The eurozone manufacturing sector has recently lost momentum. As the European Central Bank (ECB) noted at its July meeting, uncertainty about the sector’s outlook is one of the main risks to eurozone growth. Senior Economist GianLuigi Mandruzzato looks at the prospects for eurozone industrial production, also accounting for the developments in the Chinese economy.

Faltering recovery

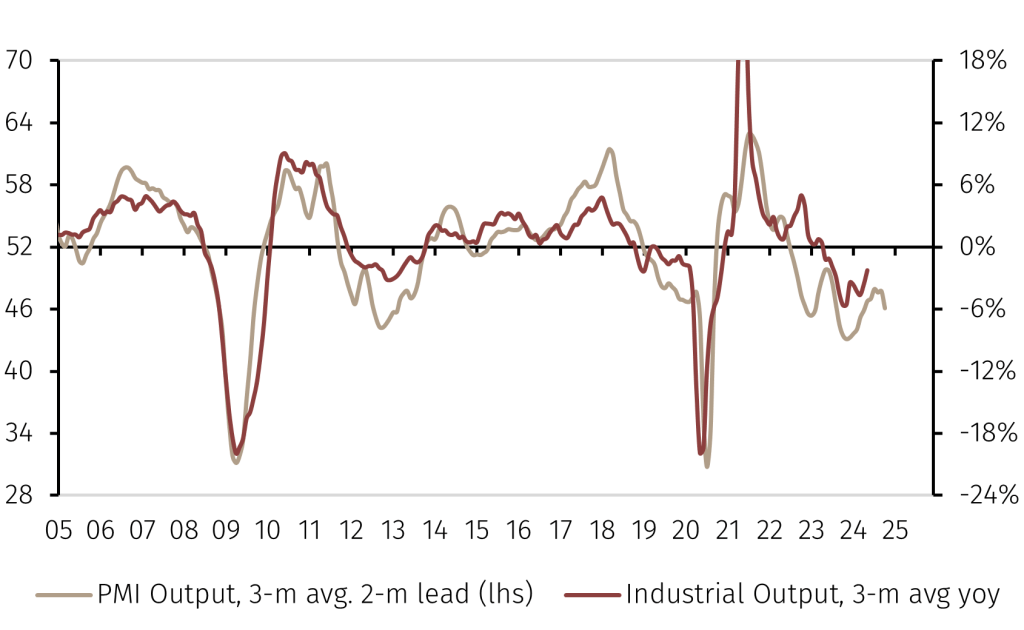

After an encouraging recovery in the first months of 2024, confidence among eurozone manufacturing firms deteriorated again in May-June. The Purchasing Managers’ Index (PMI) manufacturing sub-index fell to 46.1 in June, a level consistent with a contraction of around 5% in output on an annual basis during the second half of 2024 (chart 1).

Chart 1. Eurozone industrial output continues to fall

This would be a continuation of the contraction in industrial activity since March 2023, according to the industrial production index published by Eurostat. In May 2024, output was about 7% below the previous cyclical peak seen in February 2023, and the gap seems set to widen.

The PMI sub-indexes for new orders are, in fact, very weak and show a phase of pronounced softness in demand on both the domestic and foreign markets. The weakness of the latter is worrying given the importance of exports for the sector. Unsurprisingly, the rate of production capacity utilisation also fell during the first part of 2024, returning to levels that in the past have coincided with recessionary phases of the business cycle.

Weak Chinese demand

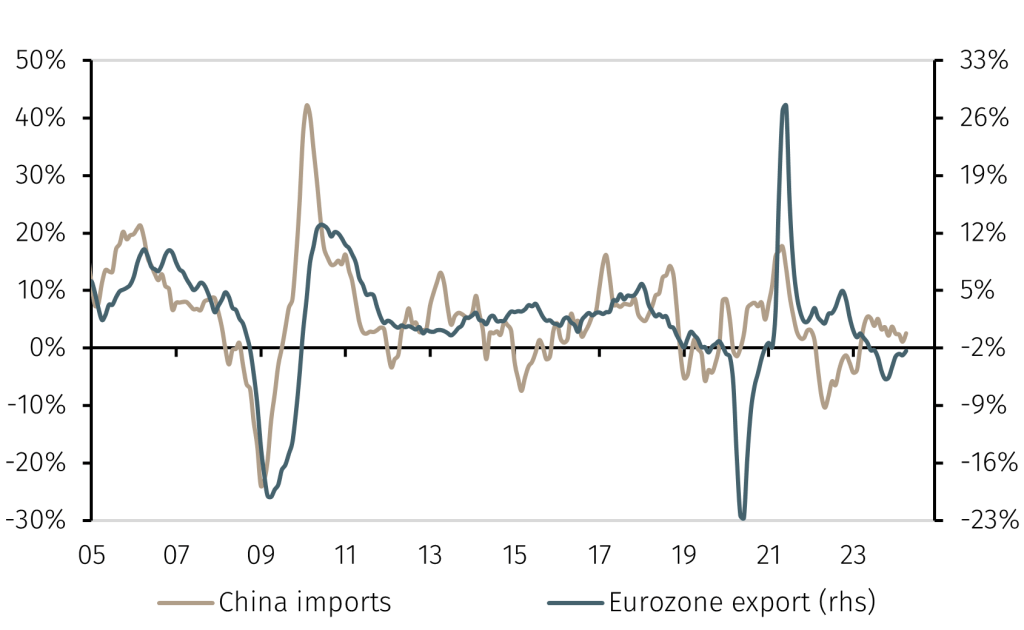

One of the main explanations for the difficulties of eurozone exports is the weak Chinese demand (chart 2). Over the last twenty years, fluctuations in Chinese demand have led eurozone export cycles, influencing the level of activity in the sector.

Chart 2. China imports and eurozone exports (YoY)

The ongoing weakness of the Chinese economy, reflected in the second quarter Gross Domestic Product (GDP) data, does not leave much room for optimism for the near future of the eurozone manufacturing industry.

Outlook remains uncertain

Furthermore, the picture for international trade is unusually uncertain in light of Trump’s plans, if elected US president, to impose new tariffs on goods imports. What happened in 2018 during the first Trump administration shows the negative impact of tariffs have on global trade and manufacturing output.

As stressed by the ECB after the Governing Council meeting on 18 July, this is one of the main downside risks to eurozone growth. If industrial production remains in the doldrums in the coming quarters, the central bank will have another reason to cut interest rates further.

From a European equities positioning perspective, Fund Manager Sam Glover noted caution on European cyclicals that operate in competitive industries, with disadvantaged cost (European) and revenue (over reliance on domestic Europe / exports to China) business models. Certain European listed companies within the chemicals and capital goods sectors are where we are seeing pressure from weak industrial activity and Chinese demand.