After two quarters of strong equity performance, markets paused and reversed in the third quarter of the year. The MSCI World index lost -3.5% over the quarter, despite gaining 3.4% in July. US equities lost -3.2% and European equities lost -2.1%1. Clearly, the change of tone at the US Federal Reserve (Fed) played a role in that reversal. After 18 months of being laser-focused on fighting inflation, the Fed is starting to balance the risk of inflation with the risk of over-tightening.

This instalment of the WisdomTree Quarterly Equity Factor Review aims to shed some light on how equity factors behaved in this complicated quarter and how this may have impacted investors’ portfolios.

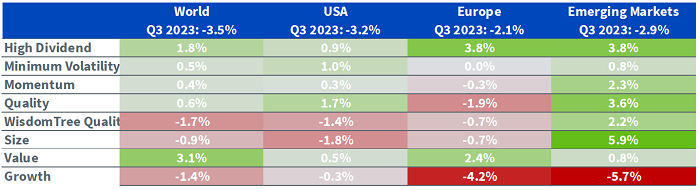

- Value and High Dividend posted the strongest return in developed markets and European markets.

- In the US, Quality performed the strongest.

- Across those regions, Size and Growth suffered.

- In Emerging Markets, the picture remains quite different to the rest of the World, with most factors outperforming and Growth being the standout loser.

Looking to the end of 2023 and beyond, the equity outlook remains quite uncertain. Easy fiscal policy in the US contributed to offset the impact of tightening monetary policy in 2023. We expect the breadth of the US market to improve, favouring Value and Dividend stocks. Given the strong manufacturing headwinds facing Europe, we expect weak growth in the eurozone for the remainder of 2023 favouring a tilt towards defensive stocks.

Performance in focus: has the 2023 bull run come to an end?

Despite good performance in July, Q3 saw markets reverse course and post negative returns. After leading for the first 7 months of the year, tech mega caps, underperformed markets in July and August.

Q3 ended up being a more favourable period for factor investing in developed markets:

- In global developed markets, Value and High Dividend posted the strongest returns after 2 difficult quarters.

- In the US, Quality posted the best return followed by Min Volatility, Value and High Dividend outperformance.

- Size and Growth suffered in both developed, European and US markets, posting underperformance.

- In Europe, High Dividend and Value also posted the strongest returns. However, Growth and Quality underperformed.

- In emerging markets, Size continues to dominate but, like in previous quarters, most factors were able to produce outperformance over the quarter. Growth was the standout loser in the region.

Figure 1: Equity factor outperformance in Q3 2023 across regions

Source: WisdomTree, Bloomberg. 30 June 2023 to 30 September 2023. Calculated in US dollars for all regions except Europe, where calculations are in EUR. Historical performance is not an indication of future performance and any investments may go down in value.

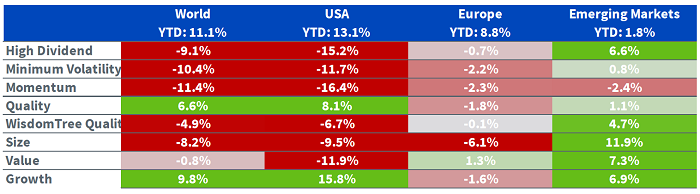

2023 has been very consistent factor-wise

Looking back at the full year, July and August were not enough to change the overall picture. Growth and Quality are the stand-out winners in developed and US markets. All other factors underperformed with double-digit underperformance for most of them. European markets look quite different, with Value dominating and the only factor to outperform. In contrast, Growth stocks underperformed for the year. As discussed recently in our equity outlook for 2024, the fundamental difference is that the US is mostly a service-driven economy that benefitted from consumer strength in 2023 on the back of strong wage growth, increasing credit card debt, and the spending of pandemic savings. Europe, by contrast, is a manufacturing-driven economy that suffered from a weak re-opening of the Chinese economy and is now facing the consequences of monetary tightening.

In emerging markets, all factors but Momentum did quite well in 2023. Small Cap posted the strongest returns, followed by Value.

Figure 2: Equity factor outperformance in 2023 across regions

Source: WisdomTree, Bloomberg. 31 December 2022 to 30 September 2023. Calculated in US dollars for all regions except Europe, where calculations are in EUR. Historical performance is not an indication of future performance and any investments may go down in value.

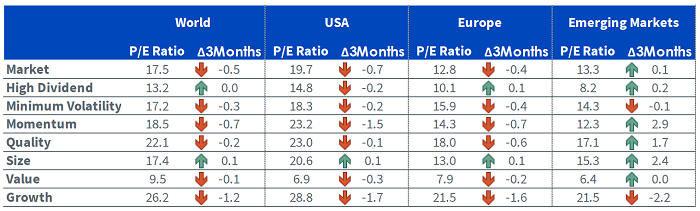

Valuations decreased in Q3

In Q3 2023, developed markets got less expensive. Most factors saw the price-to-earnings ratio (P/E) decline over the quarter. Growth saw the biggest decrease across regions followed by Momentum. In emerging markets, however, valuations increased with Momentum P/E gaining 2.9 and Size gaining 2.4. Growth, on the contrary, got cheaper.

Figure 3: Historical evolution of price-to-earnings ratios of equity factors

Source: WisdomTree, Bloomberg. As of 30 September 2023. Historical performance is not an indication of future performance and any investments may go down in value.

Q4 and beyond

Positive economic surprises helped push markets higher in the first 7 months of the year. However, looking ahead, the outlook remains more uncertain. Easy fiscal policy in the US helped offset the impact of tightening monetary policy. We expect the breadth of the market to improve, favouring Value and Dividend stocks. Given the strong manufacturing headwinds facing Europe, we expect weak growth in the eurozone for the remainder of 2023, favouring a tilt towards defensive stocks.

World is proxied by MSCI World net TR Index. US is proxied by MSCI USA net TR Index. Europe is proxied by MSCI Europe net TR Index. Emerging Markets is proxied by MSCI Emerging Markets net TR Index. Minimum volatility is proxied by the relevant MSCI Min Volatility net total return index. Quality is proxied by the relevant MSCI Quality net total return index. Momentum is proxied by the relevant MSCI Momentum net total return index. High Dividend is proxied by the relevant MSCI High Dividend net total return index. Size is proxied by the relevant MSCI Small Cap net total return index. Value is proxied by the relevant MSCI Enhanced Value net total return index. WisdomTree Quality is proxied by the relevant WisdomTree Quality Dividend Growth Index.

Sources

1 Bloomberg, October 2023.