Emerging markets (EM) remain among our long-term favoured equity markets for the Liontrust Multi-Asset funds and portfolios. We believe these markets should continue to benefit from the global reflation trade, supported by synchronised fiscal and monetary stimulus and a weak US dollar. EMs should also profit from robust commodity prices, with the recent rise providing a boost to exporting countries.

History: What Constitutes Emerging?

EMs, at least on the surface, remain relatively easy to define in economic terms: typically countries in a transitional phase between developing and developed status and moving from a low income, often pre-industrial system, towards a modern, industrial economy with higher living standards.

Equally, from a basic investment viewpoint, EM equities are seen as more volatile and potentially offering higher returns compared to developed markets; to highlight this, for our target-risk Multi-Asset range, the higher-risk portfolios have a substantial strategic asset allocation to funds investing in these countries.

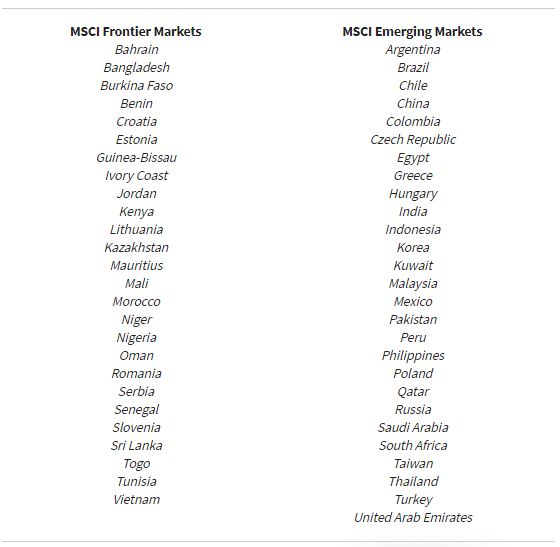

While the EM definition still broadly works, however, it increasingly fails to capture the huge scope of a ‘region’ that lumps together countries of such diverse economic strength as China and the Czech Republic. The MSCI Emerging Markets index identifies 27 countries while the Frontier Markets benchmark includes a further 27, and the IMF currently lists 152 so-called emerging and developing economies.

Covering most of Africa, Eastern Europe, South America and much of Asia, critics says the EM term reinforces the prevailing economic hierarchy, which puts emerging nations at the periphery and developed markets at the core of world affairs. The rise of China in recent years has understandably increased debate about whether the grouping is still useful, particularly as these ‘emerging’ countries contribute a larger share to global GDP than developed counterparts when measured by purchasing power parity.

To give a quick history lesson, the term was coined by then World Bank economist Antoine van Agtmael in 1981 as a collection of what he saw as promising markets. He did not lay down entry criteria at the outset and the motivation was aspirational, moving away from terms such as less developed or third world and highlighting countries on a path towards something better. As the tag has lost some of its lustre in recent years, a similar impetus has been behind efforts – with mixed success – to rebrand emerging markets using various acronyms. Many of these have come from former chairman of Goldman Sachs Asset Management Jim O’Neill, who created BRIC in 2001 (covering Brazil, Russia, India and China), the Next 11 (Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, South Korea, Turkey and Vietnam) and, as a carve out from the latter, the MINT quartet of Mexico, Indonesia, Nigeria, and Turkey. Again, much of this work has been designed to shift the perception of these countries from emerging to potentially among the world’s largest economies in the 21st century.

All this nuance is important to keep in mind when reviewing EMs and another useful definition, particularly when investing in the region, comes from political scientist Ian Bremmer, who said these are countries ‘where politics matters as least as much as economics for market outcomes’.

Current View: Benefiting from Reflation, Liquidity and Commodities

With the above caveats in mind, EMs remain among our long-term favoured equity markets for the Liontrust Multi-Asset funds and portfolios, a four on our target tactical asset allocation where five is most bullish. Overall, we believe these markets should benefit from the global reflation trade as the macro picture improves (highlighted by strong PMIs, consumer spending and GDP growth), with the liquidity environment, driven by synchronised fiscal and monetary stimulus alongside low interest rates, and a weak US dollar also being supportive. The latter is positive for the fiscal balances of emerging economies with dollar-funded debt and given the amount of money printing globally and in the US, and anchoring of the short end of the yield curve, the currency environment looks set to remain supportively weaker, even if inflation remains above Federal Reserve targets.

Our focus is on the long term, and we continue to believe EMs should outpace developed counterparts due to structural growth advantages and demographics. In the short term, however, there is plenty of noise to consider, particularly around the pandemic. On the vaccine front, perhaps the major determinant of current sentiment, distribution efforts have generally been positive in developed markets, albeit with regional differences; in contrast, a large part of the EM universe, at least in GDP and population terms, is facing a more challenging vaccination backdrop and rising Covid cases, with countries such as Turkey and particularly India in the eye of the storm.

Compared to more than 50% of the UK and US receiving at least one jab, India is currently at under 10%, despite being the world’s largest vaccine producer, and is grappling with hundreds of thousands of new cases a day amid a devastating second wave.

China remains the dominant force in the emerging bloc and our base case remains that the country will continue to grow: even over 2020, when the UK suffered a near-10% GDP contraction, China was able to post a 2.3% rise, albeit the worst annual rate since 1976. We are mindful that there remains uncertainty around President Biden’s agenda, however, with his early months in the White House dominated by domestic policies and fighting the Covid battle. While the risk of outright trade war has de-escalated under Biden and his strategy is likely to be less combative, the former status quo between the countries is unlikely to resume. A deeper fracture in the relationship comes as the US learns to deal with a shift away from decades of global hegemony. This has been referred to as the Thucydides Trap after the Athenian historian, a theory that when one great power threatens to displace another – the rise of Athens culminated in the Peloponnesian War of 431-404 BCE against the Spartans – conflict has proved inevitable.

Signs of this came at the recent meeting in Anchorage, Alaska, which was the first high-level summit between the countries under the Biden administration and proved fractious on topics such as human rights abuses in Xinjiang, Hong Kong and Taiwan, cyberattacks on the US, and economic coercion. As a flavour of the comments, US Secretary of State Antony Blinken said the relationship with China will be ‘competitive where it should be, collaborative where it can be, adversarial where it must be’. In response, Chinese Director of the Central Foreign Affairs Commission Yang Jiechi said both countries must contribute to the peace, stability and the development of the world in areas such as Covid-19, restoring economic activities and responding to climate change, urging the US to ‘abandon the Cold War mentality and the zero-sum game approach’.

A particular flashpoint was disclosure legislation signed by Donald Trump during his last days in office, effectively forcing Chinese firms to comply with US accounting standards and paving the way for giant companies like Alibaba and Baidu to be kicked off American stock markets. Advocates of these laws say Chinese companies listed in the US enjoy the trading privileges of a market economy while receiving government support and operating in an opaque system. In retaliation, China has prohibited its companies from sharing audited statements with foreign regulators and made noises about Beijing ‘opposing politicising securities regulation’. While this has not prevented new Chinese firms listing in the US, the New York Stock Exchange has delisted three this year and the situation is a lingering geopolitical risk.

Favoured Funds: Active Opportunities amid Country Volatility

Price is a key element in our tactical asset allocation and EM valuations have been attractive for some time; being supported by lower interest rates as they are longer duration growth assets. Rising rates therefore pose a risk for these markets, even more so if any hikes are abrupt and not priced in, although this looks unlikely given the close attention paid to every word that emanates from Federal Reserve chair Jay Powell.

In terms of price/earnings ratios, EM equities are at the higher end relative to their own history and while the region remains attractive versus the US, it is less so versus cheaper reflation plays such as the UK and Europe. There are pockets of attractive valuations within regions and countries, however; while not outright cheap, ex-Asia multiples are closer to median levels for example. Unsurprisingly, countries where the growth outlook hinges on the trajectory of Covid infections and vaccine rollouts are more attractively valued; risks are somewhat binary in these so we feel an active bottom-up stock selection approach is more likely to produce results.

In terms of implementing our views, we largely access EMs via active funds as we believe the stock, sector and country-level volatility presents opportunities for managers with consistent processes to outperform passives over a market cycle.

EMs remain highly geared to sentiment shifts – positive and negative – and, going back to that quote from Ian Bremmer, are sensitive to domestic and international politics, which means they can move around substantially in the short term, buffeted by geopolitics. Our view is that we always want to prepare rather than react so decisions should be based on fundamentals and valuations looking out years rather than a few months ahead. If anything, this has provided opportunities to add exposure to the region and our manager selection tends to emphasize those with low turnover, high conviction processes also focused on longer-term fundamentals.

We believe fund managers with flexibility to integrate macro positioning and bottom-up stock selection can avoid some of the country-specific risks that, at times, can be a headwind to performance, and an example is the BlackRock Emerging Markets Fund. The team who manage this fund follow a high-conviction stock selection process that identifies companies translating top-line revenue growth into free cash-flow and where this cash-flow stream is undervalued by the market. They integrate this with a macro overlay that tilts the portfolio based on country, sector and style, helping to cope with short-term volatility and lean into trends that can provide a performance boost.

Looking at historical returns of styles and factors in EMs, we also believe a quality-biased approach leads to more consistent outperformance and one fund we hold in this area is Vontobel MTX Sustainable Emerging Market Leaders. Managers Roger Merz and Thomas Schaffner have a focus on corporate profitability, measured by how well a company generates cashflow relative to the capital it has invested in its business. Companies with consistently high returns on invested capital and strong competitive positions are more likely to reinvest free cashflow in superior growth projects, sustaining above-average returns in the future. The team also considers environmental, social and governance (ESG) criteria in selecting companies with far-sighted strategies, sound financials and robust structures, believing these can enhance future profitability. Finally, the managers seek to buy these companies when they are trading at a discount to intrinsic value. For us, this approach is simple and systematic in nature and the repeatability of each component makes the process appealing.

In terms of recent trading, we had held the Stewart Investors Global Emerging Market Leaders Fund for several years in the Multi-Asset portfolios but switched into Legg Mason Martin Currie Global Emerging Markets Fund last year. The latter is more of an out-and-out growth offering, which currently has more than 30% invested in China for example.

Key Risks & Disclaimer

Please remember that past performance is not a guide to future performance and the value of an investment and any income generated from them can fall as well as rise and is not guaranteed, therefore you may not get back the amount originally invested and potentially risk total loss of capital.

This content should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, faxed, reproduced, divulged or distributed, in whole or in part, without the express written consent of Liontrust.