In our latest roundup of developments in financial markets and economies, we look at the reaction to a big gamble by Emmanuel Macron and the latest meeting of the US Federal Open Market Committee.

You know what they say: investors don’t like surprises. Typically, this equates to an underappreciation of risk premia and asset prices respond accordingly. Safe-haven assets outperform, with government bonds such as German Bunds and US Treasuries among the main beneficiaries along with the US dollar and gold. Conversely, the epicenter of concern usually underperforms.

The two causes of surprises last week were French President, Emmanuel Macron, and the US Federal Reserve (Fed).

After a disappointing showing by Macron’s Renaissance Party in the European Parliament elections and strong results for the far-right National Rally, led by Marine Le Pen, Macron on June 9 made the surprise move to dissolve the Assemblée Nationale (French parliament) and call a snap legislative election.[1] The election will take place over two rounds on June 30 and July 7, just ahead of the opening to the Paris Olympics. Winning a majority requires 289 out of 577 seats.

Macron’s gamble

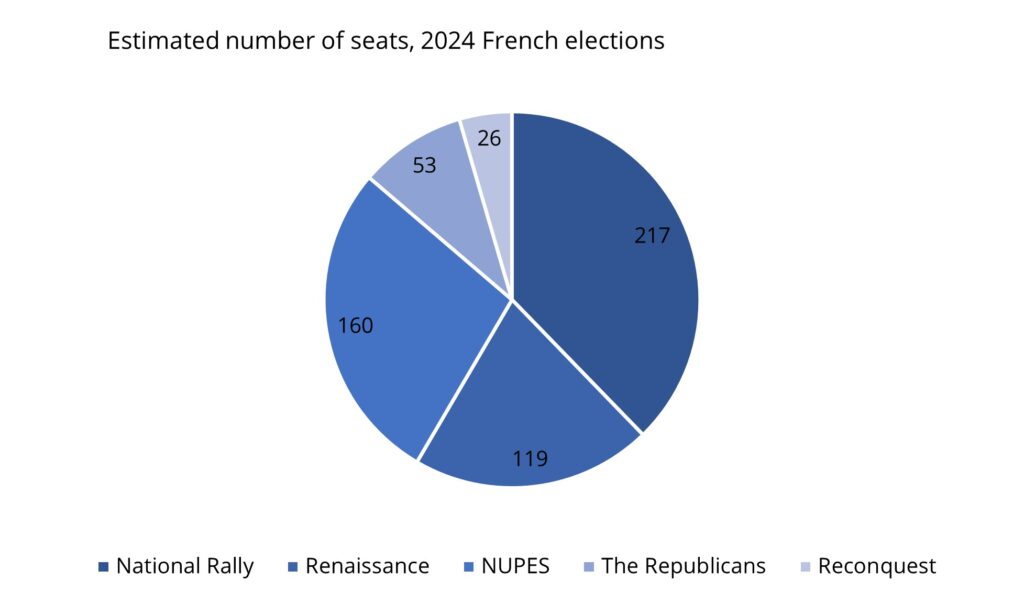

In an interview with Le Figaro, Macron insisted that, whatever happens, the result will not affect his position and he will remain President. However, initial polls suggest this high-risk strategy to boost support for his Renaissance party could backfire.[2] The National Rally is expected to win but fall short of an absolute majority. And, after the Greens, Socialists, Communists and far-left France Unbowed party announced they would contest the election as a single group, the polls currently project them as the second-biggest bloc (See Chart of the Week).

Unless there is a shift in voter sentiment, this could leave many Renaissance candidates not even making it to the second round and result in a cohabitation government, with the prime minister and president coming from different parties.

France has had three cohabitation governments, the last of which ruled from 1997-2002. With no party having a clear mandate, it could make it extremely difficult for France to implement the necessary austerity measures to comply with the European Union’s fiscal framework, in which member states are required to put in place plans to bring deficits down to 3% of GDP and public debt to 60% of GDP.[3] According to a recent release by the French national statistics institute, Insee, France’s public deficit hit 5.5% of GDP at the end of 2023, with public debt at 110.6% of GDP.[4]

On May 31, S&P Global downgraded France’s long-term sovereign credit rating from AA to AA-. citing concern over the deterioration of its budgetary position.[5]

In what was generally a poor week for European stocks, France’s benchmark CAC 40 index was the worst performer, falling over 6%. Meanwhile, 10-year French government bond yields increased 7 basis points (bps); German Bunds headed in the other direction, falling 13bps.

Losing the (dot) plot

The next surprise came at the Fed’s Federal Open Market Committee (FOMC) meeting on June 12, which noted that with economic activity continuing to grow at a solid pace, there has been only “modest progress” toward the Committee’s 2% inflation objective.[6] This comment was at odds with what the data has been showing.

The FOMC’s median dot plot is now signaling just one 25bps cut in interest rates this year (4 members favour no cuts, 7 support one and 8 want two). This is in stark contrast to the three cuts predicted by the FOMC in March and below the market’s consensus of two cuts.

Unemployment is projected to finish the year at the current rate of 4%, a level we see as conducive to a shift in Fed policy when considered alongside other soft jobs data releases recently. In the week ending June 8, initial jobless claims, a measure we monitor particularly closely, increased 13,000 from the previous week to 242,000, the highest level this year.[7]

The FOMC left its 2024 growth forecast unchanged at 2.1%. With Q1 growth locked in at 1.3%, this implies the economy will grow at 2.4% in each of the remaining three quarters. However, Bloomberg’s consensus projection for GDP growth is 2.1% for Q2, 1.7% for Q3 and 1.6% for Q4.

Meanwhile, the FOMC revised higher its 2024 inflation projection for core personal consumer expenditure (PCE) from 2.6% to 2.8%. This reflects the seasonal inflationary impulse experienced in the first quarter. Core PCE can rise 0.185% month-on-month over the remainder of the year to meet the Fed’s estimate. After softer-than expected core consumer price inflation, and a surprising 0.2% month-on-month drop in producer prices,[8] the consensus for May’s PCE numbers is a very modest 0.1% increase.

The Federal Reserve’s mandate is to “promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates”. With softer jobs data and inflation under control, investors could be forgiven for wondering whether the FOMC dot plot seems backward looking.

Chart of the Week: Macron’s gamble

References

[1] Reuters, ‘Macron calls shock French elections after far-right rout,’ as of June 9, 2024

[2] Bloomberg, ‘French finance chief warns left wing win would mean EU exit,’ as of June 14, 2024

[3] European Parliament, The EU framework for fiscal policies, as of October 2023

[4] Insee, as of March 26, 2024

[5] S&P Global, ‘France long-term rating lowered to AA-,’ as of May 31, 2024

[6] US Federal Reserve, ‘FOMC statement’, as of June 12, 2024

[7] US Department of Labor, ‘Unemployment Insurance Weekly Claims’, as of June 13, 2024

[8] US Bureau of Labor Statistics, as of June 13, 2024

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of June 17, 2024, and may change without notice. All data figures are from Bloomberg, as of June 14, 2024, unless otherwise stated.