Multiple factors may continue to push U.S. interest rates higher and increase risk to bond investors, but select emerging markets have generally been weathering these ongoing DM-led adverse scenarios.

Risks to bonds are multiplying. A Federal Reserve declaring victory on inflation too soon, a US Treasury accelerating borrowing in 2023, a Bank of Japan allowing yields to rise in a market known to fund offshore carry trades, “fiscal dominance” in the US, UK, and other developed markets (DM), and geopolitical facts (to which we continue to see great market denial) – all conspire toward higher yields.

We’ll start with the Fed. At its latest FOMC meeting, it paused rate hikes just after Fed Funds poked its head above its favored inflation measure (core PCE), when normally pauses happen several hundred basis points (bps) above core PCE. And this pause occurred even though commodity and oil prices had risen since the previous meeting. In fact, the bulk of the inflation decline the Fed is declaring victory on might not only not yet be over, but was dominated by goods prices rather than wages or services. Investors should watch labor prices, particularly with labor unions activated and supported largely by the left and right. Regarding Treasury borrowing, we won’t say much because we were early adopters of the “fiscal dominance” framework applied to developed markets. We want to re-emphasize that policymakers and market participants will be unable to accommodate this thinking because it doesn’t fit their frameworks, and humans in groups just don’t change those until they explode, in our opinion. Because US treasuries are assumed, a priori, to be “risk-free”, any curve steepness must be attributed to “term premium” (i.e., basically related to inflation), and not related to credit risk. Many will be looking at a radar screen that is no longer the guide it was, also a favorite of human groupings going back millennia. Good luck. And we know the sellers! The Bank of Japan is in a great position because it can sterilize, or not, its bond market interventions – it can sell Japanese Government Bond (JGBs), but if that pressures the yen or yields too much, they can just sell US Treasuries. China can, too, by the way. Good luck, again.

Good policy in emerging markets generally is an independent driver. As always, EM has plenty of uncorrelated economics and asset prices. High real interest rates in commodity-exporting countries like Brazil, and low inflation in countries like China, remind how EM has generally been weathering these ongoing DM-led adverse scenarios. There are a lot of strong EM setups in the current environment. Brazil is an obvious example. The country is beginning an overdue easing cycle while its balance-of-payments accounts continue to be a juggernaut. Brazil has lower inflation than the UK and Australia, and near 10% positive real interest rates. Unfortunately, a lot of the other EM “majors” don’t pass our tests, but we have found right-sized positions in Peru and Indonesia for other “majors” and in Uruguay, Dominican Republic, Zambia, and Sri Lanka for “minors”. Colombia could be a “major” that wins, too, and we are likely to increase in August. Whatever you think about the Fed, they aren’t thinking about it in Sri Lanka and shouldn’t. Talk about uncorrelated.

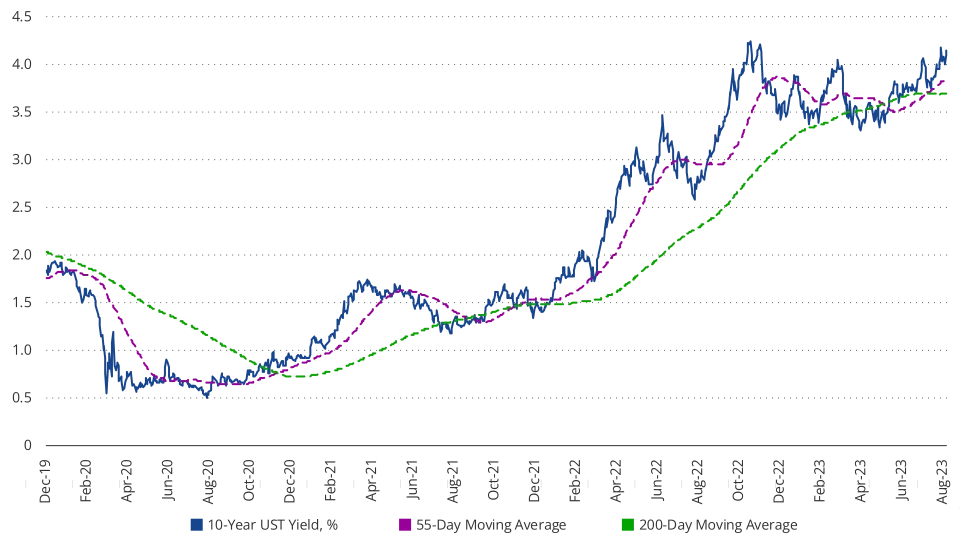

Quid nos facere? Everyone got long carry and went on their summer holidays… and now rates are at risk of breaking big levels (4.4% on the 10 year Treasury is our level) to the upside. To us, this means big risks to bonds, especially duration, and extreme duration on EM local currency markets that are correlated with US rates. Mexican local currency looks very vulnerable to us. Cash should be well above average, until the tilt is priced or rejected. “Sheep gotta do what sheep do and cannot do otherwise”, and that is to follow the other sheep while the hyenas make their plans. But even the hyenas have to fear the lion. And the lion is walking about. That lion is rising rates.

10-Year UST Yield and Moving Averages, %

Exposure Types and Significant Changes

The changes to our top positions are summarized below. Our largest positions in July were Mexico, South Africa, Indonesia, Brazil, and Colombia:

- We increased our local currency exposure in South Africa and Chile. South Africa’s disinflation progress now looks more established, and this should allow the central bank to end its tightening cycle safely. South Africa should also be expected to benefit from the potential revival of China’s reflation trade. Chile is well positioned to policy easing after the inaugural rate cut in July, and the impressive current account adjustment should strengthen the fundamental support for the peso. In terms of our investment process, this strengthened the economic, policy, and technical test scores for both countries.

- We also increased our hard currency sovereign exposure in Mexico and hard currency corporate exposure in China. Our main concern in Mexico is that it is a very popular EM long, however we added to our position in Pemex after the government indicated it was not going to withdraw its support. This improved the policy test score for the country. In China, we focused on tactical longs in selected developer companies, which can benefit from the latest round of the government’s targeted support.

- Finally, we increased our hard currency sovereign exposure in Nigeria, Uzbekistan, Israel, and Mongolia, as well as local currency exposure in Israel. Nigeria is fast-tracking some reforms, including FX unification, and this should reduce pressure on international reserves, benefiting sovereign bonds. In terms of our investment process, this improved the policy test score for the country. Mongolia’s exposure is an expression of a possible revival of the China reflation trade (as authorities are stepping up policy support). In Uzbekistan, we were comfortable to increase exposure after the July elections went smoothly. In Israel, there is still a lot of uncertainty on the legislative front, but the political crisis might be getting closer to the resolution. In addition, disinflation is progressing nicely, pointing to the end of the hiking cycle. In terms of our investment process, we saw improvements in the policy test scores in Nigeria, Israel, and Uzbekistan, and in the technical test score in Mongolia.

- We reduced our hard currency sovereign exposure in Malaysia and local currency exposure in Indonesia. We continue to like Malaysia’s fundamentals, but we are concerned about high correlations with China’s growth and currency outlooks. In Indonesia, we decided to take partial profits after a good rally on the back of concerns that external surprises might decline due to downside pressure on exports to China (while domestic demand, and hence, demand for imports) remains solid. These considerations worsened the technical test scores for both countries.

- We also reduced our local currency exposure in the Czech Republic and hard currency sovereign exposure in Romania. Stretched valuations – and hence the deteriorating technical test score – was our main concern in Romania. In the Czech Republic, there is a risk that the national bank will be too hawkish for too long, leading to a policy mistake. This worsened the policy test score for the country.

- Finally, we reduced our hard currency sovereign exposure in Angola, Qatar, Oman, and the United Arab Emirates (UAE). Angola’s bonds were getting quite “rich”, just as the country will be facing higher external amortizations, while still being highly dependent on global oil prices and China’s growth outlook. This worsened the technical test score for the country. The oil “channel” was the primary reason in the remaining countries, in addition to persistent concerns about global duration. This also worsened the technical test score for these countries.

Investors must read the sales prospectus and key investor information before investing in a fund. These are available in English and the KIIDs/KIDs in certain other languages as applicable and can be obtained free of charge at www.vaneck.com, from the Management Company or from the local information agent details to be found on the website.

IMPORTANT DISCLOSURE

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH which has been appointed as distributor of VanEck products in Europe by the Management Company VanEck Asset Management B.V., incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM). VanEck (Europe) GmbH with registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, is a financial services provider regulated by the Federal Financial Supervisory Authority in Germany (BaFin). The information is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. All indices mentioned are measures of common market sectors and performance. It is not possible to invest directly in an index.

All performance information is historical and is no guarantee of future results. Investing is subject to risk, including the possible loss of principal. You must read the Prospectus and KIID before investing.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.