As the first quarter moves along, there appears to be an absence of consensus among investors about the risk of a U.S. recession, the severity of a potential recession, and the end of the bear market. Given the lack of consensus, this month we investigate investment implications of three U.S. recession scenarios: no recession, a mild recession, or a severe recession.

Investment strategies highlighted this month:

- Scenario 1: No U.S. Recession – Opportunities in growth stocks, commodities, and emerging markets.

- Scenario 2: Mild U.S. Recession – A focus on income generation in rangebound trading markets by harvesting volatility premiums with covered call strategies in volatile sectors like Technology.

- Scenario 3: Sharp U.S. Recession – A reduction in exposure to equities or a turn toward buffers to protect on the downside.

Scenario 1: No U.S. Recession — Growth Back in Favour

Many equity investors believe that a bull market is underway, based on an optimistic scenario in which the Federal Reserve (Fed) is successfully reducing inflation with only modest slowing in economic growth, corporate earnings, and employment. Some economic indicators, including the Purchasing Managers Index (PMI), point to a slowdown in U.S. economic activity, but employment remains strong despite higher interest rates. Overall, the resilience of the U.S. economy as this monetary tightening cycle approaches its end reduces the risk of a first-quarter collapse in earnings and supports U.S. equities. The strong year-to-date performances of the U.S. Financials (5.7%), Industrials (3.4%) and Materials (5.0%) sectors are encouraging, as cyclical sectors tend to drop ahead of an imminent recession.1 Broadly, a strong first half looks possible given continuing improvements on inflation and a resilient job market.

Global inflation is likely to continue to ease amid lower base effects due to declining oil and commodity prices alongside the slowing global economy. All things equal, in this scenario we expect a gradual rotation back to growth stocks, supported by slower tightening in developed markets, large public spending on infrastructure, tech and clean energy, attractive valuations in certain areas of tech, and a lower U.S. dollar.

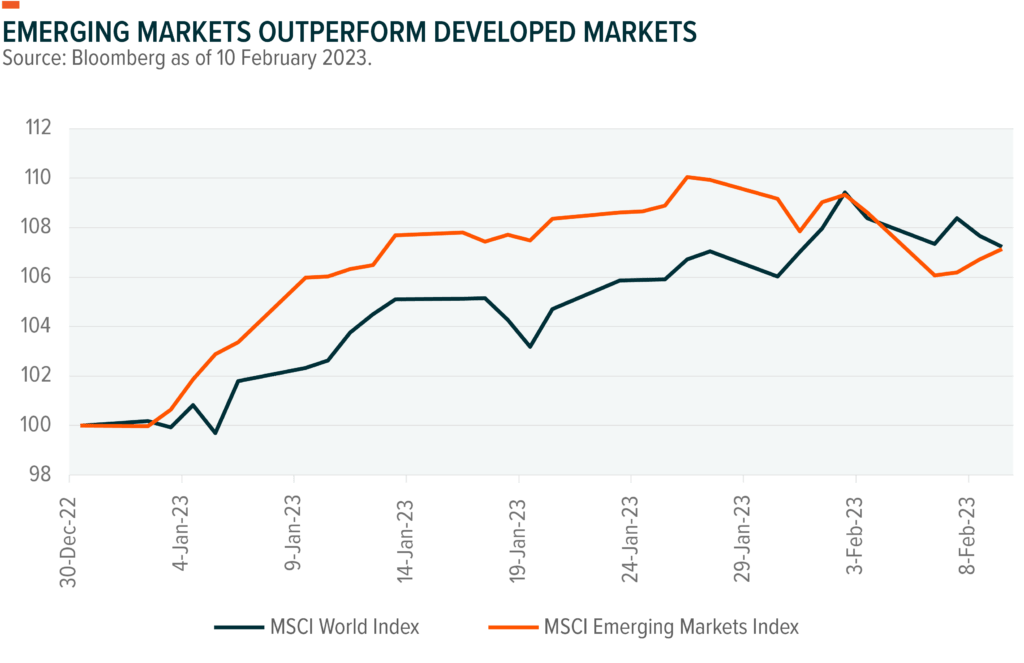

In China, a weaker U.S. dollar coupled with easing COVID restrictions, a real estate rescue plan, and expectations for easier policy from the People’s Bank of China helped attractively valued Chinese equities to rebound toward the end of 2022. More broadly, the rebound improved investor sentiment on emerging markets (EM). Asia ex-Japan has led equity markets since the end of October, outperforming Europe and Japan, which have also outperformed the U.S.

Some commodities, like copper and its leveraged strategy through copper miners, could also benefit from improving economic data in China while also being supported by structural demand as core components for clean energy technologies and electrification.

Scenario 2: Mild U.S. Recession — Covered Calls for Volatility

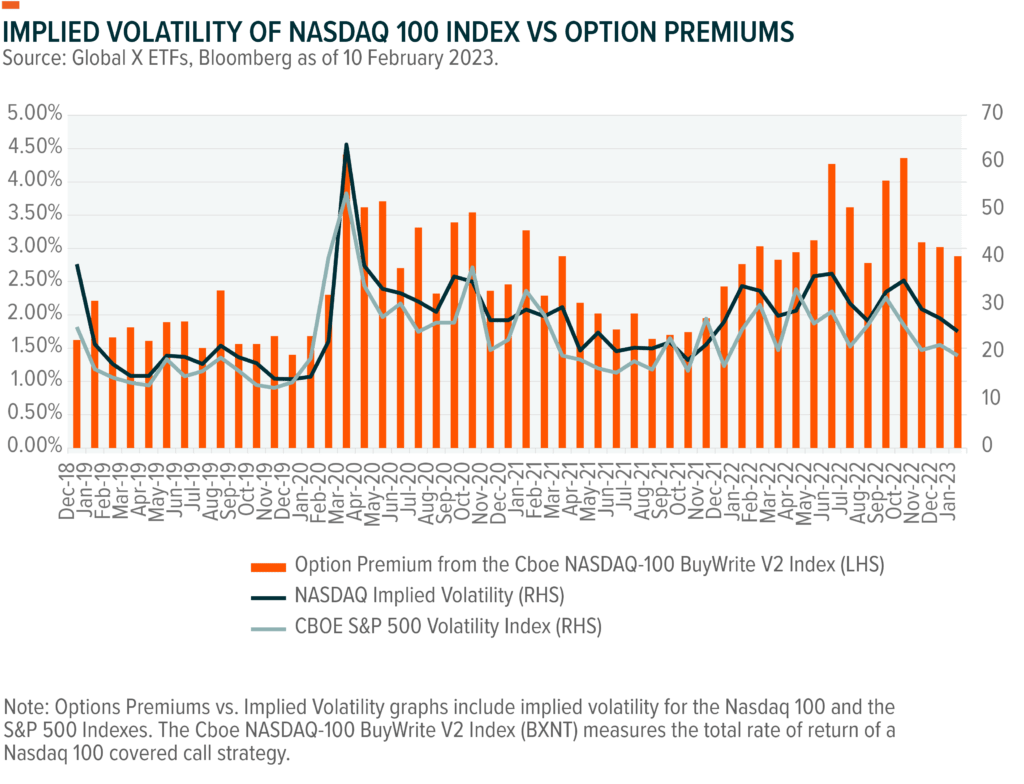

Given expectations of slower global growth this year, investors could consider a more nuanced approach towards equities in a mild recession scenario. For example, covered call strategies, which benefit from slowly rising or rangebound trading markets. The potential income collected from covered call writing could be particularly attractive to add on dividend yields amid higher interest rates.

A case study may be big tech companies, which are increasingly scrutinised by U.S. regulators and the government to prevent them from becoming too dominant. Scrutiny that includes the potential for tighter regulations could slow big tech’s growth rates. Also, Treasury yields continue to increase amid the Fed’s monetary policy tightening, which could lead to volatility and lower upside for the largest tech stocks, including those listed in the Nasdaq 100 Index.

In this situation, investors could implement a strategy that focuses on income generation while benefitting from the heightened volatility. One way would be to purchase the Nasdaq 100 Index and then sell call options on the index. This covered call strategy limits potential upside but generates income by collecting premiums from the option writing. In volatile markets, option premiums tend to be higher, so covered call strategies tend to perform best in choppy or sideways markets rather than in major bull or bear markets. Typically, the Technology sector is more volatile than other sectors, and options can harness that volatility. Selling at-the-money calls are often used to maximise volatility premiums.

Scenario 3: Sharp U.S. Recession — Buffers for the Downside

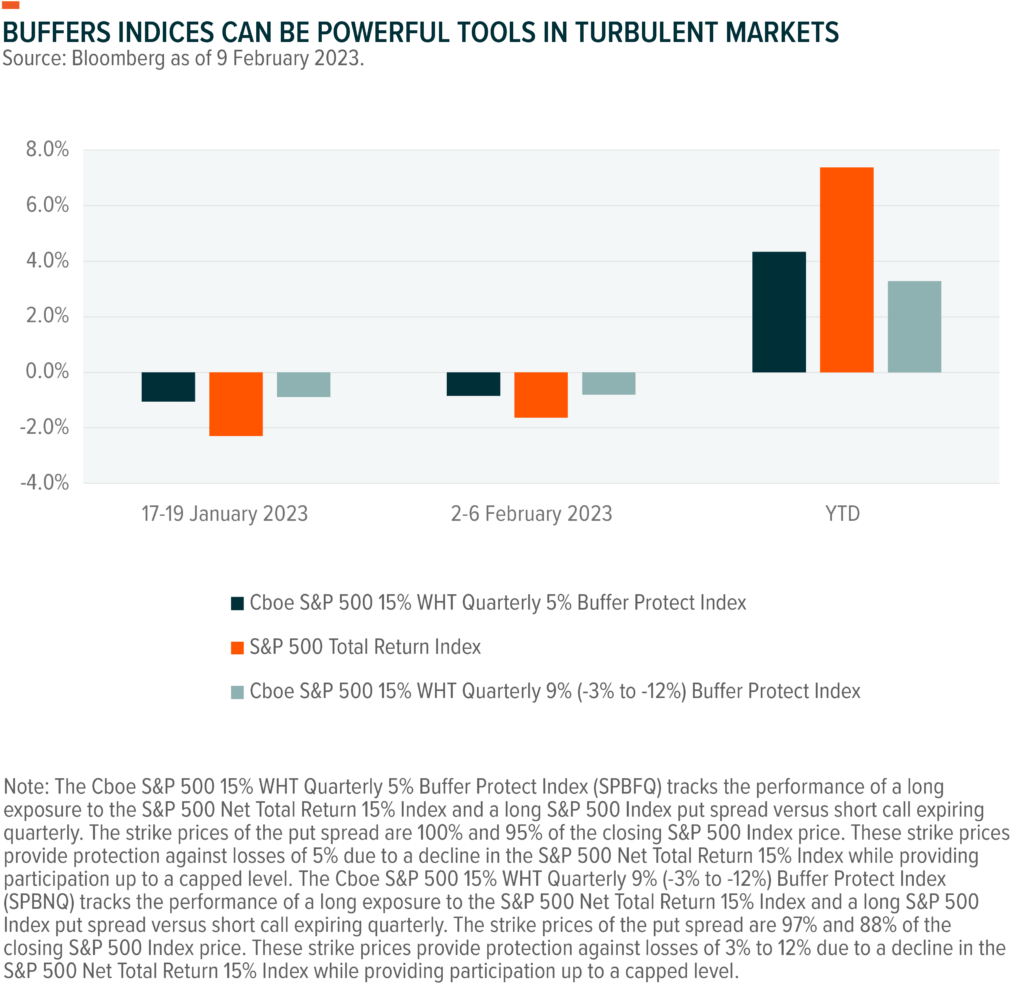

The U.S. Treasury yield curve remains deeply inverted, which is usually a signal that a recession is on the horizon. Also, oil prices are 35.4% percent lower than their peak in June 2022, which suggests investors are not expecting a rebound in economic activity despite China’s reopening.2 Depending on the level of conviction that a sharp U.S. recession is likely, strategies might differ. If investors are convinced of an upcoming bear market, they would likely reduce exposure to U.S. equities. If they are unsure, a more moderate approach could be to look at strategies that offer downside protection in exchange for some upside, such as a defined outcome strategy. This strategy enables investors to stay invested in equity whilst lowering equity betas.

Buffered strategies are a type of defined outcome strategy, built to mitigate investors’ loss aversion by absorbing a certain level of market losses over a defined outcome period. In bear markets, these strategies only expose investors to losses that exceed the buffer.

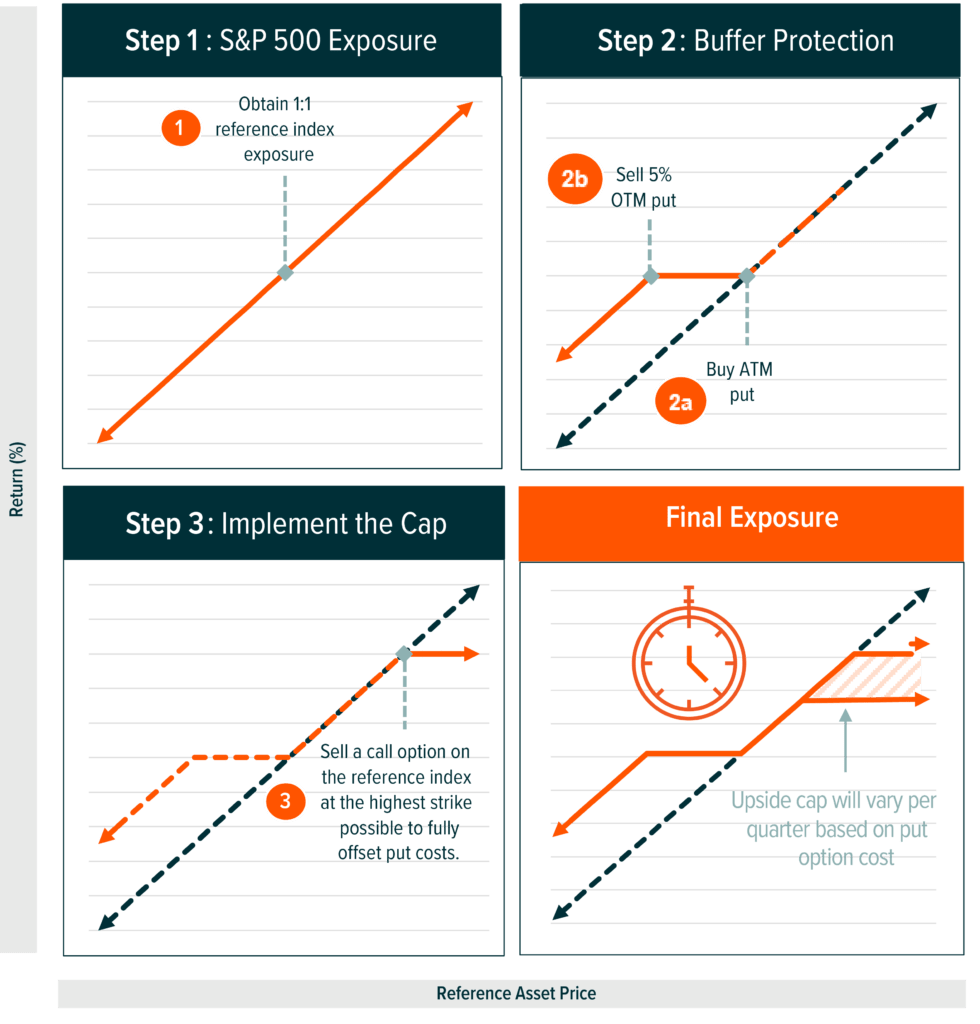

A combination of options is used to obtain a buffer. For example, a defined outcome strategy with 5% buffer protection protects against the first 5% of losses in the reference asset, such as the S&P 500 Index (SPX), over the course of the outcome period. The strategy typically includes a long exposure to the S&P 500 Index, a long put spread where the strike prices on the long and short put option positions determine the level of downside protection being offered (e.g., 5%), and a short SPX call. The upside cap is used to offset the premium costs of the put spread. The result is an exposure that achieves the full upside potential of the reference asset, up to a cap, with the ability to provide a specified amount of downside mitigation over the life of the contracts.

Unlike structured notes, buffered ETFs are more liquid and transparent, have limited credit risk, and are usually cheaper.

This document is not intended to be, or does not constitute, investment research as defined by the Financial Conduct Authority

FOOTNOTES:

- Bloomberg as of 10 February 2023

- Bloomberg as of 10 February 2023