Key Takeaways

- Sunday’s results indicate President Macron will either have to share governing responsibilities with Le Pen’s group or manage a parliament that is basically gridlocked.

- Both the far right and left coalitions have a fairly expansionary fiscal policy in mind at a time when France’s debt sustainability is back on the radar.

- A lot of international companies are based in France and not particularly exposed to the domestic environment in terms of revenue.

- Related ProductsWisdomTree Europe Equity UCITS ETF – USD Hedged, WisdomTree Europe Equity UCITS ETF – GBP Hedged, WisdomTree Europe Equity UCITS ETF – EUR AccFind out more

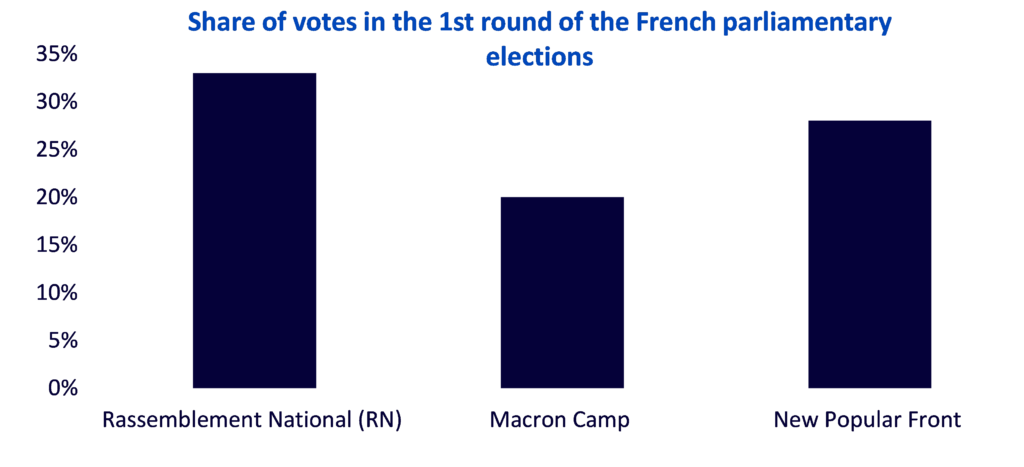

Marine Le Pen’s National Rally (RN) and its allies dominated the first round of voting on Sunday, locking up 33.2% of the vote1. The New Popular Front, formed by left-wing parties got 28% while the parties supporting President Macron got 20.8% of the vote1. Overall participation was strong at 67%1. Even though Macron’s presidency isn’t formally at stake – and he’s said he has no plans to resign – Sunday’s result indicates it’s likely he will either have to share governing responsibilities with Le Pen’s group or manage a parliament that is basically gridlocked.

Macron camp and left alliance see greater coordination

The Macron camp and the left-wing alliance have announced that they will withdraw their candidates if the other camp’s candidates perform better in the first round. The emerging cooperation between the Macron camp and the New Popular Front reduces the RNs chances of winning an absolute majority of parliamentary seats.

In an early sign that Macron’s team is seeking to build alliances with the left, the prime minister decided on Sunday evening to suspend the implementation of an unpopular change to unemployment insurance. The government had said the plans would encourage people into work by paring back the generosity of welfare, but opposition parties widely criticised the move at a time when joblessness has risen.

France under pressure over budget deficit

France’s deficit stood at -5.5% of GDP in 2023 (exceeding the bloc’s deficit threshold 3%) and is set to narrow only slightly this year to -5.3% and next year to 5%2. The start of the Excessive Deficit Procedure (EDP) by the European Commission (EC) for Belgium, France, Italy, Hungry and Malta brings debt sustainability back on the radar3. Despite France’s high investment needs and weak growth, the times of unlimited fiscal stimulus are over.

Both the far right and left coalitions have a fairly expansionary fiscal policy in mind. Calling a snap election was a gamble to Macron’s party but it comes at a time when France’s debt sustainability comes under scrutiny. While Macron’s government was already struggling with fiscal consolidation, the campaign pledges, under the French political parties of both the far right and far left, threaten to bust an already swollen government budget, push up French interest rates and strain France’s relations with the European Union. Macron is playing to his strengths. The snap elections will provide a rude awakening to voters of the implications of surrendering to parties whose campaigns have abandoned any pretence of fiscal discipline.

Wide market dislocations triggered by French elections

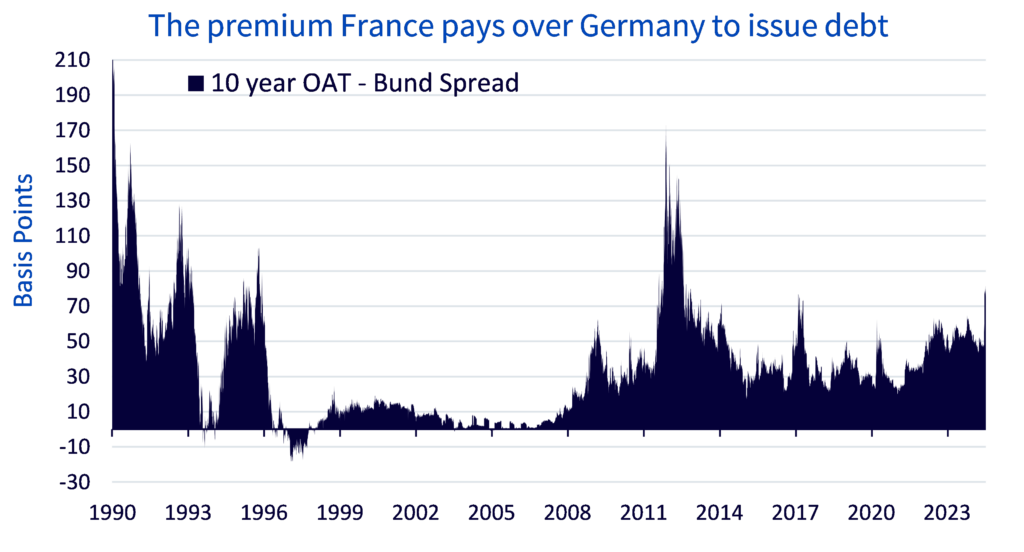

The run up to the French snap elections have already seen a widening of bond yield spreads, with France’s 10-year Obligations assimilabes du Tresor (OAT) yield versus German 10-year Bunds increasing by nearly 20Bps to reach an annual high4. The first-round results have resulted in a positive reaction in the euro, primarily owing to some market relief over RNs lower chances of winning an absolute majority of parliamentary seats. Yet the fiscal concerns alongside the uncertainty around the outcome of the second-round results of the French elections does not remain an attractive proposition for the euro.

French equities have fallen 5.3%5 in the wake of the announcement of the French snap elections in comparison to 2.1% decline for the broader European EuroStoxx 600 Index. However, only 15% of sales of companies are domestically exposed with France’s benchmark CAC 40 Index. It’s a very global market from a revenue perspective. A lot of international companies are based in France and not particularly exposed to the domestic environment in terms of revenue. As a result, we have seen some specific pockets being hit hard especially the domestically exposed names within financials, infrastructure, utilities, and defense sector. In the domestic market, banks hit hard as they hold a large amount of debt are likely to suffer from higher credit costs. There is an increase in risk premia related to French Banks owing to potential windfall tax and capital gains tax on dividends. Infrastructure-related stocks have also come under pressure as the government could require these companies to lower retail prices. Utilities have come under pressure owing to the government intervening to force lower retail prices. Defence stocks have performed well in Europe over the last couple of years, relating to increased defence spending following Russia’s invasion of Ukraine, but there is concern that the far-right party might be less concerned on foreign interventions and focus more on domestic security. Amidst the higher uncertainty around domestically oriented equities, adopting a tilt towards profitable and growing European exporters could be a prudent alternative.

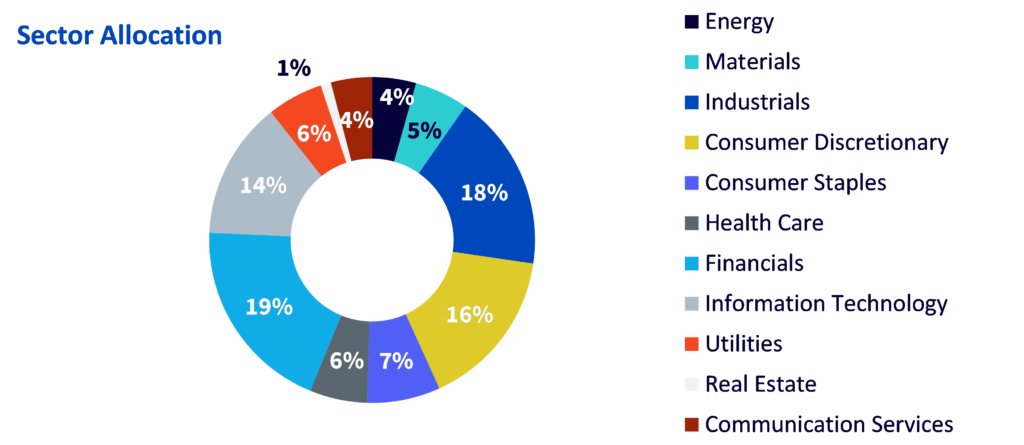

Tilting towards dividend paying Eurozone exports

The WisdomTree Europe Equity UCITS ETF – USD Hedged (HEDJ) provides investors exposure to dividend paying Eurozone companies that derive at least 50% of their revenues outside of Eurozone while hedging exposure to the EUR. By virtue of including dividend paying Eurozone exporters, HEDJ attributes a higher weighting to sectors that exhibit a stronger earnings growth across – consumer discretionary, industrials, financials, and information technology. While it has a lower weighting to sectors with weaker earnings growth and higher risk permia emanating from the elections– energy, utilities and basic materials.

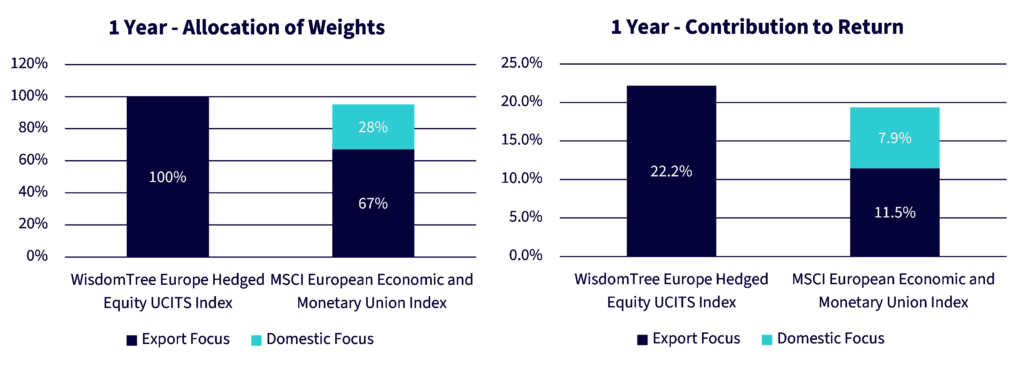

The connection between stronger earnings and performance is evident from HEDJ’s performance in 2024. Over the past 1 Year (from 31 May 2023 to 31 May 2024), the higher allocation to companies with an export tilt helped the WisdomTree Europe Hedged Equity UCITS Index outperform the benchmark MSCI European Economic and Monetary Union (EMU) Index by 3.38%.

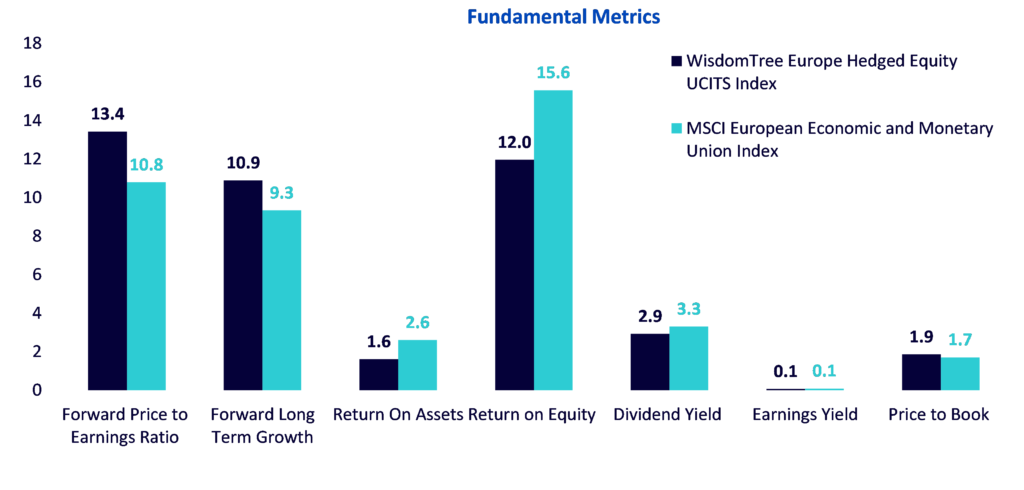

The WisdomTree Europe Hedged Equity Index compares favourably to the benchmarks when looking at fundamental metrics such as long-term forward growth and profitability estimates:

1 Le Monde as of 30 June 2024

2 European Commission as of 31 December 2023

3 Euractiv 19 June 2024

4 Bloomberg as of 28 June 2024

5 Bloomberg – CAC 40 Index from 10 June to 28 June 2024