In the second instalment of a three-part series, we examine the impact of fees on the investment outcomes of ESG multi-asset investors.

Sometimes called ‘the only guarantee in the world of investing’, fees are one of the first things any investor should consider. Over the long term, a small increase in the level of fees can result in a large drag on performance. For ESG investors, the good news is that rising demand has led to a raft of fund launches – both active and passive – providing scope to minimise the drag of fees without compromising ESG credentials.

In the first instalment of this series, we explored the implicit biases present in some ESG strategies, which may not be fully appreciated by investors, but can still impact their portfolios’ performance.

In this instalment, we examine how innovation in ESG investing has led to new, cost-effective solutions and quantify what that could mean for investors.

Fees compared

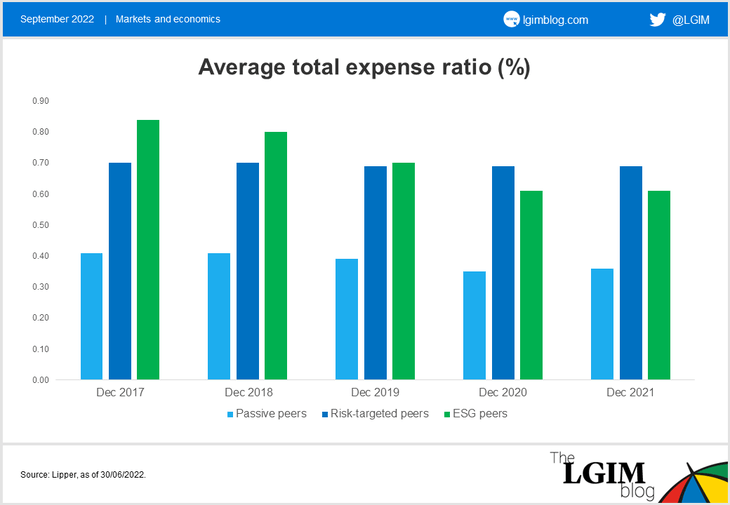

Let’s look at the evolution of the average total expense ratio (TER) across different peer groups and what it means for fees. For this comparison we identified three peer groups of UK-domiciled multi-asset funds:

- Risk-targeted: funds targeting risk profile 5 as per Dynamic Planner

- Passive: funds with a risk rating of 5 and a passive approach as designated by Dynamic Planner i.e. strategies that invest predominantly in index funds

- ESG: funds with a risk rating of 5 and designated ESG/Sustainable/Ethical by Dynamic Planner

We chose risk profile 5 on the Dynamic Planner scale from 1 to 10 as it represents an intermediate level of risk, which is most popular among UK retail investors.1 To make the comparison as fair as possible, we always chose the primary share class across all three peer groups.

In 2017, the average TER was just under 40 basis points (bps) for passive peers, around 70bps for risk-targeted peers and just over 80bps for ESG peers.2 As new, cost-effective ESG multi-asset funds came to the market, they were added to the ESG peer group and its average TER gradually fell.

While the downward pressure on charges was experienced across all three groups, the drop in the average fee was most significant for ESG peers. This was a welcome development in the ESG market which, in the past, might have priced out more cost-conscious investors.

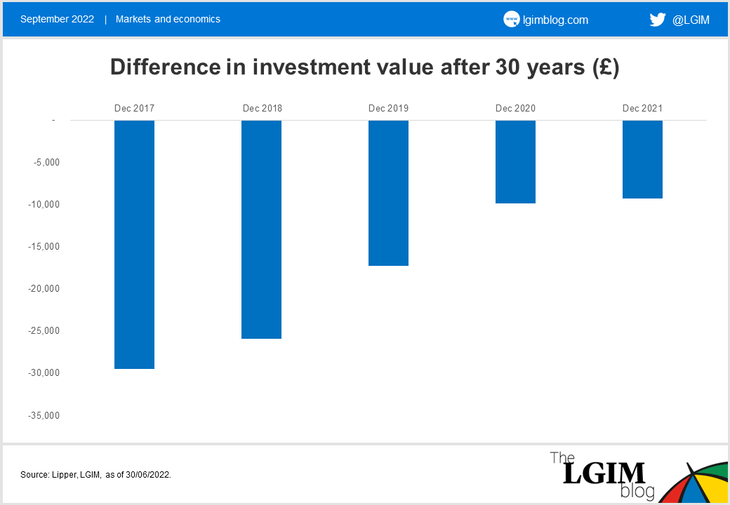

To quantify the expected benefit of this reduction in ESG fees, we can simulate the long-term performance of an initial investment of £100,000 in two strategies:

- Strategy 1: TER aligned with average TER of passive and risk targeted peers

- Strategy 2: TER aligned with average TER of ESG peers

Using the 2017 average fee numbers and an investment horizon of 30 years, the simulation reveals the difference in the final investment value is just under £29,500 in favour of Strategy 1.

Our simulation assumes the same gross return for both strategies, which gives us information about the hurdle faced by ESG strategies given their higher fees. As time passed, that hurdle lowered, dropping below £10,000 by 2021.

Why did ESG fund fees fall?

One explanation is the improvement in the quality of ESG data, a result of improved disclosure from companies. More reliable, financially material ESG data allowed for a more meaningful company-level comparison across most sectors and geographies. As a result, a significant share of listed corporate issuers can be consistently assessed on a set of relevant and quantifiable ESG metrics – something that simply would not have been possible 10 years ago.

That opened the door to a new way of ESG investing. Rather than choosing individual companies with an active strategy, it’s now possible to construct and track an index that will tilt weightings according to the ESG credentials of the underlying constituents. While these strategies are still priced at a premium to cover the cost of additional data requirements and a more sophisticated design, the premium is materially lower than that of earlier ESG funds.3

Investors are certainly warming up to the new approach, with half of the top 10 funds with largest net inflows in 2021 now being ESG, sustainable or low-carbon trackers.4

A blended approach

Multi-asset investors have been blending active and index strategies for years, and today ESG investors are able to do the same thing. This allows them to monitor not only fees but also their overall level of diversification – something we discussed in the first instalment in this series.

Fees will always be an important influence on investment outcomes, and the shrinking premium of ESG funds is a welcome development.

In the final part of this blog, we’ll examine how to marry sustainability with ongoing sustainability and explore the importance of risk-stability in multi-asset ESG solutions.

Key risks; Past performance is not a guide to the future. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. It should be noted that diversification is no guarantee against a loss

1. Source: Distribution Technology

2. Source: Refinitiv Lipper, as at 30/06/2022

3. Source: Refinitiv Lipper as at 30/06/2022; representative sample of actively managed and index-based ESG funds in 2017 and 2022

4. Source: Morningstar UK Fund Flows Report, 2021