A recession next year is our base case for the world’s largest economy. However, what indicators might signal an increased chance of a ‘soft’ landing?

Let’s be clear, it looks bad. The US Federal Reserve (Fed) is effectively 2-0 down in the match to avoid recession, as Chair Jerome Powell appeared to concede in his market-moving comments last week. The central bank’s star macro model has been taken off for repeatedly missing the target. But there is still time to turn this around…

Defining a soft landing

We believe success for the central bank now involves a period of sluggish growth, as long as GDP avoids contraction. Some rise in unemployment from today’s low levels would be acceptable, in our view, providing it settles near its estimated long-run sustainable rate of around 4%.

As growth slows, it’s difficult to distinguish between a soft landing and recession in the initial phase. So the crucial feature of a soft landing would be core inflation returning to target with an acceptable lag (so by early 2024).

A soft landing should also set up the potential for a period of steady economic expansion and push out the timing of the next recession into the indeterminate future.

What to watch for

Inflation would be most important indicator of a soft landing, because the faster it comes down, the more flexibility afforded to the Fed to stop rate hikes – or even reverse back to neutral – to support demand and financial markets.

The unwinding of the negative supply shocks is necessary, but not sufficient. We are already seeing good progress on semiconductor production, freight costs, supplier delivery times and inventory normalisation. The quicker these shocks reverse and goods price inflation eases, the better.

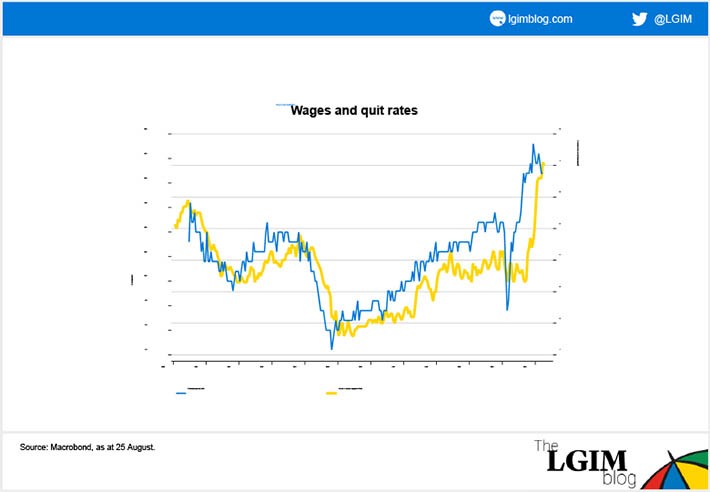

But the key battleground will be the labour market. Wage growth needs to slow. Historically, from such a starting point, this has only occurred with a recession.

Perhaps the uniqueness of the pandemic will make this time an exception. The rise in wages could be a one-off, level adjustment to attract people back to work and compensate for the surge in goods price inflation, which itself was largely caused by the pandemic. Also, labour supply could improve as retirees come back to work and inactive workers either recover from long COVID or relinquish caring duties.

There is a large array of labour market data to track to see whether supply and demand are settling back to balance without a significant rise in unemployment.

Other indicators

As we monitor the US economy, we’re also watching out for:

• Stable inflation expectations, but these might be well-anchored because of belief the Fed is prepared to generate a recession if necessary to control inflation

• Business surveys to remain mixed, rather than deteriorate much further, alongside still-reasonable durable goods orders and retail sales

• Absences of an excessive inventory build

• Steady household savings rate at a low level

• An easing in high frequency data on rents

• Improving productivity (though hard to spot in real time)

In mid-June the markets were worrying about an imminent US recession. The rebound off the bottom by risk assets suggests investors were starting to embrace the chance of a soft landing. Through this period, we have maintained our forecast for a recession in the second half of 2023, but will be carefully watching these and many other indicators to see if there is indeed a path to a soft landing.