RBC Global Asset Management (RBC GAM)1 continues to have a focus on responsible investment, inclusive of climate change.

Our Approach to Climate Change is built upon a belief that considering material2 climate-related risks and opportunities in our investment approach, where applicable, can enhance our long-term risk-adjusted returns.

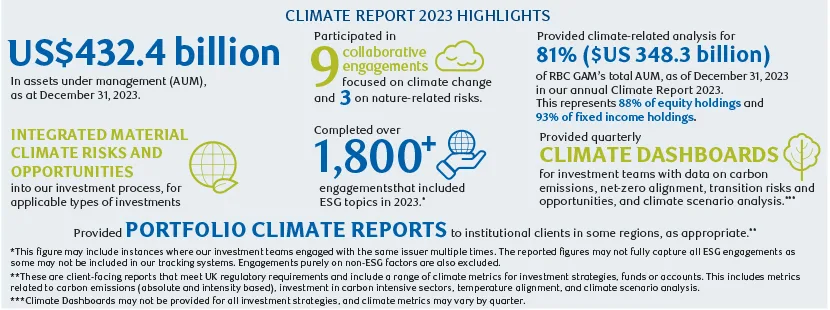

Accompanying these efforts, RBC GAM seeks to provide robust and timely disclosure of our climate change commitments and actions, and aims to report transparently on our progress. We report annually in the RBC GAM Climate Report 2023 on our governance, strategy, and risk management of climate-related risks and opportunities, as well as key climate-related metrics. This report is guided by the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD) and published in line with the regulatory requirements of the U.K. Financial Conduct Authority Environmental, Social and Governance (ESG) Sourcebook. This year marks RBC GAM’s fourth annual climate report.

What to look for in the RBC GAM Climate Report 2023

- Expanded climate-related analysis. In the time since RBC GAM’s inaugural climate report in 2020, we have endeavored to expand the scope and depth of our climate-related disclosures. This includes expanding the percentage of our assets under management (AUM) for which climate-related analysis is conducted from 48% (in 2020) to 81% (in 2023).3 In 2023, we expanded our climate analysis to include all sovereign bond holdings across our AUM.

- Reporting on the net-zero alignment of our investments. RBC GAM measures the net-zero alignment of our AUM using two metrics: investment in issuers with net-zero or science-based targets, and implied temperature rise. Across RBC GAM’s equity and corporate bonds in scope of analysis, which represents 68% (US$292.8 billion) of RBC GAM’s total AUM as at December 31, 2023:

- 26% (US$76.9 billion) of RBC GAM equity and corporate bonds are invested in issuers with validated net-zero or science-based targets (as per Science Based Targets Initiative, SBTi). An additional 9% (US$27.6 billion) is invested in issuers who have committed to set SBTi targets within two years.

- 53% (US$155.5 billion) of RBC GAM equity and corporate bonds are invested in issuers with a temperature alignment that is below 2°C.4

- Assessing the impact of climate scenarios. Climate scenario analysis enables investors to assess the impact of potential future climate scenarios on the value of assets. Our analysis includes the calculation of Climate Value at Risk (VaR) for five transition risk scenarios and four physical risk scenarios, which includes a net-zero by 2050 scenario. For physical risk scenarios we consider the impact of ten natural hazards including coastal flooding, extreme heat, tropical cyclones, and wildfires. Our analysis indicates that, for a given temperature pathway, the potential financial impact on our AUM is greater for disorderly scenarios.

- Disclosure of nature-related metrics. RBC GAM continues to expand our understanding, and assess our exposure to nature-related risks, opportunities, impacts and dependencies. We are encouraged by the final recommendations of the Taskforce on Nature-related Disclosures (TNFD), released in September 2023. Our report includes disclosure of core metrics recommended for asset managers by the TNFD, including exposure to priority sectors5 and exposure to companies with operations in sensitive locations. We also provide an analysis of nature-related impacts and dependencies for TNFD priority sectors.

- The role of active stewardship. Active stewardship is a core pillar of our approach to climate change. We convey our views through thoughtful proxy voting and engagement with issuers on the management of climate-related risks and opportunities, where appropriate. In 2023, our investment teams completed over 1,800 engagements that focused on various ESG factors, including climate change.6 We also work collaboratively with other investors to advance dialogue on material climate issues. This included participating in nine collaborative engagements through Climate Action 100+ and Climate Engagement Canada in 2023.

RBC BlueBay Asset Management (RBC BlueBay) represents RBC Global Asset Management (RBC GAM) outside of North America and invests across fixed income, equities and alternatives. RBC BlueBay proactively engages in many aspects of responsible investment, inclusive of climate change. The initiatives outlined within our Climate Report encompass our entire asset management business globally.

1 In this document, references to RBC Global Asset Management (RBC GAM) include the following affiliates: BlueBay Asset Management LLP (for the reporting period between January 1, 2023 – April 1, 2023), RBC Global Asset Management Inc. (including Phillips, Hager & North Investment Management), RBC Global Asset Management (U.S.) Inc., RBC Global Asset Management (UK) Limited (RBC GAM UK), and RBC Global Asset Management (Asia) Limited, which are separate, but affiliated subsidiaries of Royal Bank of Canada (RBC).

2 Material ESG factors refer to ESG factors that in our judgment are most likely to have an impact on the financial performance of an issuer/security and may depend on different factors such as the sector and industry of the issuer. Certain investment strategies or asset classes do not integrate ESG factors, including but not limited to money market, buy-and-maintain, passive and certain third-party sub-advised strategies.

3 All climate metrics are as of December 31, 2023. Please see relevant reports for scope of analysis of climate-related analysis. (RBC GAM Climate Report 2023, RBC GAM Climate Report 2022, RBC GAM TCFD Report 2021, RBC GAM TCFD Report 2020. Percentages are rounded.

4 The goal of the Paris Agreement is to limit global warming to ‘well below 2°C’ by 2100, and to aim to achieve 1.5°C, compared to pre-industrial levels.

5 Defined by TNFD as having material nature-related impacts and dependencies.

6 This figure may include instances where our investment teams engaged with the same issuer multiple times. This figure is calculated on a best efforts basis, and may not capture every ESG-related engagement. In certain instances involving quantitative investment, passive and certain third-party sub-advised strategies, there is no direct engagement with issuers by RBC GAM.