It’s been a tough year for wheat in 2023. Wheat futures have declined 33% Year to Date (YtD)2. Higher exports from Russia (the world’s leading wheat exporter) have largely been responsible for wheat’s price decline. However, there are a number of catalysts – such as lower moisture levels in India, drought conditions in Australia owing to the El Nino weather phenomenon that could lead to a more price supportive environment for wheat. Russian exports could also be at risk over the short term as the Kerch Strait, which connects the Sea of Azov with the Black Sea has been hit by a severe storm.

Russia-Ukraine war has evolved into a headwind for wheat prices

Russia’s invasion of Ukraine on 24th February 2022, sent wheat prices to new highs as the two countries account for nearly 30% of global exports3. Since the war, concerns over Ukraine’s production and export potential led to the creation of the Black Sea Grain deal in July 2022. The initiative was set up to re-introduce vital food and fertilizer exports from Ukraine to the rest of the world amidst the war. The Black Sea Grain deal allowed much needed wheat to be shipped to the poor and biggest importers in Africa and Middle East.

However, a year later Russia withdrew from the Black Sea Grains deal in July 2023 as its demand for Russian agricultural exports to be facilitated has not been met. Russia presumably hoped to gain a considerably larger share of the global wheat market when it terminated the Black Sea grains deal. Russia’s wheat exports have remained robust in 2023. IKAR, a Russian consultant firm has upwardly revised its export forecast for wheat from Russia in the current crop year by 2mn to 49.5mn tons . This is why, restricted wheat supply from Ukraine caused by repeated Russian drone and missile attacks on port facilities, failed to provide a price supportive effect.

Global wheat stocks remain tight

According to the United States Department of Agriculture (USDA), global production is forecast lower from last year’s record owing to smaller crops in India, Argentina and Kazakhstan, partially offset by a larger Russia crop. Record consumption has been adjusted even higher in November on expended feed and residual use for Russia. Global wheat stocks remain at their lowest level since 2015/16 and global stocks to use ratio at 34.27 remains at its lowest level since 2016/17.

Figure 1: Global wheat stocks to use ratio at its lowest in 7 years

Source: United States Department of Agriculture (USDA), Bloomberg as of 31 October 2023. Historical performance is not an indication of future performance and any investments may go down in value.

India’s wheat crop could falter for 2023/25

Low moisture levels, a consequence of below-normal monsoon rains triggered by the El Nino are forcing farmers to switch to less water intensive crops such as chickpeas or sorghum. India, the 3rd largest global producer, is already dealing with low wheat supplies. India’s wheat stocks are at their third lowest level in 15 years owing to a rise in exports over the prior two years5. Given the strong likelihood of the El Nino strengthening during the main December-March period, the risk of additional unfavourable weather for India’s wheat crop remains high as it is planted in October and November and harvested in March.

Australia battling with drought

Wheat is also likely to find support from Australia, where the supply outlook has worsened again a month and half before the end of harvesting. Australia’s crop estimate has been lowered from just over to just under 8mn tons, owing to the extreme drought during September and October triggered by the El Nino weather phenomenon6. Australia is one of the most important supplier countries responsible for nearly 15% of global wheat exports.7

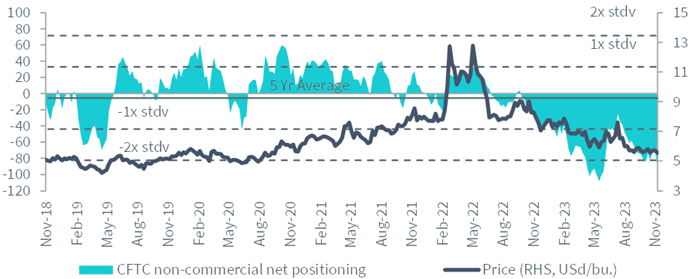

Net speculative positioning in wheat futures remains weak

Owing to the backdrop of the global wheat market remaining amply supplied, net speculative positioning in wheat remains close to 2-standard deviations (stdv) below the five-year average8. With positioning so extreme for wheat, the presence of current catalysts in both India and Australia could create an environment ripe for a short covering rally, similar to the period from May to August 2023.

Figure 2: Net speculative positioning in wheat remains bearish

Source: Commodity Futures Trading Commission (CFTC), WisdomTree as of 21 November 2023. Historical performance is not an indication of future performance and any investments may go down in value.

Sources

1 Bloomberg from 31 Dec 2022 to 29 November 2023

2 Bloomberg from 31 Dec 2022 to 29 November 2023

3 United States Department of Agriculture, 2022

4 IKAR as of September 2023

5 USDA as of 31 October 2023

6 Grain Industry Association of Western Australia as of 20 November 2023

7 USDA 2022/23

8 Commodity Futures Trading Commission as of 21 November 2023