Key takeaways

Our framework remains in a contraction regime. We expect decelerating earnings to drive equities lower.

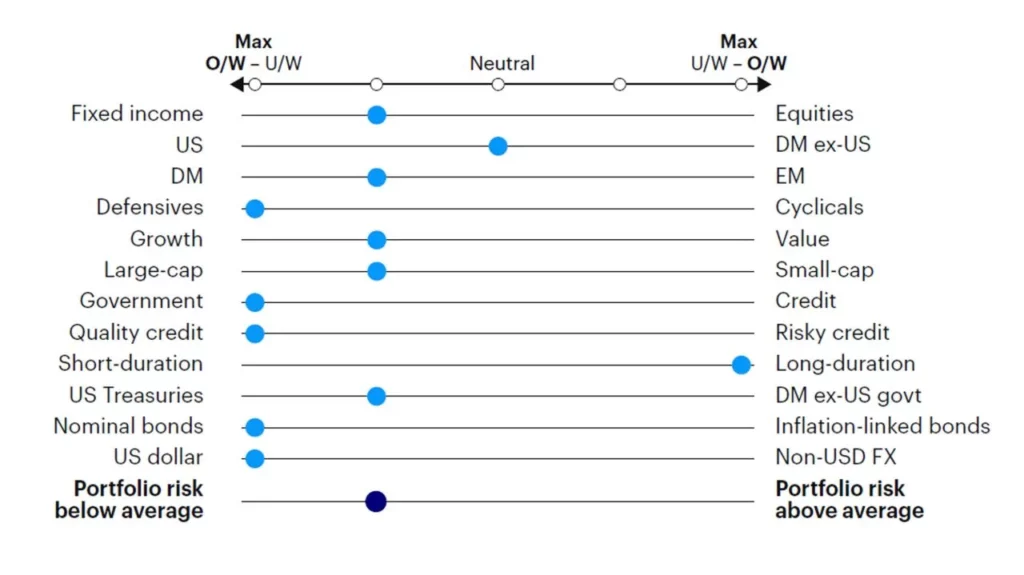

We favour fixed income over equities, underweighting credit risk, overweighting duration, the US dollar and defensive equity factors.

Leading economic indicators continue to weaken, suggesting growth is likely to be below trend across regions.

Surveys of consumer sentiment remain around all-time lows in both the United States, eurozone, and United Kingdom, but have stabilised in the last three months.

Business surveys, manufacturing activity and the construction sector continue to decline towards their long-term trend, while monetary conditions continue to tighten.

Risk sentiment continues to deteriorate, with equity markets underperforming fixed income, and credit spreads widening again to recent highs. It’s likely that this process has further to run and is indicative of deteriorating growth expectations.

Figure 1. Relative tactical asset allocation positioning