Market commentators expect the US dollar to depreciate in the medium term. This poses the question of which currencies are likely to rise the most against it. In this Macro Flash Note, senior economist GianLuigi Mandruzzato looks at the US dollar index and its components to identify which currencies have the greatest potential for appreciation.

Observers expect the US dollar to weaken in the medium term.1 This, however, raises the question of whether to assess the dollar against another specific currency, perhaps the euro, or against a basket of currencies. The second approach is more appropriate to capture a broad-based change in the value of the US dollar regardless of idiosyncratic factors that may influence a bilateral exchange rate.

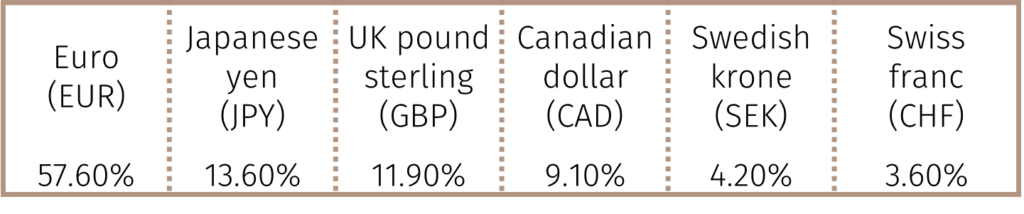

Investors often use the US dollar index (DXY) as a representative basket. The DXY was created in 1973 by the Federal Reserve to give an average value of the US dollar against other main currencies following the end of the Bretton Woods fixed exchange rate regime in 1971. The index was constructed as a weighted average of US dollar exchange rates against a basket of currencies, with the weights based on the relative size of both trade and financial bilateral flows with the US.2 After the launch of the euro in 1999, the weights of the DXY basket were set as shown in Table 1.

Table 1. Dollar index components and weights

Source: Intercontinental Exchange (ICE). Data as at 30 January 2024.

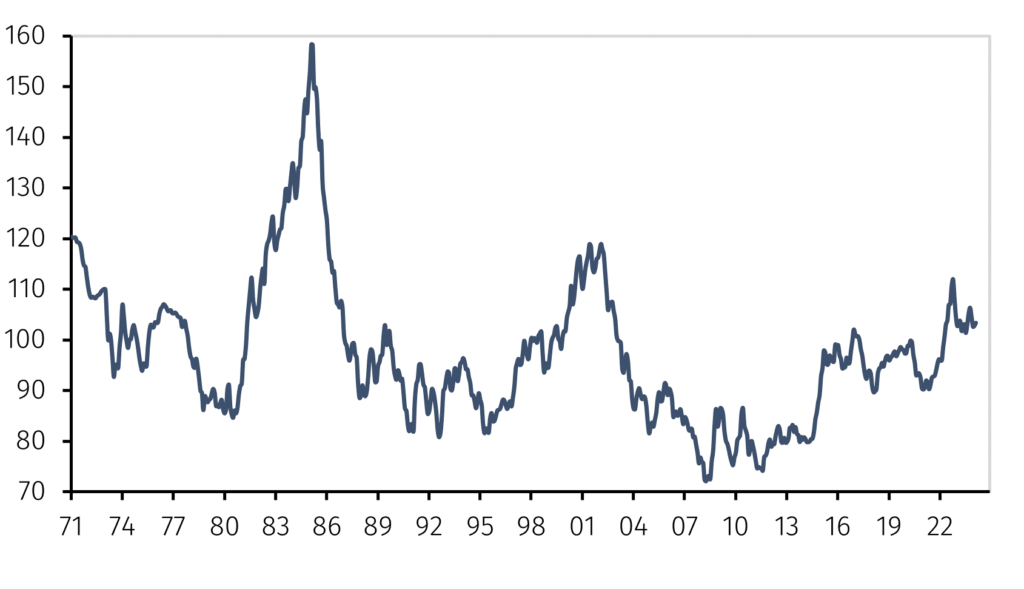

Historically, the DXY swung between long cycles of appreciation and depreciation (see Chart 1). The last ascending phase of the DXY began in 2008 after the US real estate bubble burst and the Lehman Brothers’ bankruptcy. According to many commentators, the DXY peaked in late 2022 and a new depreciation cycle has begun.

Chart 1. US dollar index, monthly average

Source: LSEG Data & Analytics. Data as at 30 January 2024.

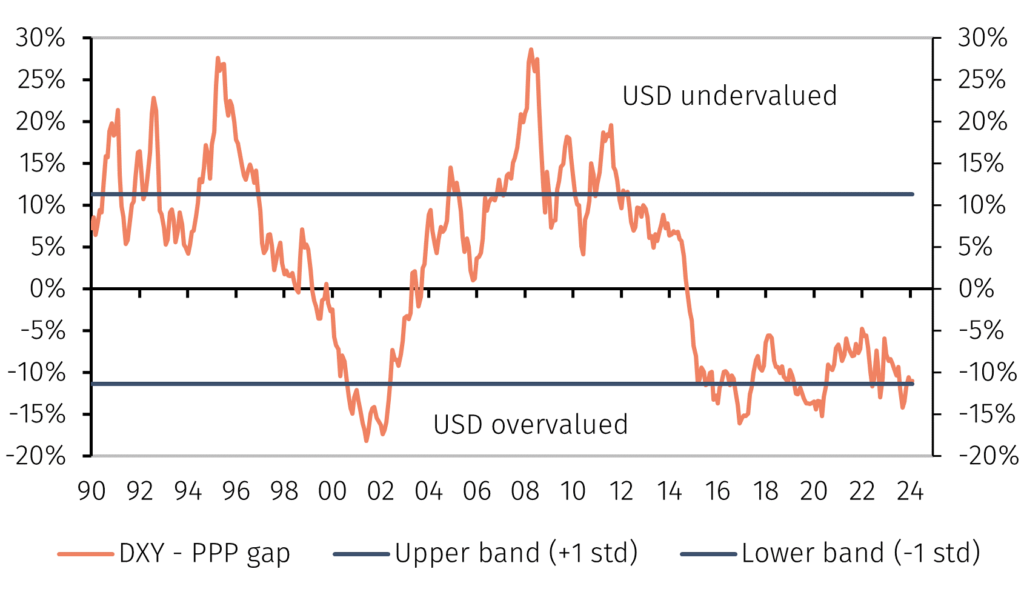

However, before concluding that the DXY is bound to weaken, it is useful to evaluate how it currently compares to an equilibrium estimate. Using data on tradeable goods inflation from 1990, we calculate a DXY fair value based on the Purchasing Power Parities (PPP) of the US dollar against the six currencies in the basket.3

Chart 2. US dollar index and PPP estimates

Source: LSEG Data & Analytics and EFGAM calculations. Data as at 30 January 2024.

Based on this approach, the DXY is approximately 10% overvalued (see Chart 2).4 This gap is close to one standard deviation calculated over the sample period up to December 2008, a level that has rarely been exceeded in the past 30 years. This supports the expectation that the DXY will decline towards the PPP model’s equilibrium in the medium term. However, it is notable that, according to the model, the DXY appears to have been overvalued for the last ten years. This contrasts with previous episodes during which the DXY deviated by at least one standard deviation from the estimated equilibrium which were followed by a steady closing of the fair value gap.

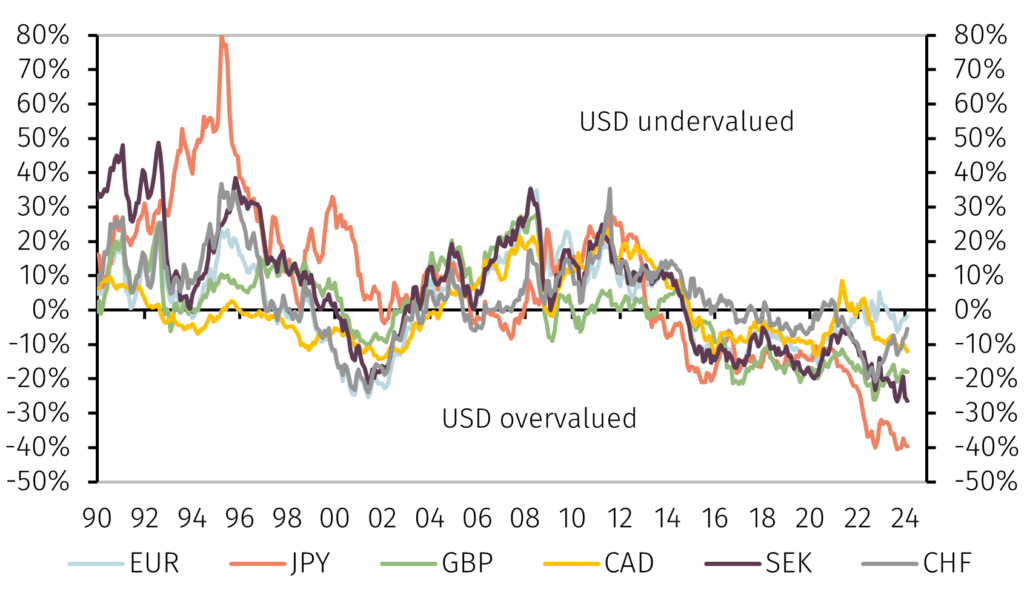

A granular approach to DXY valuation reveals that more than half of the current gap to fair value is due to the Japanese yen, despite it having a weight of less than 14% in the DXY basket. The bilateral PPP model estimates that the US dollar is almost 40% overvalued against the yen (see Chart 3). The combination of the expected end of the Bank of Japan’s negative interest rate policy in 2024 and multiple interest rate cuts by the Federal Reserve could trigger a rebound in the yen from current lows.

Chart 3. US dollar deviations from bilateral PPPs

Source: LSEG Data & Analytics and EFGAM calculations. Data as at 30 January 2024.

At the other extreme, the euro exchange rate is close to estimated fair value. The exchange rates for the four other currencies included in the DXY basket appear to be overvalued by between 25%, as is the case for the Swedish krona, and less than 10%, as for the Swiss franc.

In conclusion, estimates of an equilibrium model of the DXY lend support to the hypothesis that the US dollar will depreciate in the medium term. However, it is important to acknowledge that history shows this process may take a long time to unfold. A closer look at US dollar valuation against the DXY basket components points to the Japanese yen having the greatest appreciation potential while the euro exchange rate is already close to fair value

1 See https://go.pardot.com/e/931253/2024-if-fed-pivots-2023-12-20-/3x1n8/323372848/h/dfM2wSQZf8rYysv6cskzDxSeMoRQ9sp01Vx3cR12n6I

2 The Federal Reserve has discontinued the DXY which is now maintained by the Intercontinental Exchange as a fixed weight currency index.

3 The Producer Price Index is used to approximate the price of tradeable goods. The bilateral PPP-based valuation gaps are aggregated to obtain the DXY valuation gap according to their weights in the basket.

4 It is well known that valuations are not a timing tool for investments. The PPP approach to exchange rate valuations is structurally geared to the long term. One consequence is that, as shown by the model results, periods of over or undervaluation can be long lasting.