Reduced recession risk, an approaching peak in interest rates and better-than-expected corporate earnings make us less pessimistic on equities.

Asset allocation: rewarding resilience

It’s all a matter of perspective.

On the face of it, the fact that corporate earnings are down on last year doesn’t seem to be very good news. But the numbers reported for the second quarter so far have actually been comfortably above consensus expectations. Encouraged, analysts are starting to revise up their forecasts for future profits; for the first time in a year, upgrades now outnumber downgrades.

We see similar signs of resilience elsewhere. Recession remains a risk, but the odds of avoiding one have improved from a month ago. China’s economy has slowed, but the government has shown a willingness to backstop the faltering recovery.

All this leaves us feeling a little more optimistic about the prospects for global equities; we have therefore moved from underweight to neutral. For us to shift to overweight, we would need to see proof that the global economy is reaccelerating rather than just stabilising. So far we see no evidence of that.

At the same time, we have reduced our weighting on cash. With yields expected to grind lower in coming months as central bank monetary tightening reaches a peak, now is a good time to move money out of cash and lock in the relatively high rates still on offer in the bond market, where we are overweight.

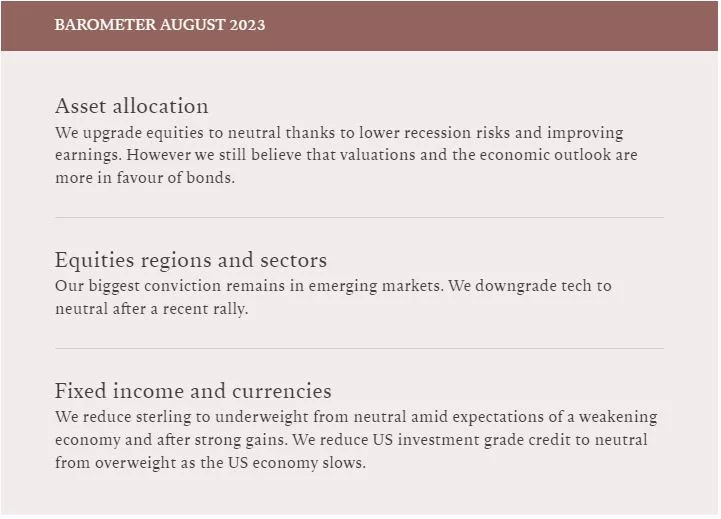

Fig 1. Monthly asset allocation grid

August 2023

Our business activity indicators point to a soft landing for the global economy.

Emerging markets (EM) remain the star performers. They took on the battle against inflation earlier than their developed peers and are now seeing growth bounce back. A persistently weak US dollar and a likely peak in US interest rates will further help developing economies from Latin America to Asia.

We see EM growth outpacing that of developed world by 2.6 percentage points this year and 3.4 percentage points in 2024 – comfortably above the 5-year moving average. This supports our positive stance on both EM equities and EM local currency bonds.

In the developed world, there have been some positive signs from the US economy, with recent data surprising to the upside. However, we are concerned that this strength is now very much in the rear-view mirror and expect anaemic growth through 2024.

The outlook for the euro zone, meanwhile, is less encouraging than it was a few months ago. The drop in energy prices has not translated into the increases in disposable income and the revival we had expected in consumer spending now looks less likely given that borrowing costs are now reaching decade highs. Moreover, soft demand from China is translating into slower European exports, exacerbating the manufacturing recession.

All this makes us more cautious on European stocks.

Our liquidity models indicate a draining of liquidity across most major developed economies. This is however offset by an easing of monetary conditions in China.

Our positive stance on EM assets could be strengthened if China eases monetary policy further. We expect a number of easing measures to be introduced over the summer months, particularly on infrastructure and housing.

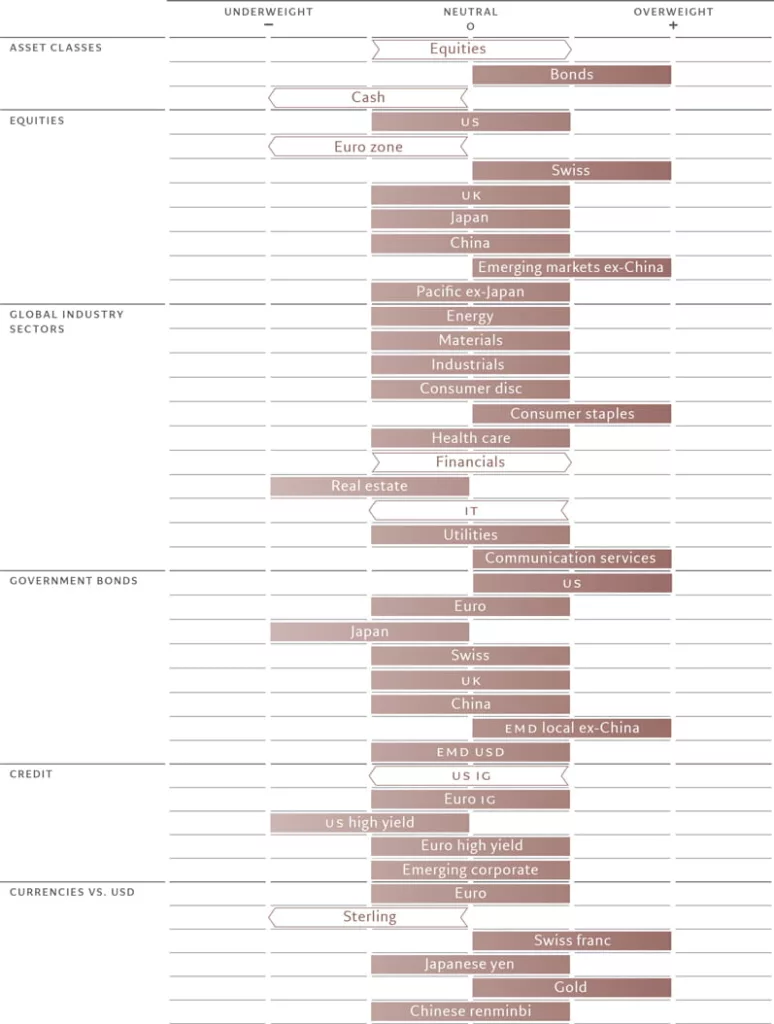

Fig. 2 – Optimism returns

US equities’ 12 month forward EPS estimates and breadth of revisions

Our valuation models offer further grounds for optimism on EM assets. In equities, developing market valuations are now at a double positive following recent underperformance. Latin American stocks look particularly attractive.

Elsewhere, though, equities are expensive relative to history and bonds strategically offer better value.

For US stocks, the 12-month P/E ratio is around 25 per cent above our long-term value forecast of 16 times, for example. But we see the potential for a near-term overshoot above fair value due to a trough in earnings revisions (see Fig. 2) and a peak in central bank policy rates. The reduced probability of a US recession (as signalled both by our own models and by IMF analysis) and more evidence of moderating inflation could add further momentum.

Technical indicators also suggest that equities could have a bit further to run despite the stretched valuations. Equity trends are positive, with market breadth, or the number of stocks participating in the rally, rising in July.

However, the drop in equity market volatility is a cause for concern. With summer’s typically muted trading volumes, it won’t take much for conditions to suddenly worsen, potentially catching out the more optimistic investors. Any such moves could be particularly painful given market positioning – net call volumes1 on the S&P 500 are at their highest in two years, while retail investors’ sentiment is in euphoria territory, with the AAll bull-bear spread2 in the top decile. This reaffirms our decision to go neutral rather than overweight.

[2] The difference between the percentage of investors with a positive short-term outlook on US stocks (bulls) and those with a negative one (bears).

Equities regions and sectors: emerging markets offer more value

Emerging stocks continue to be a bright spot.

They enjoy superior economic growth and more attractive valuations compared with their developed peers.

Inflation is falling faster than in the developed world, which may prompt central banks to start cutting interest rates, especially in Latin America and emerging Europe.

In China, the policymakers appear to be more willing than before to support the economy, having so far confined themselves to targeted measures in selective sectors.

Our forecast for earnings growth through this year and next shows emerging economies topping the league at 12 per cent per annum, nearly double that for Japan which is the strongest among developed economies.

What is more, emerging stocks should benefit from a secular deprecation of the US dollar which we expect to play out in the coming years.

We therefore expect emerging stocks to outperform, and remain overweight in the EM regions outside of China.

Our neutral stance on China is unchanged as we wait for more evidence of a pick-up in consumer spending and a recovery in the real estate sector.

Stabilisation in the US-China relations is also necessary for us to become positive on Chinese stocks.

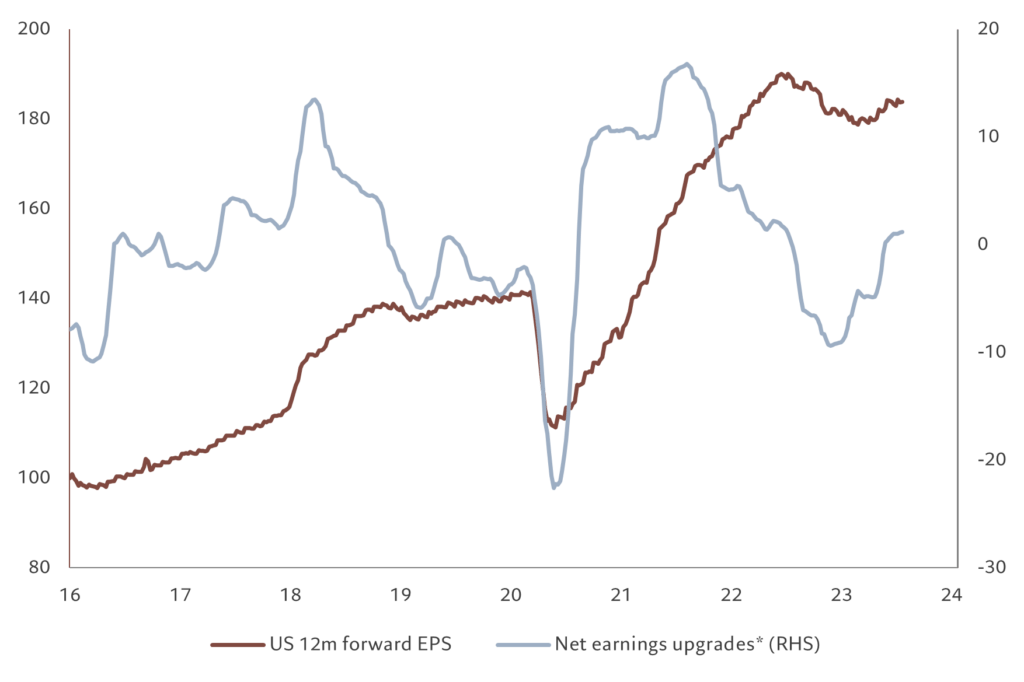

Fig. 3 – Bubbly tech

US tech sector* market cap and earnings share of total market (%)

The outlook for developed stocks is more mixed, especially because investors appear to be getting ahead of themselves in cyclical and growth-oriented parts of the market.

We think an expansion in developed market multiples is overdone. Our model shows earnings growth of DM companies weakening from this year to next.

Separately, our liquidity analysis shows valuation in developed market equities has expanded by 25 per cent, more than double what is implied by the level of excess liquidity, or the difference between the rate of increase in money supply and nominal GDP growth.

This is especially the case in the US, where equity multiples have significantly overshot what we consider sustainable. US 12-month price earnings stand at 20 times, nearly 25 per cent above our fair value estimate.

The US economic outlook is becoming uncertain as tighter monetary policy and slowing consumption spending point to below-potential growth in the coming quarters.

That said, inflationary pressures are easing further and optimism about the impact of AI could keep multiples supported well above fundamentals for a while longer. Considering all this, we maintain our neutral stance in the US.

We downgrade Europe to underweight. The economy remains weak with a recession in Germany and little signs of a rebound in economic growth nor corporate earnings. What is more, a strong euro is a drag on exports.

We continue to prefer companies and sectors with high profitability, good earnings visibility and low leverage – characteristics often found in “quality” companies which typically perform well in an uncertain low growth environment.

Switzerland has a high concentration of quality companies, such as consumer goods manufacturers. We therefore remain overweight Swiss stocks.

The most recent leg of the market rally has been led by growth stocks – or those whose earnings are expanding faster than the market – most notably in the technology sector, which has risen nearly 40 per cent so far this year and attracted the most inflows in the past four weeks.

As a result, this cohort has become red hot with the prospect for higher earnings and lower interest rates all factored in the price. We therefore downgrade technology to neutral from overweight.

We are cutting our underweight position in financials as we are encouraged by the prospect for large banks to collect healthy income from credit products.

Elsewhere, we remain overweight on communication services and consumer staples, high quality and defensive sectors, respectively, that should perform well under the current economic environment.

Fixed income and currencies: the levitating pound

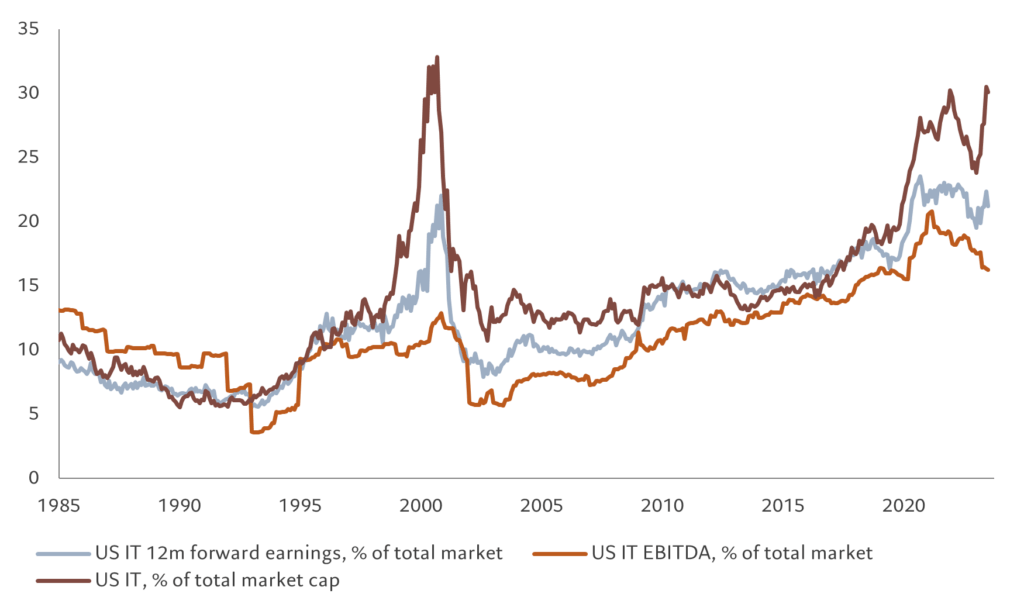

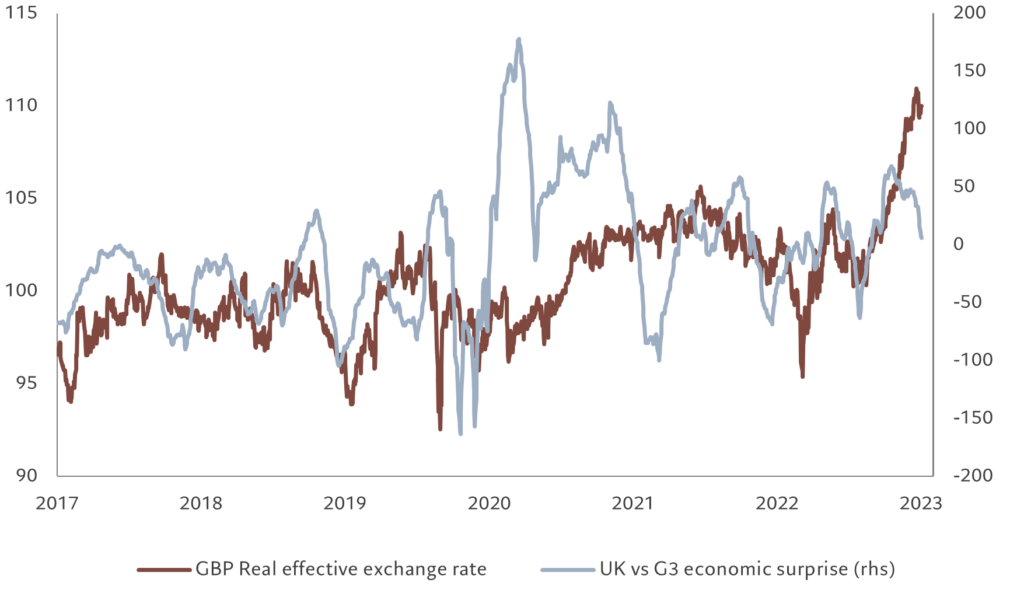

Sterling’s ascent since last October has seemingly defied gravity. But we question for how much longer. As a result, we cut our position on the currency to underweight from neutral.

Having hugged a fairly tight range during recent years, within a rough 10 per cent valuation band on a trade-weighted basis, the British currency broke out over the last nine months or so (see Fig. 4). From lows reached during the sovereign bond crash triggered by former Prime Minister Liz Truss in September 2022, the pound has jumped some 16 per cent. Although some of this reflects concurrent dollar weakness, the pound has also been driven by the Bank of England’s (BoE) jittery but eventually sizeable response to naggingly persistent UK inflation. Expectations for the maximum rate the BoE is expected to reach and how long it’s likely to stay that high have progressively been ratcheted up.

A wage-price spiral is central bankers’ nightmare and we see little evidence to suggest that the UK is firmly in the grip of one. Indeed markets were surprised by the first softer than anticipated inflation print and we expect a few more such data points confirming our view of sharp disinflation in the coming months. Goods prices have been falling as they have in other economies, prices paid by producers are on the verge of slipping into outright deflation and consumers’ expectations of inflation have rolled over sharply – all a nod in the direction of the UK not being on a particularly sticky wicket when it comes to inflation.

But rate hikes have also started to take a bite out of growth expectations. Relative to other major economies, UK economic surprises have become increasingly less positive and run the risk of being outright disappointing in the coming months. Lead indicators are rolling over sharply and labour market is softening albeit from extremely tight levels. We think that sterling investors will start to price in an increasingly gloomy economic outlook.

Fig. 4 – Too much too soon

GBP real exchange rate and relative growth momentum, real effective exchange rate 04.11.2019=100

As for the dollar, although it has lost substantial ground over the past year the effect has been to take it from being overvalued to just being fairly priced on our models. The greenback is still no bargain.

In part, the dollar’s weakness has come from the fact that, among major central banks, the US Federal Reserve appears to be furthest along in fighting inflation. Following its latest hike, the markets expect the Fed’s next move to be a cut. Our economists think that the effect of higher rates will start to be felt across the economy over the coming quarters – though any slowdown will fall short of recession. That includes the corporate sector, which, so far, has managed to thrive. But while earnings have been positive, the outlook for sales is starting to slip and that of margins continues to be negative.

This along with wafer-thin additional returns over cash is behind our decision to trim our positioning on US investment grade credit from overweight to neutral.

The softer dollar is good for emerging market assets and we remain overweight emerging market local currency bonds. Domestic currency strength makes it easier for EM governments to service their dollar-denominated debt, which, in turn, lessens sovereign risk for investors.

Global markets overview: Magnificent Seven's leadership

Equities extended their rally in July, bringing this year’s gains to 18 per cent as a strong run of earnings results from corporate heavyweights and data showing moderation in inflation encouraged investors to temper their pessimistic outlook on the global economy.

The US was the best performing developed equity market with the Dow Jones blue chip index clocking 13 straight daily gains for the first time since 1987, thanks to strong second-quarter earnings results.

Energy shares were in the lead in July, with oil prices registering their steepest monthly gains since January 2022, supported by signs of tightening global supply and rising demand towards the year-end.

Technology and communication services remain the best performing sectors this year as they attracted the most inflows from investors year to date.

Indeed, this year’s rally in the S&P 500 index has been led by only a handful of companies, making it a narrowest leadership since the 1980s. So-called “Magnificent Seven” stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – are up 68 per cent so far this year, compared with the rest of the S&P index which has gained just 6 per cent.

Historically, a narrow leadership has tended to make the market vulnerable to a sentiment change or unexpected shocks.

A brighter outlook on the economy lifted corporate bonds on both sides of the Atlantic with high yield debt slightly outperforming investment grade counterpart.

Emerging assets rallied across the board as the dollar weakened broadly, with emerging local debt rising nearly 3 per cent on the month to bring this year’s gains to more than 10 per cent.

Expectations grew that central banks in Latin America and parts of Asia could soon ease monetary policy to support growth after Chile delivered a bigger-than-expected 100 basis points interest rate cut.

Tokyo stocks and the yen ended the month up more than 1 per cent while Japanese government bond yields raced to a nine-year high after the Bank of Japan adjusted its yield curve control scheme, taking a first step towards policy normalisation.

The BOJ offered to buy 10-year Japanese government bonds beyond the previous 0.5 per cent target rate while keeping unchanged its benchmark short-term rate at -0.1 per cent and long-term bond yields at zero.

Gold hit an eight-week high as expectations grew the Federal Reserve has ended its most aggressive tightening campaign in more than four decades following its latest interest rate hike in July.

In brief