Navigating the expanding private equity secondary market

Highlights

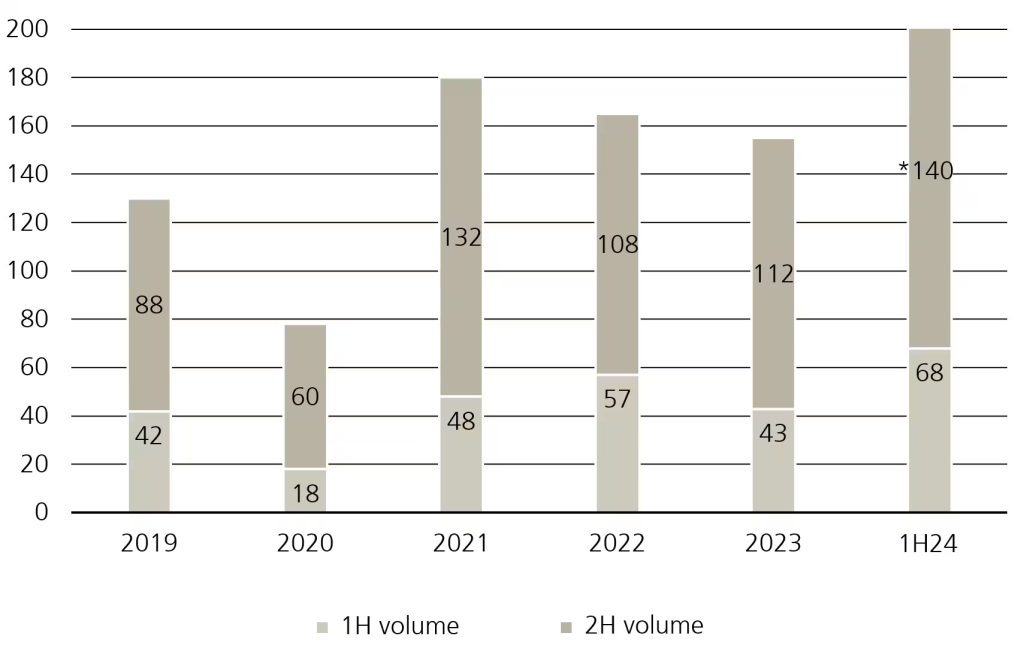

The private equity secondary market has witnessed substantial growth and evolution over recent years, emerging as a vital component of the broader private equity ecosystem. In the first half of 2024, the secondary market volume reached a remarkable USD 68 billion, and the growth trajectory is expected to continue for the foreseeable future.¹ This significant growth is indicative of the increasing complexity and specialization within the market, with investors and fund managers alike recognizing the benefits of liquidity, diversification, and the ability to recalibrate portfolios. Notably, there has been the introduction of semi-liquid open-ended secondary funds, offering a flexible and attractive vehicle for a diverse range of investors, from institutional and retail investors, to sophisticated family offices. This article explores the dynamics of the secondary market, with a focus on the rise of semi-liquid secondaries funds and their role in the evolving landscape.

Breakdown of the secondary market

The secondary market in private equity consists of transactions where investors buy and sell existing private equity fund interests. In the first half of 2024, the global secondaries market had an estimated volume of USD 68 billion, which represents a 58% increase on the previous year’s 1H volume of USD 43 billion.1 The market can be broadly categorized into two main segments: GP-led secondaries and LP-led secondaries.

GP-led secondaries

Representing 41%1 of transactions in the first half of 2024, this segment includes transactions initiated by General Partners (GPs) to provide liquidity to their Limited Partners (LPs) or to facilitate the continuation of a fund beyond its initial term. In the present day’s secondary market, the companies or assets in GP-led secondaries are often considered ‘trophy assets’. These companies may require recapitalization to achieve a successful exit, or the GP may wish to hold onto the asset longer to realize its full potential. This marks a significant shift from 10–15 years ago when GP-led secondaries typically involved underperforming assets. The evolution in the quality of assets reflects the broader changes in the secondary market, which has become more sophisticated and diversified.

LP-led secondaries

Comprising 59%1 of the 1H24 market volume, LP-led secondaries involve the sale of fund interests by existing investors. This segment has grown significantly as investors use these transactions as a portfolio management tool. The rise in buyside capital and the availability of more comprehensive pricing information have created a favorable pricing environment, making LP-led secondaries an increasingly attractive option for liquidity and portfolio rebalancing.

Secondary market transaction volume (USD billion)

This chart shows how in the first half of 2024, the secondary market volume reached USD 68 billion, and the growth trajectory is expected to continue for the foreseeable future.

The rise of semi-liquid secondary funds

Amidst the growth of the private equity secondary market, semi-liquid open-ended secondary funds have gained traction in recent years. These funds, often referred to as ‘evergreen’ funds, provide investors with a blend of liquidity and long-term investment exposure. Unlike traditional closed-ended private equity funds which are illiquid and have fixed lifespans typically for well over a decade, semi-liquid funds are open-ended and offer more frequent redemption opportunities, typically on a monthly or quarterly basis.

Why semi-liquid funds are gaining popularity

- Flexibility and liquidity

One of the primary attractions of semi-liquid secondary funds is the ability to subscribe and redeem investments with relative ease. This flexibility appeals to a broad spectrum of investors who seek exposure to private equity but also value the option to adjust their holdings periodically. For institutional investors, this can mean better alignment with cash flow needs and portfolio rebalancing strategies. Retail investors and family offices, on the other hand, benefit from access to private markets without committing capital for extended periods. - Diversification and risk management

These funds typically invest in a diversified portfolio of secondary transactions, which can include both LP-led and GP-led deals. This diversification helps mitigate risk by spreading investments across various assets and vintage years. Additionally, the secondary market’s nature often allows investors to gain exposure to mature, cash-generating assets, providing a different risk-return profile compared to primary investments. - Enhanced market access

Semi-liquid funds democratize access to the secondary market. Traditionally, participation in private equity secondaries was limited to large institutional investors with substantial capital and the necessary expertise to navigate the complexity of secondaries investing. However, the advent of semi-liquid structures has opened the market to smaller investors, including retail investors, who can now participate with smaller ticket sizes. This broader participation is particularly appealing given the increased availability of information and transparency in pricing.

The role of local feeder funds

Another significant development in the secondary market landscape is the increasing use of local feeder funds to access the master fund’s portfolio. Local feeder funds, which are established in the investor’s home country, offer a conduit through which local investors can gain exposure to the assets held by the master fund, typically domiciled in financial hubs like Luxembourg. This arrangement provides several benefits:

- Regulatory compliance and ease of investment

Local feeder funds simplify the investment process for investors by aligning with local regulatory requirements. This is particularly advantageous in countries like Australia, Canada and Switzerland, where regulatory frameworks can vary significantly from those of the jurisdictions where the master funds are domiciled. By investing through a local feeder, investors can navigate these regulations more smoothly, ensuring compliance and reducing administrative burdens. - Tax efficiency

In some cases, investing through a local feeder fund can offer tax advantages. These funds may be structured in a way that exempts investors from certain taxes and fees that they would otherwise incur if investing directly in the overseas master fund. This tax efficiency makes local feeder funds an attractive option for investors seeking to optimize their returns while maintaining compliance with local tax laws. - Simplified investor onboarding

The use of local feeder funds can streamline the onboarding process for investors, providing a familiar and locally compliant investment structure. This ease of onboarding is particularly beneficial for smaller investors, including retail clients and family offices, who may find the direct investment process into foreign domiciled funds cumbersome and complex.

Trends driving the market

At present, we see a number of trends in the secondaries market, both in the GP and LP segments of the secondaries market.

Counter-cyclical nature and secular trends

In the past, secondaries were generally considered as a counter cyclical sub-asset class, as secondaries tended to perform well during economic downturns. However, this dynamic has shifted as long-term, secular economic drivers now underpin the secondaries market. One notable secular driver is the growing recognition of the benefits of holding assets for longer periods in order to maximize value creation. Indeed, the rapid growth of GP-led secondaries, in particular continuation funds, as these funds allow GPs to extend the life of high-quality assets, which offer investors long-term exposure to said assets and potentially higher returns upon exit. Furthermore, secondaries have now become a well-established portfolio management tool, offering liquidity and enabling portfolio managers to calibrate their exposure to a particular vintage year, sector or geography. This evolution reflects the increased sophistication and integration of secondaries into portfolio management in general, and we expect these trends to continue along these lines in the coming years.

GP-led secondaries

In the GP-led market, we see that continuation vehicles are steadily gaining acceptance and we expect a strong pipeline of such continuation vehicles for the second half of 2024. In addition, the liquidity that such a vehicle can provide is highly appreciated by LPs especially in an environment where merger and acquisition (M&A) activity has decreased, and the route of exiting a company via initial public offering (IPO) significantly diminished in 2023. This shift makes GP-led secondaries one of the few viable options for generating liquidity, further fueling their growth and attractiveness in the market, a trend which we expect to continue in the latter half of 2024.

LP-led secondaries

The trend of LP-led secondaries has reached record levels, driven by a rising frequency of LPs seeking liquidity. This surge has brought transaction volumes to new heights, bolstered by high levels of fundraising from both new entrants and established large secondary buyers. Not only has the volume of LP-led secondaries increased, but the size of the transactions too. In the first half of 2024, we saw 10 LP-led transactions of USD 1 billion or greater, whereas in 1H23 there were only six such deals of this size. Indeed, based on these observations we expect this trend to continue into the second half of 2024 and into early 2025.

Final thoughts

The private equity secondary market is experiencing a dynamic phase of growth and innovation, driven by the increasing use of GP-led and LP-led secondary transactions, as well as the emergence of structured liquidity solutions. The rise of semi-liquid open-ended secondary funds is a testament to the market’s evolution, offering a compelling option for investors seeking both exposure to private equity and the flexibility of liquidity. Additionally, the growing popularity of local feeder funds provides a practical and tax-efficient avenue for investors in specific jurisdictions, allowing them to access global markets while navigating local regulatory landscapes.

As the market continues to mature, with projections of reaching USD 140 billion¹ by the end of 2024, the role of semi-liquid funds and local feeder structures is likely to expand, providing versatile and accessible investment vehicles for a diverse range of investors. The continued development of the secondary market, supported by advancements in data analytics and a favorable pricing environment, bodes well for its future. However, investors must remain vigilant, considering the complexities and risks associated with these investments. As the market evolves, the adaptability and innovative spirit of fund managers and investors will be key to navigating the secondaries landscape.