On 23 January 2023, the Bank of England’s Prudential Regulation Authority (PRA) published the results of its 2022 insurance stress test exercise launched in May 2022 and covering 54 insurers (including 16 life insurers).

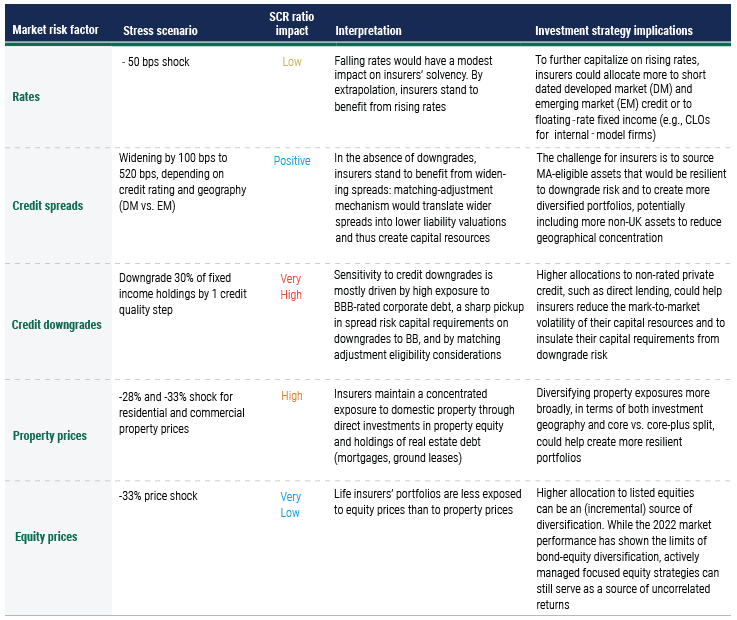

For life insurers, the exercise highlights vulnerability to credit downgrades and to bond market illiquidity. The stress test assumes a combination of falling interest rates, widening spreads, declining equity and property prices, and full-letter rating downgrades on 30% of life insurers’ non-sovereign debt holdings.1 The main stress driver under this scenario is credit downgrades which account for a roughly 20 percentage-point decrease in the aggregate solvency capital requirement (SCR) coverage ratio.

In our view, this reflects the combined impact of:

- Sizable and growing exposure to BBB-rated credit. BBB-rated bonds accounted for 25.3% of UK life insurers’ overall bond holdings as of third-quarter 2022, up from 21.1% in third-quarter 2017.2

- The capital impact of downgrades from BBB to BB. Under the standard formula approach, the spread risk capital requirement for a 6.5-year duration rises to 26% from 16% on a downgrade to BB from BBB.

- The cliff-edge effect of matching adjustment (MA) eligibility. Firms subject to matching-adjustment mechanism will be forced to divest from downgraded names and reinvest in MA-eligible assets.

This last point puts into focus the UK corporate bond market liquidity. The PRA estimates that under the stress scenario, insurers will be selling between £8 billion and £9 billion of liquid below-investment-grade assets, a meaningful proportion of the overall ~£180 billion UK BBB-rated corporate bond market.3 Market illiquidity and lack of buyers could exacerbate insurers’ losses and thus lead to further deterioration in the SCR ratio.

How plausible is this severe downgrade scenario? In 2002, in the wake of the dot-com bubble burst and subsequent recession, one-year downgrade rates for BBB-rated corporates reached as high as 12.6%, with over 20% of issuers rated BBB− ending the year rated below investment grade or in default.4 At the peak of the Great Depression in 1932, 44.8% of BBB-rated issuers were downgraded and 0.9% defaulted.5 While a single-year downgrade rate of 30% seems like a remote tail event, a protracted recession could compound downgrade losses on insurers’ buy-and-hold portfolios.

What could help insurers insulate their balance sheets against downgrade risk? For non-matching adjustment portfolios, the solution could include a higher allocation to non-rated private credit, such as direct lending strategies. These investments would benefit from much lower volatility of capital requirement (no downgrade risk), lower volatility of capital resources (stable fair value), and lower rate sensitivity in a rising rate environment (a higher proportion of floating-rate exposures). Despite a challenging 2022, we see opportunities for insurers in US middle-market lending in particular.

Matching-adjustment firms remain beholden to the investment-grade rating requirements under Solvency II regulations. While the ongoing matching adjustment reform is expected to bring some degree of relaxation of these requirements, insurers should remain focused on sourcing resilient private-market assets that are unlikely to suffer from credit quality deterioration, potentially complementing their internal sourcing capabilities with those of specialist third-party asset managers.

Life Insurers’ Market Risk Stress Sensitivities: Investment Strategy Implications

1 For full stress scenario specification, see Table 1 in Bank of England Prudential Regulation Authority (4 May 2022) Life Insurance Stress Test 2022 – Scenario Specifications, Guidelines, and Instructions

2 See Bank of England Insurance aggregate data quarterly report

3 ICE BofA BBB Sterling Corporate Index (UR40) as of 31/12/2022

4 Moody’s (February 2003) Default & Recovery Rates of Corporate Bond Issuers: A Statistical Review of Moody’s Ratings Performance, 1920-2002

5 Simone Varotto (December 2012) Stress testing credit risk: The Great Depression scenario – Journal of Banking & Finance, Vol. 36 (Issue 12)

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.