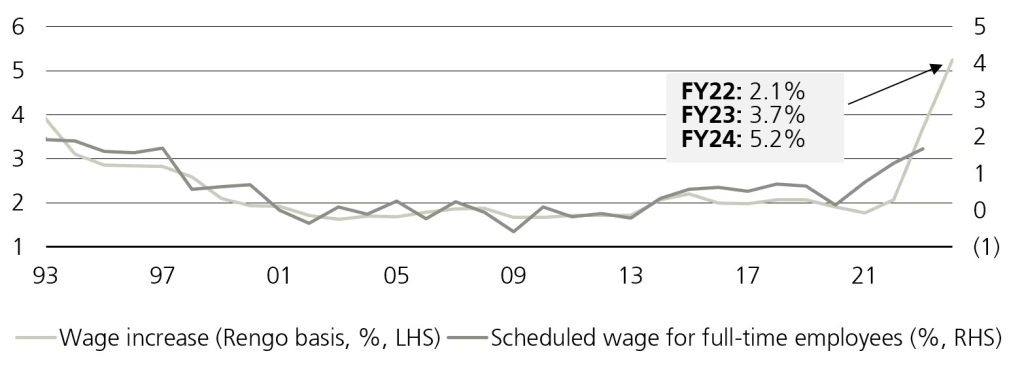

Japan’s economy is on the cusp of a major change, emerging from its three decades of stagnation. This narrative has further solidified since our last paper. Wage growth has shot up to the highest in more than three decades with the 2024 Shunto wage negotiation (annual wage negotiations between enterprise unions and employers in Japan) result at 5.2% (2023: 3.7%), see Figure 1. Adjusted for inflation, real wage growth also turned positive in June 2024 after falling consecutively for more than two years.

Encouragingly, this robust wage growth is finally translating into greater household spending. Indeed, 2Q24 household consumption registered the strongest growth in almost a decade if we were to exclude the period which benefited from post-pandemic normalization. It was also the first improvement after four quarters of decline. If sustained, it could help Japan rediscover its dynamism.

Nevertheless, it is perhaps still too early for celebration. Firstly, the price-wage virtuous cycle is still in its early stage and inconclusive. Secondly, it remains unknown whether positive real wage growth would lead to sustained household consumption as the aging society may opt to save more instead. Thirdly, policy error is a potential risk. Japan is highly accustomed to low interest rates after decades of easy monetary policy. The BoJ will likely need to be watchful of any withdrawal symptoms.

Figure 1: Spring wage negotiation results

Is Japan multifamily still attractive?

Is multifamily still an attractive investment in this evolving macro landscape? We think so.

Japan’s transition from deflation to inflation is expected to have positive implications on long-term yield spread and rental growth. Nonetheless, the demographic trend is a pivotal factor and should guide our investment focus

Macro: inching closer

Japan’s economy is on the cusp of a major change, emerging from its three decades of stagnation. This narrative has further solidified since our last paper. Wage growth has shot up to the highest in more than three decades with the 2024 Shunto wage negotiation (annual wage negotiations between enterprise unions and employers in Japan) result at 5.2% (2023: 3.7%), see Figure 1. Adjusted for inflation, real wage growth also turned positive in June 2024 after falling consecutively for more than two years.

Encouragingly, this robust wage growth is finally translating into greater household spending. Indeed, 2Q24 household consumption registered the strongest growth in almost a decade if we were to exclude the period which benefited from post-pandemic normalization. It was also the first improvement after four quarters of decline. If sustained, it could help Japan rediscover its dynamism.

Nevertheless, it is perhaps still too early for celebration. Firstly, the price-wage virtuous cycle is still in its early stage and inconclusive. Secondly, it remains unknown whether positive real wage growth would lead to sustained household consumption as the aging society may opt to save more instead. Thirdly, policy error is a potential risk. Japan is highly accustomed to low interest rates after decades of easy monetary policy. The BoJ will likely need to be watchful of any withdrawal symptoms.

Figure 1: Spring wage negotiation results

Source: CEIC; UBS Investment Bank; UBS Asset Management, Real Estate & Private Markets (REPM), September 2024.

Past performance is not a guarantee for future results.

Given the rising confidence, the BoJ has commenced its policy normalization and delivered two rate hikes in April and July. While the July rate hike was not entirely a surprise, the timing of its hawkish tone was less than ideal as it coincided with weak macro data and recession fear in the US. This resulted in sharp market volatility in the week following the policy tweak. The BoJ has since attempted to calm the market with a more neutral tone.