Key Takeaways

- Gold has hit new highs, recovering quickly from the initial cross-asset global sell-off at the beginning of the month.

- White precious metals have been slower to recover, but silver is now gaining traction and catching up.

- Slowing global manufacturing activity may have dented silver prices, but silver’s application in many more uses today and in the future, compared to the past should help it overcome the cyclical soft-patch in manufacturing.

- Related ProductsWisdomTree Core Physical Silver, WisdomTree Physical Silver, WisdomTree Energy Transition MetalsFind out more

Gold recently hit a fresh new high ($2,529.75/oz, based on LBMA PM price on 20/08/2024). The metal rebounded strongly after an initial wobble at the beginning of August that was driven by a global sell-off across all assets. As we discussed in Gold usually dips before making substantial gains in financial crises, gold often falls with other assets in the initial phase of market turbulence because it is used as a source of liquidity to cover losses elsewhere. Gold’s recent recovery has been speedier than in 2008 Global Financial Crisis and the COVID crisis, although it only fell by a small amount in the first place and the recent market wobble is hardly comparable to those big crises. Indeed, most risk assets have staged a recovery as well (which did not happen in the big crises this early). Nevertheless, the recent episode illustrates a behavioural trait of gold that holds even in market stresses of a relatively small magnitude. We are less than a month away from the highly anticipated US Federal Reserve (Fed) interest rate cuts, which we believe will be a boost for gold (and risk assets alike). At the moment, Fed Fund futures are pricing in five 25bps1 rate cuts from the Fed by January 2025. Given that there are only four scheduled FOMC2 meetings in that time frame, it seems a bit ambitious. OIS3 markets are pricing in three 25 bps European Central Bank rate cuts in that time frame. If the markets are right and the Fed cuts with that cadence, that could soften the US Dollar which could be a boost for gold.

While gold bounced back quickly, the white precious metals – silver, platinum and palladium – have been slower. However, silver is currently staging a robust catch-up. In the past week alone (14-21 August), silver is up 7.8%.

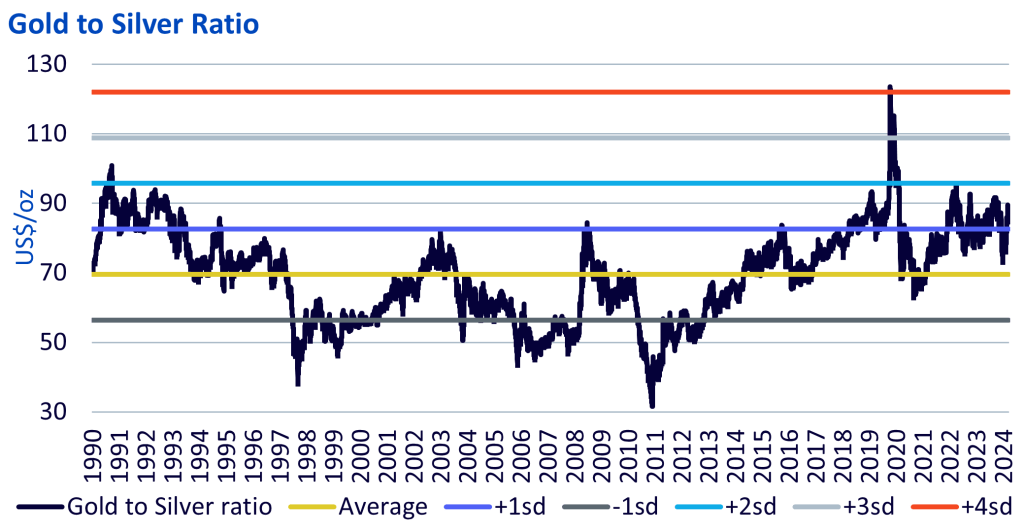

The gold-to-silver ratio – a gauge of relative price of the two metals has been above the long-term average since 1990 for the last few years (since July 2021), indicating that silver has been relatively cheap for some time. The ratio is currently more than a standard deviation above that average and has been so for more than half the trading days since July 2021. However, in May 2024, after gold had hit several new highs, silver broke out and it looked the gold-to-silver ratio was trending back to long-term average levels, but it never quite got there.

Source: WisdomTree, Bloomberg 01/06/1990 – 22/08/2024). Sd = standard deviation. Historical performance is not an indication of future performance and any investments may go down in value.

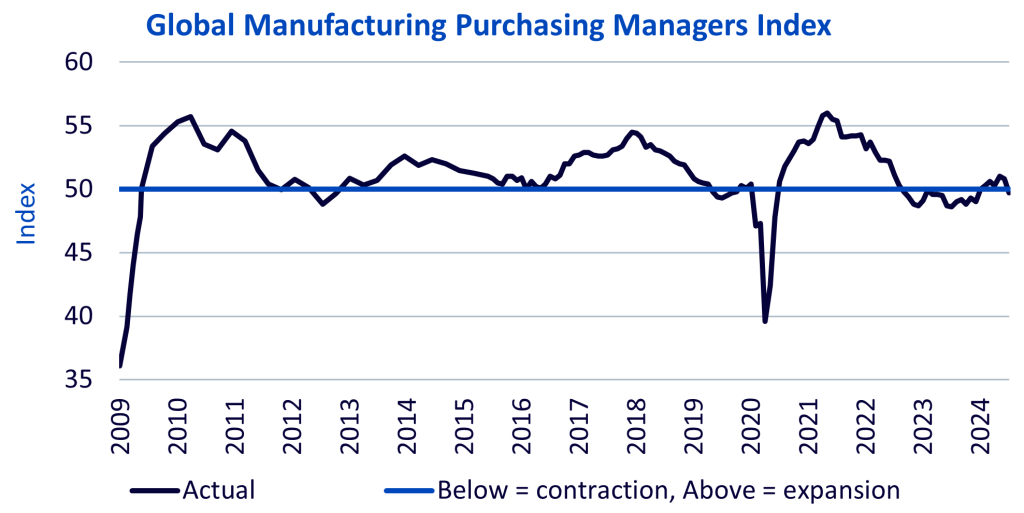

Silver’s price, which is more influenced by industrial demand than gold, stumbled as broad global industrial indicators softened. Notably Global Manufacturing purchasing managers indices (PMIs) have been declining for the past two months and in July fell below the 50 demarcation between expansion and contraction. We believe that PMIs are likely to rebound as interest rate cuts set in, boosting industrial activity and thus will support silver.

Source: WisdomTree, Bloomberg, S&P Global, May 2009 to July 2024. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

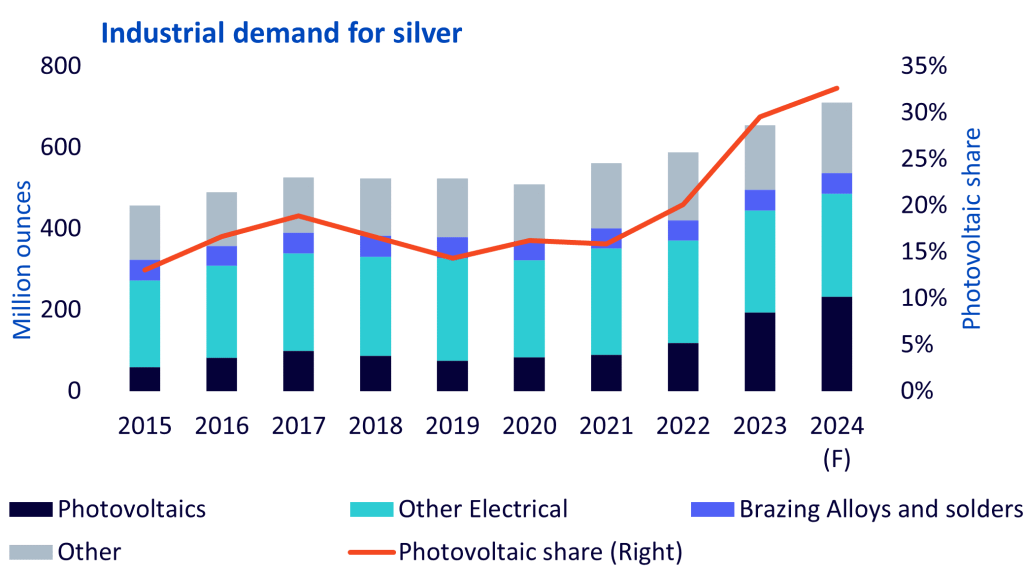

Moreover, with silver’s expanding uses, demand for the metal is rising faster than you would expect from simply looking at historic macro industrial indicators. The electrification megatrend is highly supportive for silver. Photovoltaics (PVs, solar panels) are taking an increasingly large share of overall industrial demand for the metal. Between 2021 and 2023 PV demand for silver more than doubled. PV installations have been rising exponentially for the past decade, yet silver demand remained fairly flat until 2021 mainly because of thrifting of the metal. However, the latest, most solar efficient PV technologies require higher loadings of silver. That’s a trend we don’t see reversing in the near future.

Source: Metals Focus, WisdomTree, July 2024. (F) = Forecasts. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Silver demand is also being boosted by 5G infrastructure buildout, artificial intelligence applications and data centres. Anything that requires electrical conductivity is likely to require some silver. Vehicles – both electric and internal combustion engine – have increasingly more electrical connection points and thus have been driving silver demand higher.

As electric vehicle technology evolves, we could see a further boost for silver. Kitco reports a Samsung’s solid-state battery breakthrough, which is likely to consume more silver than competing battery technologies4. Admittedly Samsung has not provided any concrete numbers to judge the metal intensity, but even conservative estimates of its use once commercialised could add significant demand units to an already tight market.

As we discussed in our recent Silver Outlook, the silver market is in supply deficit when including investment demand. Even when netting investment demand out (because it can easily be mobilised as a source of supply), the surplus would be the lowest since data collection by Metals Focus began. These secular increases in demand for silver in new applications can belie the cyclical trends and we believe that the market has not really priced that in. Once they do get priced in, silver could seize the gold medal.

Implementation

WisdomTree Core Physical Silver (WSLV) is a newly launched, 100% physically backed silver exchange traded commodity listed on Deutsche Boerse XETRA, LSE and Borsa Italiana. With a management fee of only 0.19%, it provides an attractive access point to silver.

1 Basis points

2 Federal Open Market Committee

3 Overnight Index Swaps

4 https://www.kitco.com/news/article/2024-08-19/silver-set-soar-samsungs-solid-state-battery-breakthrough-analysts