Resource companies, bolstered by structural advantages and years of efficiency-focused operations, may be uniquely positioned to fill supply gaps facing the global energy landscape.

Oil companies extend their gains

The third quarter of 2023 largely extended trends seen in the second quarter. The Oil & Gas sector continued its dominance within the resource equity landscape while most other sectors faced challenges.

U.S. exploration & production (E&P) companies approached their November 2019 monthly crude oIl production record in July, achieving an output of 12.99 million barrels per day. Remarkably, this growth was realized with fewer rigs than in 2019, underscoring the increased efficiencies of these companies. Furthermore, their reinvestment rates, which denote capital expenditures in relation to operational cash flow, remained below 2020 levels, reflecting a cautious stance on capital spending to prioritize shareholder value.i

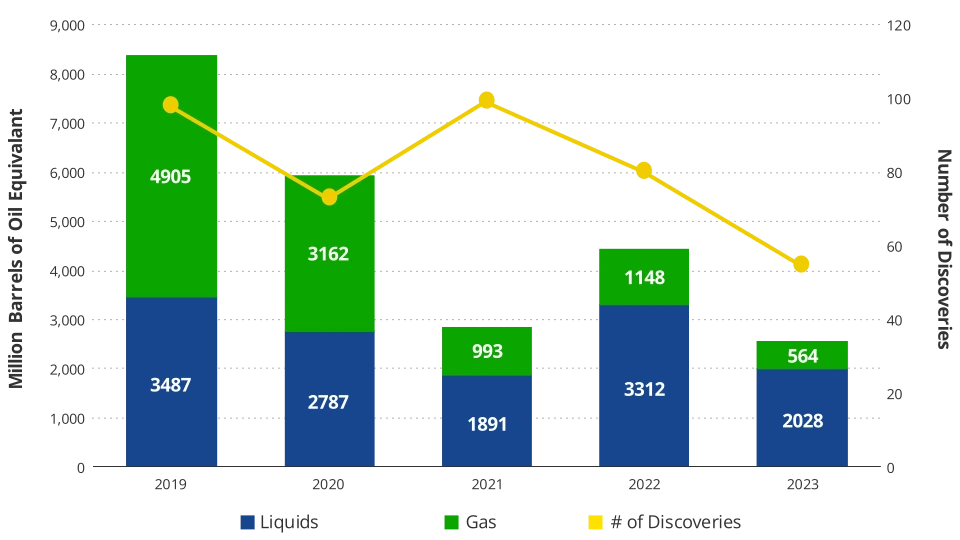

Despite the conservative spending by E&Ps, oil servicers held their ground. Stable oil prices and industry-wide cost inflation have enabled these servicers to maintain pricing, especially in offshore services like deepwater drilling. Cash-rich integrated oil companies intensified their exploration efforts in these areas. However, a point of concern emerges from dwindling conventional oil discoveries, which hit a five-year low during the first half of the year.ii

Valuation Total Conventional Discoveries (January – June)

Continued pressure on all things green

Battery metal companies, chiefly lithium producers, faced headwinds this quarter. The combination of rising competition and the lingering effects of elevated lithium prices from 2021/2022 led to concerns about potential market oversupply in 2024 and beyond. These apprehensions were manifested in significant price reductions, with lithium hydroxide experiencing a drop of over 50% during the quarter.

Battery manufacturers confronted challenges due to increased input costs and capital expenditures and research & development (R&D) efforts, aimed at staying ahead of competitors. Additionally, solar and wind equipment producers continue to grapple with the impacts of prolonged high-interest rates, resulting in subdued earnings growth forecasts. Growing backlogs for grid connections in renewable projects have further dampened investor optimism.

The agricultural sector presented a varied performance landscape this quarter. Fertilizer producers faced a divide in demand, with dwindling interest in potash contrasted by an uptick in nitrogen-based fertilizers, largely attributed to ongoing natural gas shortages. Grain processors remain optimistic, balancing concerns about potential margin reductions from declining corn and soy prices with a bullish outlook for the latter half of the year.

Looking ahead: fundamentals should outweigh uncertainties

From a broader perspective, our positive long-term stance on resource equities remains unchanged. The evolving global energy landscape hints at potential supply gaps across several commodities. As countries grapple with the complexities of transitioning to renewables, geopolitical tensions pose threats to the supply chain for vital clean energy materials.

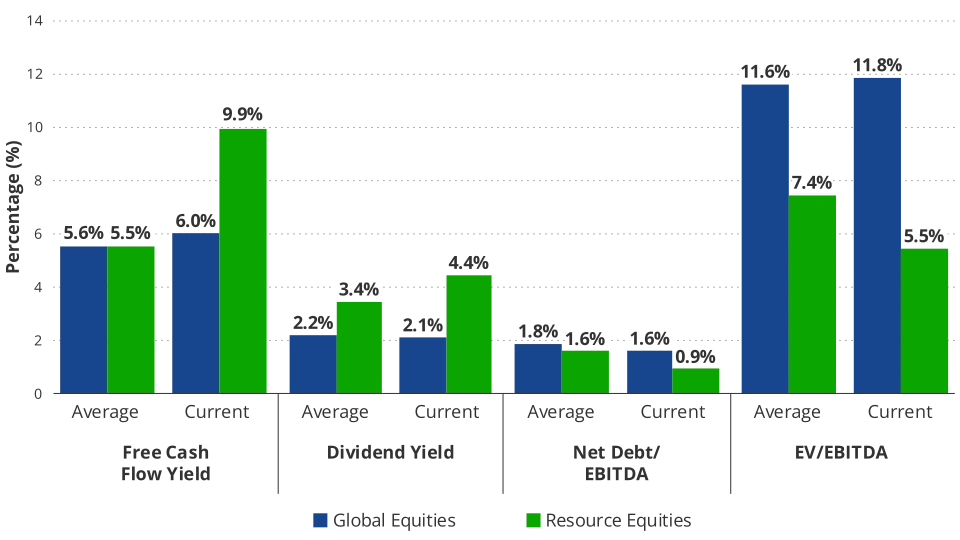

Resource companies, bolstered by structural advantages and years of efficiency-focused operations, are uniquely positioned. Their valuable assets, strong financial health, commitment to shareholder value and attractive valuations make them compelling investment opportunities, in our view.

Valuation Metrics Comparison (10-Year Average vs. Current)

However, resource equities might still face near-term macroeconomic uncertainties that have influenced returns intermittently over recent years. Fluctuations in inflation, interest rates and the U.S. dollar’s strength, combined with varying investor risk appetites, are critical factors. These challenges may persist given the current limited visibility on long-term economic growth.

Our investment approach remains rooted in thorough company evaluations, helping us pinpoint businesses that can navigate these immediate challenges and align with our broader, optimistic long-term vision.