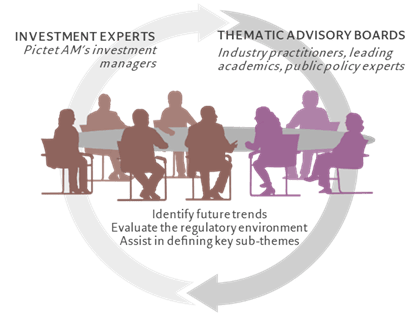

Pictet’s thematic equity managers can draw on the expertise of Thematic Advisory Boards to help gain a differentiated perspective of the key questions surrounding themes.

In search of an information edge

Getting access to differentiated sources of information and insights is a critical factor in investment management. A number of broadly available information sources, e.g. sell-side research, traditional information and data services, are largely commoditized. Hence investment managers need to ensure they can maintain an information edge. Pictet’s Thematic Equity teams each focus their investments on a thematic subset of the global equity markets and acquire highly specialized expertise in doing so.

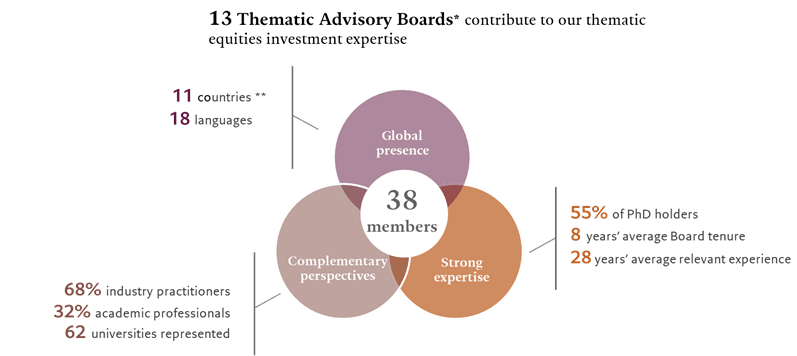

In search for an additional informational advantage, we rely on groups of external experts organised as Thematic Advisory Boards (TAB). They typically consist of three members with backgrounds ranging from academics, industry veterans or policymakers with deep relevant expertise or experience for the theme at hand. While some TAB members may have name recognition, they aren’t necessarily chosen as high-profile figures, the views of such people are often quite visible and therefore freely available. Rather, we tend to choose to work with experts whose insights draw on a strong industrial or entrepreneurial track record or an impressive body of academic research. Collectively, Thematic Advisory Board members represent a considerable amount of diversity of knowledge, backgrounds and experiences.

** Countries where the members of our Thematic Advisory Boards perform their main activity.

Data on this chart refer to all the Thematic Advisory Boards at Pictet Asset Management, across all thematic strategies. Source: Pictet Asset Management, January 2022

Role of Thematic Advisory Boards

The role of a TAB is not to help with investment decisions per se, nor to ‘pick’ stocks for the portfolio, but rather support the investment managers with a range of relevant insights that help frame the key questions surrounding the theme.

Thematic Advisory Boards help track the long-term course of a theme and provide specific insights on shorter-term developments, too.

- Strategic insights: Thematic investment managers adopt a long-term focus. Our TABs contribute to maintaining that perspective by helping to track and appreciate relevant megatrends and helping distinguish structural shifts from short-term noise. For example, during 2020 with the COVID pandemic being potential catalyst for a number of themes, TABs were relied on to formulate hypotheses about possible lasting changes and then validate them over time. Such insights can ultimately help guide the evolution of thematic stock universes.

- Tactical insights: TAB discussions can also center on the understanding of shorter-term drivers for certain portfolio segments. For instance, analyses of where exactly in the business cycle a specific industry segment finds itself might be provided by one of our industry experts. Similarly, feedback on how a particular shock (e.g. supply chain shortages) may be affecting specific types of companies may be sought.

- Theme definition: Thematic portfolios are not static but rather evolve over time, with occasional repositionings. TABs play a critical role as a sounding board when structural adjustments to a theme are being considered.

- Sustainability topics: ESG and impact topics have always played a central role in thematic portfolios. However, in this rapidly evolving field, innovation is essential. How we chose to approach emerging sustainability topics is guided by insights from our TABs.

Role of the Thematic Advisory Boards

Our Thematic Advisory Boards formally meet approximately twice a year. In addition to Pictet Asset Management thematic investment teams, occasional guests but also other investment teams might attend when topics discussed allow for read across.

The TAB meetings typically take place in our Geneva or Zurich offices. Whenever appropriate they also include virtual or hybrid formats. Occasionally, they are combined with a fieldtrip, thus allowing the TAB members and investment team to gain insights from visits to industrial sites, research facilities or think tanks. For example, recently, the Clean Energy TAB met in the US during a trip that included visits to the National Renewable Energy Laboratory and Electric Power Research Institute. The Timber TAB met in Germany during a trip that included visits of a large sawmill, a pulp mill and various forest sites.