Elections have been a key topic on the mind of investors in recent weeks, with the UK, France, India and Mexico among countries recently going to the polls.

With those elections behind us, attention has turned to the US in November – not least as investors digest the shocking attempted assassination of former President Donald Trump this weekend. With both the monetary policy and political path ahead somewhat uncertain, markets may well see spells of US-driven volatility through the rest of the year.

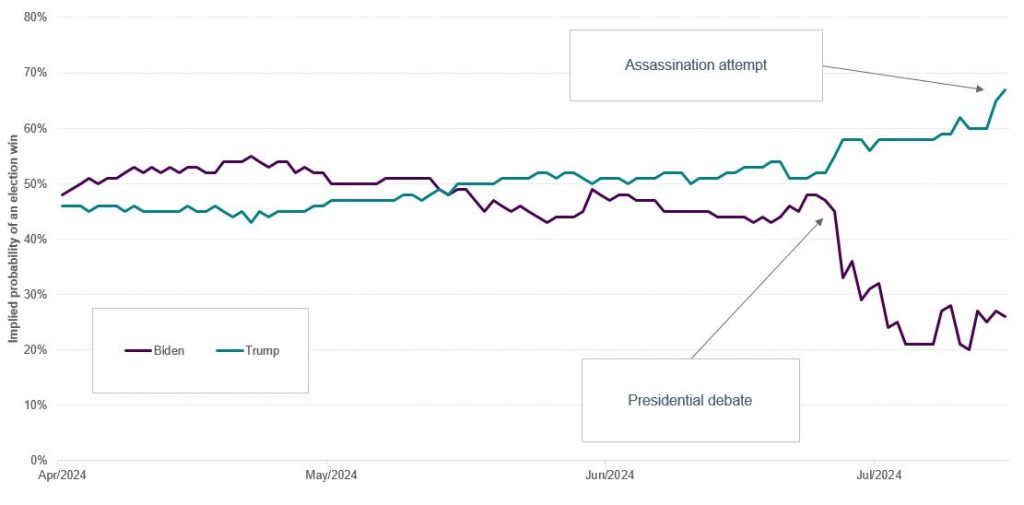

Market reaction to the weekend’s events has been relatively muted so far. However, the probability of a Trump win (implied by betting odds) have rose further (Chart 1). The likelihood of a return to office for the former president already seemed to be rising, with the presidential debate last month having also spurred a shift in many polls in favour of Trump. However, much can happen between now and November’s election and we will continue to monitor developments closely. A Trump win and a Republican clean sweep of the House and Senate are both potential outcomes and could bring significant change in the policy backdrop. At the moment, we believe that US stocks could still have room to outpace other markets, but that the outlook for the US dollar is more challenging.

Chart 1: Trump odds improve

Source: Bloomberg, PredictIt as at 15 July 2024. Implied probability of who will win the 2024 US presidential election, based on prediction market odds.

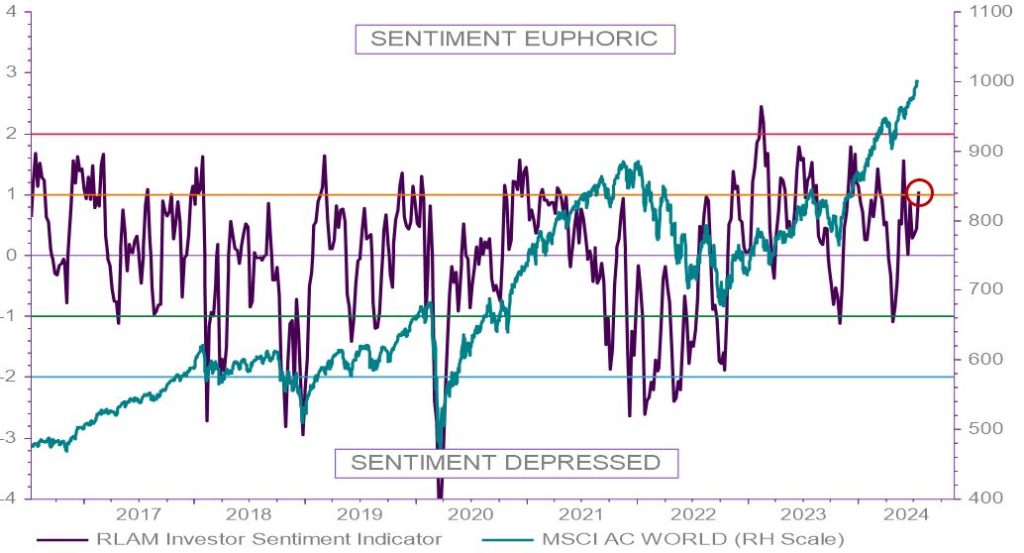

Despite much uncertainty around politics over recent weeks, equity markets have continued to rally and market volatility remains near historic lows. Retail investors are also bullish on equity market prospects, which leaves our measure of investor sentiment at ‘euphoric’ levels (Chart 2). With stocks continuing to make fresh all-time highs, perhaps there is some market complacency as we head into a busy few weeks for central banks.

Chart 2: Investor sentiment is bullish

Source: LSEG Datastream as at 12/07/2024

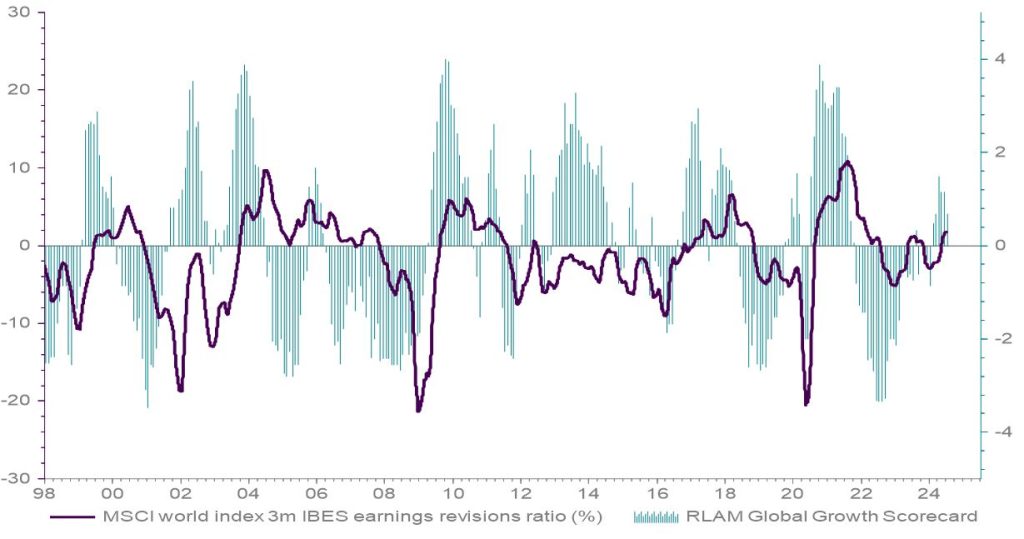

Aside from politics and central bank action, a main driver of markets over the coming weeks will likely be corporate earnings. As we head into US earnings season, we note that earnings revisions have been positive. However, as the macro environment has softened somewhat, we ponder whether earnings can match the investor sentiment and continue to deliver and lead markets higher (Chart 3).

Chart 3: Earnings revisions and global growth scorecard

Source: LSEG Datastream as at 04/07/2024

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.