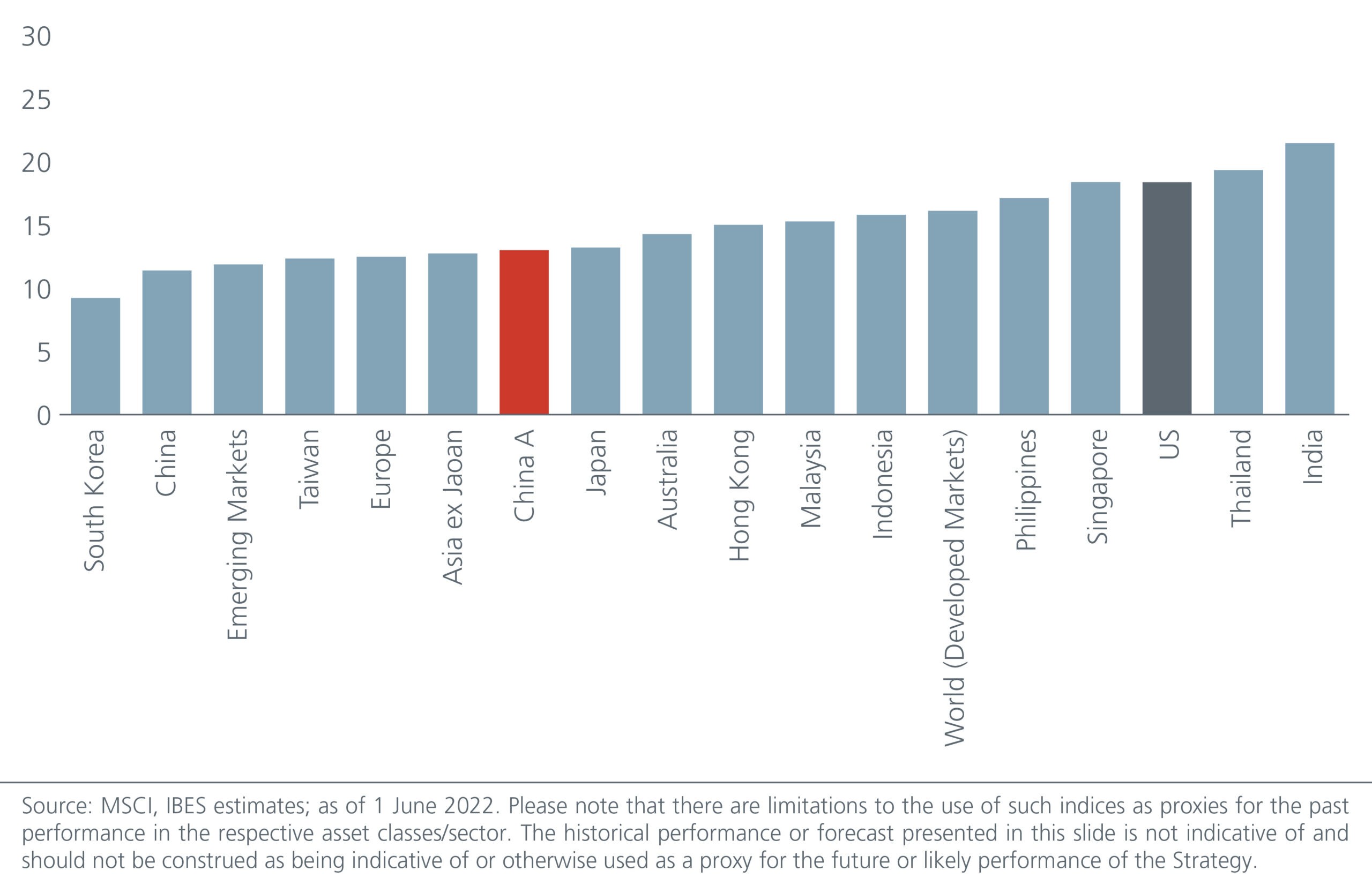

Valuations offer attractive upside with the CSI 300 Index trading around its historical average. Fig. 1. Valuations also look attractive compared to the developed markets as well as most Asian markets despite the China A-share market’s outperformance in the 2nd quarter of 2022. Fig. 2.

Fig. 1. CSI 300 Index – price to earnings ratio (x)

Fig. 2. 2022 Expected price to earnings ratio (x)

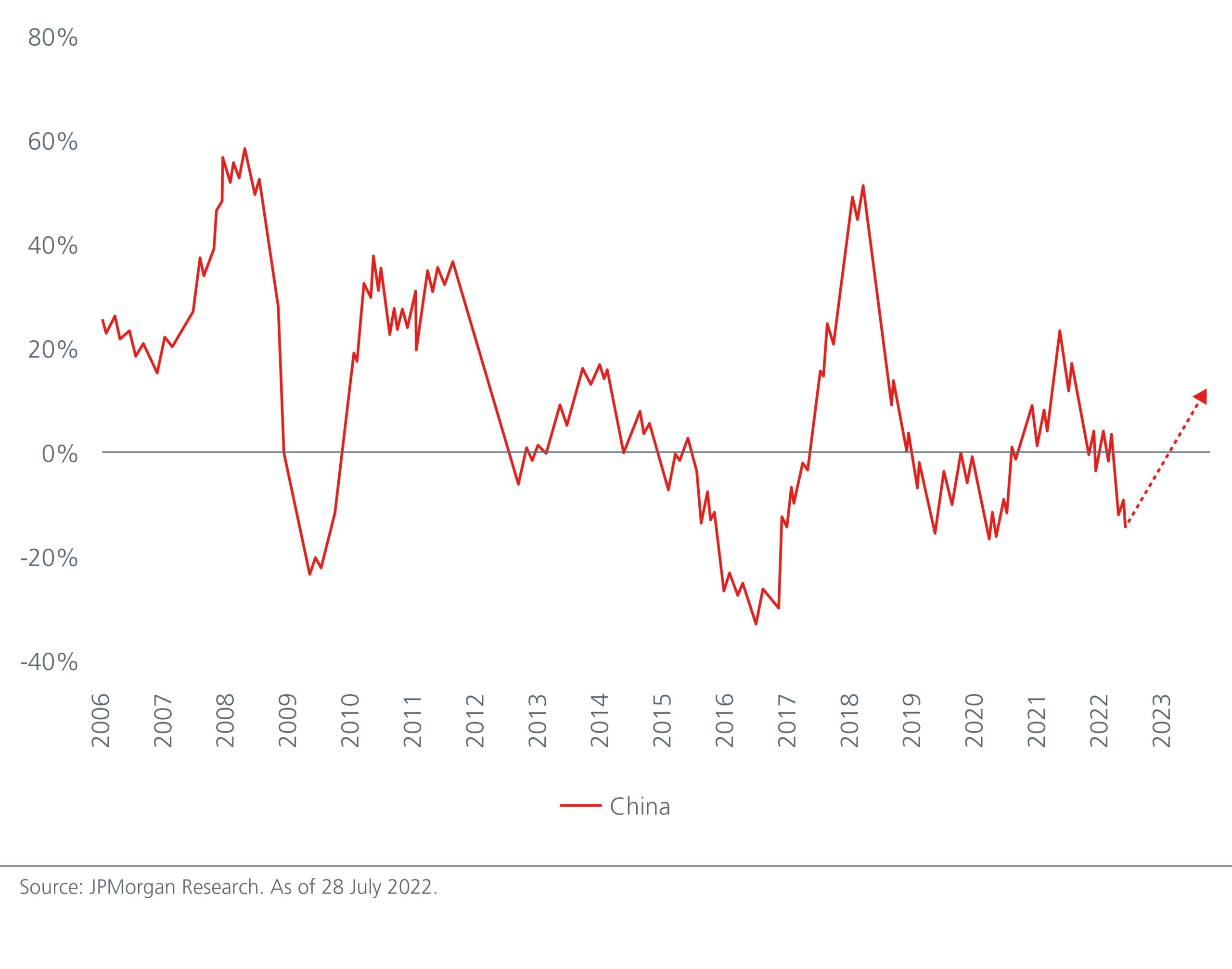

More importantly, we think that negative earnings revisions in China have troughed, with earnings growth forecasts having fallen by 28% from their most recent peak. See Fig. 3. As such, we believe that there is scope for China’s earnings to surprise from here. This is important because the recent rally in the China A share market has mostly come from the expansion in valuation multiples. We would need earnings growth for a sustained rally.

Fig. 3. Earnings growth forecasts

The Chinese economy has bottomed

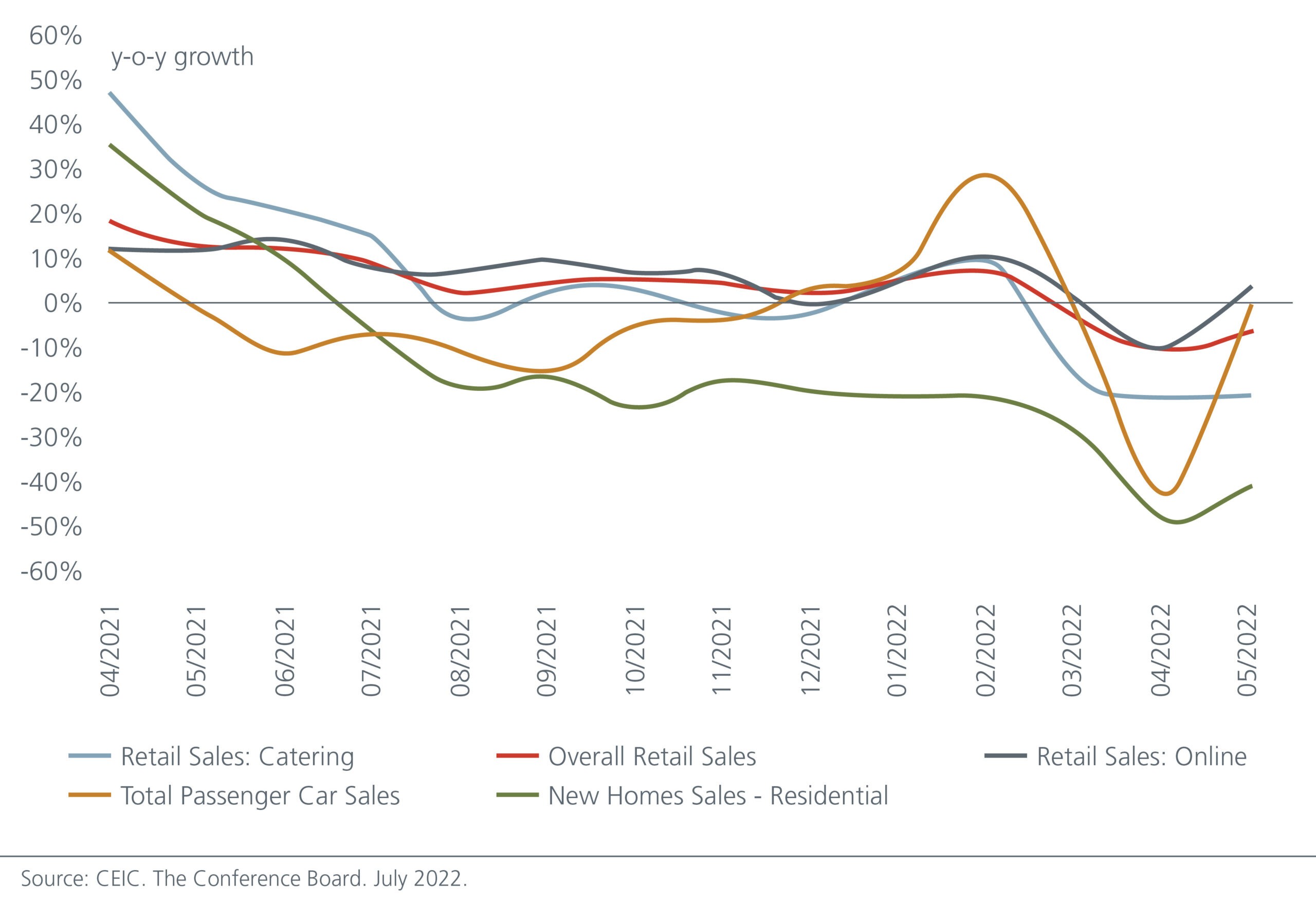

Our conviction for the China A share market stems partly from the gradually improving outlook for the Chinese economy. We believe that the economy troughed in the second quarter of the year, helped by a number of policy measures which were announced in late May. These included tax rebates (140 billion yuan), deferral of corporates’ social security contributions (320 billion yuan) and the cut in the purchase taxes on passenger cars and other goods (60 billion yuan).

Fig. 4. Some signs of a consumption recovery in May

More recently, we have seen local easing measures for the property sector such as mortgage rate cuts, lower down payments, and more relaxed home-purchase restrictions. China also plans to invest USD1.5 trillion between 2021 and 2025 on smart infrastructure projects to support growth – the projects will use 5G, Artificial Intelligence and the Internet of things to transform traditional sectors and support emerging industries. Meanwhile, recent signs that the Chinese authorities have eased its regulatory crackdown on the internet platforms should help to stabilise investor sentiment. On the monetary front, the People’s Bank of China has cut the Reserve Requirement Ratio (RRR) as well as the Loan Prime Rate (LPR) to lower companies’ financing costs.

Going forward, we expect policies to further support infrastructure investments, as well as more subsidies for larger ticket consumer products such as cars, home appliances and electronics. Monetary policy will also stay accommodative via a combination of RRR cuts, liquidity injections and targeted credit support (e.g. relending quotas). A further cut to the LPR also cannot be ruled out.

That said, the strength of China’s recovery would largely depend on the property sector and China’s zero-COVID policy.

A light in the property tunnel?

Chinese homeowners have been in the headlines recently for refusing to pay their mortgage payments, with over 300 projects across 93 cities affected. We highlight that the mortgage suspensions were triggered by fears that property developers would not be able to deliver on their projects, rather than the inability of homebuyers to make their mortgage payments. Hence the key is to help restore developers’ ability to complete their projects. At the point of writing, it is reported that China will launch a real estate fund amounting to USD44 billion to help developers resolve their liquidity issues.

China’s mortgage boycott is estimated to account to about 3% of China’s home mortgage loan book for China’s 14 largest banks. While the boycott is unlikely to pose a significant threat to the financial industry for now, it can damage buyer sentiment further and have other negative spillover effects. A buyers’ strike will hurt home sales and pre-payments are an important source of liquidity, especially for indebted developers. Meanwhile, local governments rely heavily on land sales for funding and a dearth of such income will weaken the impact of any local initiatives designed to bolster the economy. In 1H22, land sales declined by 31.4% from the previous year. Our estimates suggest that a 5% deceleration in real estate investment would lower China’s GDP growth by 0.6-0.7%.

We believe that a strong and clear signal from the central government is needed to help the property sector beyond the piecemeal measures we have seen from the local governments. While the “stability fund” mentioned earlier is a step in the right direction, we believe that the government can consider other measures such as:

- Forming a special agency to collectively take over unfinished projects, which can then potentially be converted into affordable housing

- Forming a committee to coordinate efforts to prevent excessive tightening of property measures

- A temporary suspension (or pushing back the deadline) of the three redline policy that restrict the amount of debt developers can take on

While there is risk that these measures come later rather than sooner, our baseline assumption is that the housing market bottoms out in 3Q22 and will be on course for a more meaningful recovery in 4Q22 or 1Q23.

Navigating the risks that remain

China’s zero-COVID policy and the unprecedented lockdowns in Shanghai/Shenzhen had battered an economy which was already reeling from the troubles in the property sector. While China is maintaining its zero-COVID policy, the recent modest easing of quarantine requirements and travel restrictions in China, as well as the lower frequency of testing suggest that China would adjust its response according to how the COVID situation evolves. While renewed restrictions cannot be ruled out if the number of COVID-19 infections rise, we believe that China should be able to avoid the level of disruptions seen in April/May due to more proactive monitoring of potential outbreaks.

On the political front, the 20th Party Congress where major leadership changes are announced will be the most important event to watch in the second half of the year. The consensus view is that President Xi will continue his third term as leader of the communist party but there may be some uncertainty surrounding the remaining composition of the Politburo Standing Committee. Personnel shifts at the ministerial level of China’s key economic and financial institutions will have the most significant macroeconomic impact and therefore important for investors to watch.

Position for the recoveries

We believe that the China A share market is poised to benefit from the recoveries in the Chinese economy, property market and earnings. Compared to its H-share counterpart, the China A-share market’s bias towards manufacturing-oriented companies should benefit from the government’s increased focus to advance its manufacturing through green initiatives, greater tech self-sufficiency, automation, and digitalization. There are investment opportunities in companies within the Electric Vehicle (EV) and battery supply chains, as well as those involved in the production of solar panels, consumer electronics, semiconductors, and innovative drugs. In addition, the China A share market tends to march to its own beat – domestic policies matter more and hence it may be less affected by the global tightening cycle.

Disclaimer

This document is produced by Eastspring Investments (Singapore) Limited and issued in:

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

This document is produced by Eastspring Investments (Singapore) Limited and issued in Thailand by TMB Asset Management Co., Ltd. Investment contains certain risks; investors are advised to carefully study the related information before investing. The past performance of any the fund is not indicative of future performance.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. – UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing.

Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company, a subsidiary of M&G plc (a company incorporated in the United Kingdom).