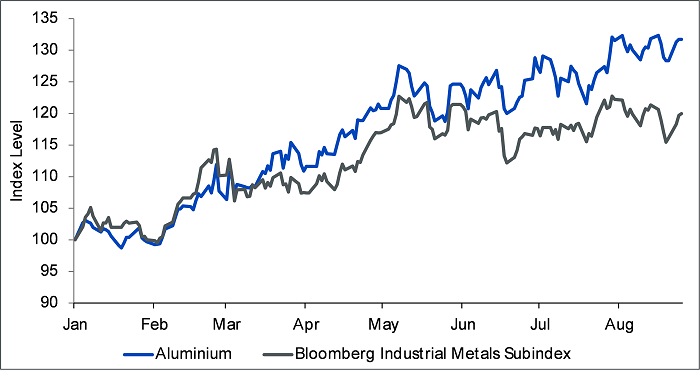

Earlier this year in April, we observed the rising tide of aluminium and ascribed it to supportive fundamentals. Fortunately for investors, the tide hasn’t turned as the metal’s fundamentals continue to improve. No wonder, therefore, that aluminium is now widening its lead over the broader industrial metals basket – which includes behemoths like copper and nickel (see figure 1 below).

Figure 1: Aluminium prices have outpaced the industrial metals basket recently

Source: WisdomTree, Bloomberg. Data as of 25 August 2021. Year to date performance shown with prices rebased to 100 on 31 Dec 2020. Industrial metals is comprised of copper, nickel, aluminium and zinc.

Historical performance is not an indication of future performance and any investments may go down in value.

Automobiles driving demand growth

The global pandemic hit the automobile industry particularly hard, with semiconductor shortages impeding manufacturing activity even after the economic recovery had otherwise begun. Early signs of these shortages easing may be on the horizon. Since the transport sector accounts for 23% of aluminium demand1, this is a positive sign for the metal. According to Citi, semiconductor shortages are expected to ease significantly from the fourth quarter onwards, resulting in a potential 3% increase in aluminium’s automotive demand in 2022 compared to July/August 2021 levels.

Aluminium’s automotive demand prospects look promising for the long term as the metal’s physical properties render it indispensable. Aluminium’s high strength to weight ratio gives it a 20% smaller CO2 footprint over a vehicle’s lifecycle compared to steel2. The metal also absorbs twice the crash energy compared to steel, making it not only lighter but safer and, therefore, the go-to material across various modes of transport.

Supply tightness is likely to persist

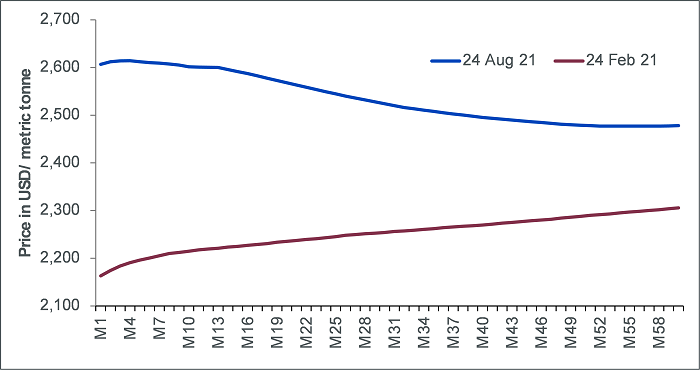

China’s crackdown on coal-powered aluminium production for environmental reasons since the start of this year has resulted in supply cuts and producers looking to transition towards alternative energy sources. With China being the largest aluminium producer by far, this could keep the market undersupplied for years. Market pricing is beginning to reflect this ‘tightness’ with aluminium’s futures curve going from contango to backwardation in recent months, a relatively unusual state for an industrial metal (see figure 2 below).

Figure 2: Futures curve backwardation highlights tin’s tight supply relative to demand

Source: WisdomTree, Bloomberg. Data as of 25 August 2021

Historical performance is not an indication of future performance and any investments may go down in value.

Aluminium’s surge, therefore, is in line with its improving fundamentals. A positive roll yield, which investors gain from rolling backwardated futures, is currently offering a bonus.

Sources

1 Statista 2021.

2 The Aluminum Association

3 Citi Research August 2021