Markets in Q2 2022 continued to suffer from entrenched inflation and aggressive rate hikes from central banks. They also reacted to the slowdown of the global economy and the increased risk of a recession in developed economies. These changing market conditions impacted equity factors differently.

In this instalment of the WisdomTree Quarterly Equity Factor Review1, we aim to shed some light on how equity factors behaved in Q2 2022 and how this may have impacted investors’ portfolios.

- High dividend continued to dominate, followed by a revival of min volatility

- Value started to show signs of slowing down due to its cyclical nature

- Momentum and size continued to suffer

- Quality strategies continued to deliver mixed results depending on their portfolio’s overall valuation

Over July, central banks aggressive tightening continue to slow down the global economy, raising the probability of a global recession.The impact of this slowdown has been clear with rate hike expectations lowering leading to a factor rotation in favor of quality and size.

Looking forward, uncertainty around recession and economic growth will continue to rise. Investors are facing the need to balance their portfolio between building wealth over the long term and protecting their portfolio during economic downturns. This environment could therefore favour high dividend and quality stocks.

Performance in focus: high dividend continues to lead, but min vol is catching up

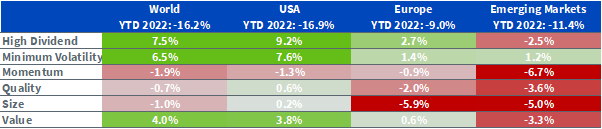

In the second quarter of 2022, equity markets suffered from a deep drawdown, leading to the worst first half year in decades. The MSCI World lost -16.2%. Unusually, the US underperformed European markets with -16.9% versus -9%. Emerging markets suffered as well with -11.4%.

Q2 2022 factor performance continued to be driven by inflation surprises on the upside and the hawkish stand of developed countries’ central banks. However we also saw two new entrants this quarter with heightened volatility and the fear of recession rocking markets further. Faced with such a brutal landscape, some factors continued to do well, and some did not:

- High dividend dominated in most regions. This factor finished first in all developed geographies

- Pushed by increasing volatility and heightened fears of recession, min volatility followed closely: second in developed markets and first in emerging markets (EMs)

- Value is the last factor that managed to outperform consistently this quarter thanks to rate hikes and despite the volatility increase

- Momentum, size and growth suffered the most over the quarter, delivering underperformance across regions

- Quality sat between those two groups, delivering mild underperformance in European and global equities but outperforming in US equities. However, like in Q1, the definition of quality and the criteria used would have hugely impacted the result. Quality, left unattended, tends to tilt toward growth (investors pay for quality, after all) and would have suffered from that tilt. For example, highly profitable companies and dividend growers have fared better over the period using their value/high dividend tilt to outperform.

Figure 1: Equity factor outperformance in Q2 2022 across regions

Source: WisdomTree, Bloomberg. 31st March 2022 to 30th June 2022. YTD performance figures are sourced from Bloomberg from 31st Dec 2021 to 30th June 2022. Full index definitions can be found below.

Historical performance is not an indication of future performance and any investments may go down in value.

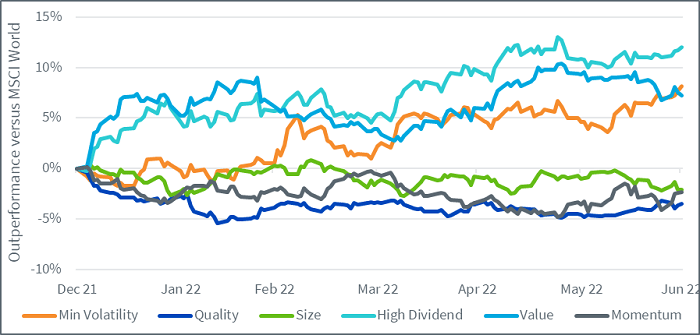

Looking at the outperformance of factors over the last six months, we notice that:

- After a very strong start, value showed signs of slowing down in Q2. Value is a mostly cyclical factor, and an inflationary environment with aggressive rate hikes is very supportive. Fear of recession and increased volatility are not

- High dividend is the overall winner for the 2022 first half and went from strength to strength

- Min volatility started a bit slower in Q1 but has picked up speed in Q2 on the back of recession fears

- Size and momentum suffered across the full six months in an environment that was not supportive of cyclical stocks

- Finally, quality suffered the most in the first six weeks of the year and has hovered around the same level since then. With the market turning more defensive toward the end of Q2, quality is showing signs of life. Here again, highly profitable companies and dividend growers, for example, have fared better.

Figure 2: Year to date outperformance of equity factors in developed markets

Source: WisdomTree, Bloomberg. 31st December 2021 to 30th June 2022. Full index definitions can be found below.

Historical performance is not an indication of future performance and any investments may go down in value.

It is worth noting that since the end of June, markets expectation of a recession has continued to grow. This has led to a revision downward of the expectation on future rate hikes. Equity factors have reacted to this change pretty strongly, with quality and size taking the lead for that month while value and high dividend released some of their performance. This rotation has been particularly strong in Europe where economic predictions are the most dire. Having said that, the performance difference in the first 6 months were so high that the full year to date picture remains similar.

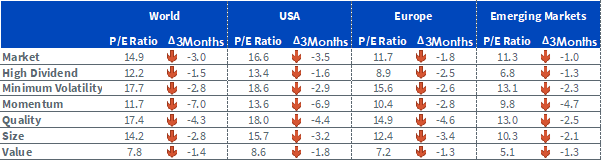

Valuations continue to come down across the board

In Q2 2022, valuations continued to decrease across the board for factors. Momentum and quality saw the largest drop in valuations in all geographies. On a relative basis, high dividend stocks and value stocks got more expensive versus the market on the basis of lower drop in their price to earning ratios.

Figure 3: Historical Evolution of Price to Earnings ratios of equity factors

Source: WisdomTree, Bloomberg. As of 30th June 2022. Full index definitions can be found below.

Historical performance is not an indication of future performance and any investments may go down in value.

The re-opening trade in 2021 has evolved into the ‘recession trade’ in 2022, owing to a tardy start to the hiking cycle by central banks. Their aggressive tightening plan is slowing the global economy, raising the probability of a global recession. Leading economic data (LEI) shows economic momentum is fading quickly. The impact of this slowdown has been clear in July with rate hike expectations lowering leading to a factor rotation in favor of quality and size. However, this risk of recession only adds to the uncertainty for investors. They need to carefully balance the risk in their equity allocation. All-weather assets continue to be best positioned, delivering balance between building wealth over the long term whilst protecting the portfolio during economic downturns. This environment could therefore favour high dividend and quality stocks.

World is proxied by MSCI World net TR Index. US is proxied by MSCI USA net TR Index. Europe is proxied by MSCI Europe net TR Index. Emerging Markets is proxied by MSCI Emerging Markets net TR Index. Minimum volatility is proxied by the relevant MSCI Min Volatility net total return index. Quality is proxied by the relevant MSCI Quality net total return index.

Momentum is proxied by the relevant MSCI Momentum net total return index. High dividend is proxied by the relevant MSCI High Dividend net total return index. Size is proxied by the relevant MSCI Small Cap net total return index. Value is proxied by the relevant MSCI Enhanced Value net total return index.

Sources

1 Definitions of each factor are available below