Over the last five years, the assets under management in European thematic strategies – both Exchange Traded Funds (ETFs) and open-ended mutual funds – have almost quadrupled, from $84 million in December 2018 to $328 million in December 20231. In parallel, the number of investable thematic products jumped from 249 to 808 during the same period.

On paper, this development is very positive for investors as they get access to more themes and more strategies. The reality is more complex, as thematic funds sit outside of the usual classifications. Historically, equity funds and ETFs would end up being classified by the geography in which they invest, the sector in which they specialise, the size of their target companies or the type of stocks they focus on. Quite logically, they would end up in a very well-defined box, for example, ‘U.S. Large-cap Value’ or ‘European Consumer Discretionary’. Such classifications are irrelevant for thematic investing.

In fact, this lack of classification has become such as problem that in our latest institutional investors survey2, when asked ‘Which of the following, if any, are the biggest barriers to allocating to thematic ETF strategies?’ almost a quarter of all respondents ticked ‘Lack of a classification system’ as the main barrier. Without this classification, it is hard for investors to easily find all of the funds that match the theme they want to invest in, and it is hard to run a proper search that would compare all of the relevant funds. This is why at WisdomTree we started to create our own classification as early as 2021.

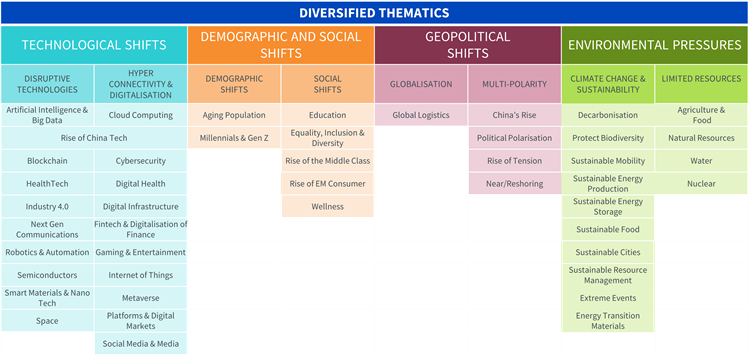

Introducing the WisdomTree Thematic Classification: 4 Clusters, 46 Themes

The WisdomTree Thematic Classification lists and organises the different investment themes. Academics, consultants, international organisations (like the World Economic Forum), or think-tanks have all been publishing lists or scans of megatrends that are impacting, or will impact, the world in the long term. While those lists all differ from one another, they still share some commonality. Collating a range of those reports, we highlighted four areas of consensus, leading to the creation of four thematic clusters:

- Technological Shifts

This cluster focuses on the different themes that originate from the introduction of new technologies and innovation. It incorporates disruptive and emerging technologies as well as their impact on societies and economies, such as the increasing digitalisation and connectivity of the world.

- Demographic and Social Shifts

This cluster focuses on the different themes that originate from changes in population and societies alike. It incorporates, for example, changes in the world’s pyramid of age, the impact of the growing, younger, wealthier populations in emerging markets, as well as changes to societal values and lifestyles.

- Environmental Pressures

This cluster focuses on the environment and, more importantly, on the impact of human activities on the planet. It incorporates changes driven by sustainability issues, the increasing scarcity of resources and the need to address global warming and climate change.

- Geopolitical Shifts

This cluster focuses on the themes driven by the globalisation and the changes in the global geopolitical order with the rise of new geopolitical powers, like China. It also taps into the increasing polarisation of modern societies as a counterforce to globalisation.

Within the classification, all thematic ETFs and open-ended funds can be organised into a coherent universe. They can be classified into:

- Diversified thematics if they try to harness a large number of megatrends in one go. Those funds tend to have a very diluted focus, which could mean that it might be harder to find sources of potential differentiation against a broad market benchmark.

- A specific cluster if they try to harness multiple themes across sub-clusters but within one particular cluster. For example, a fund investing in Artificial Intelligence, Robotics, Cloud, and Cybersecurity would be classified as a ‘Technological Shifts’ fund.

- A particular sub-cluster if a strategy aims to invest in most of the themes within that sub-cluster. For example, a fund investing in Cloud Computing, Platforms, Cybersecurity, and Fintech would be classified as a ‘Hyperconnectivity & Digitalisation’ fund.

- A theme if the investment strategy is focused on a specific, clear theme.

Overall, the classification includes 201 live European domiciled ETFs, 607 live European domiciled open-ended funds and 926 ETFs domiciled in Europe (US, Canada, Asia).

Figure 1: The WisdomTree Thematic Classification

Source: WisdomTree. January 2024

The multiple uses of the WisdomTree Thematic Classification

The WisdomTree Thematic Classification allows us to make better sense of the thematic space by bringing structure to it. It allows us to:

- Know the thematic investment landscape

By having access to a structured organisation of all thematic strategies, we are able to aggregate AuM, Flows or performance at theme or cluster levels by wrappers or regions. This allows us to know which themes have gathered the most assets, which theme is currently experiencing a wave of inflows (or outflows), or which theme has performed the best on average in a given period of time. All those insights are compiled in the WisdomTree European thematic monthly update, which is available on WisdomTree’s website every month.

- Keep up with the Thematic investment landscape

The classification is a living organism. It evolves with the space as funds get launched or closed, as managers change their investment objectives. Over the last three years alone, 11 themes got added to the classification to reach the 46 that it contains today. By keeping the classification up to date, WisdomTree has to remain at the forefront of Thematic Research and know the latest developments in the space.

- Search in the Thematic investment landscape

The classification is the perfect tool for thematic fund selection. Each theme is, in effect, a peer group since it compiles the full list of all strategies that invest in that theme and having a peer group is the first step in a successful fund search. Once all the relevant funds have been properly identified it is then possible to apply a selection framework such as our thematic selection framework that includes ‘clarity of theme’, ‘expertise’, ‘purity of exposure’, ‘differentiation’ and ‘transparency, investability and discipline’. However, this is a topic for another day.

Sources

1 Source: WisdomTree. As of 31 December 2023. In USD

2 Source: WisdomTree, Censuswide. Pan-Europe Professional Investor Survey Research, Survey of 803 professional investors across Europe, conducted during August 2023.