Key Takeaways

- The early-cycle recovery has left valuations of stock indices elevated, thus potentially limiting equity returns over the near- to mid-term.

- Going forward, a focus on individual companies should play a greater role in delivering equity returns.

- Many companies’ efforts in transitioning to a digital, post-pandemic world are underappreciated by the market, while other stocks don’t have fundamentals to justify rich valuations.

Macro developments have been a driving force in financial markets since the COVID-19 pandemic upended the global economy. Lockdowns, the arrival of stimulus and the rapid approval of vaccines – at times these forces overshadowed security-specific factors, and in the process, caused riskier asset classes (and in some instances Treasuries) to move in lockstep.

While risks remain, including the emergence of the Delta variant, we believe that the global economy has recovered to a degree that the sway macro drivers have had on asset classes will soon diminish and the fate of individual securities will revert to idiosyncratic factors.

With equities valuations above historical averages, a renewed emphasis on security-specific factors, in our view, should help investors maximize future returns and – importantly – avoid pockets of the market where high valuations may not be justified by underlying fundamentals.

A Recovery Matching the Crisis

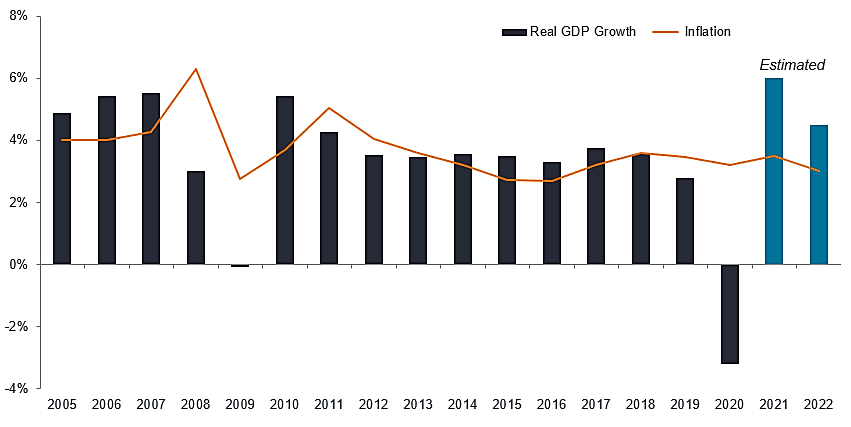

Recessions caused by natural disasters tend to be short-lived. This has proven to be the case with the pandemic. After having contracted by 3.3% in 2020, global gross domestic product (GDP) growth is forecast to climb by 6.0% this year. The promise of increased economic activity has been welcomed by riskier assets, as evidenced by the MSCI All Country World Index rising over 30% from early November 2020 through July 30, 2021.1

GLOBAL GDP GROWTH AND INFLATION

The rolling economic reopening continues, but upward price pressure – thus far – appears transitory

Improving GDP forecasts are not the only forces pushing equities higher. Also at play are trillions of dollars created by global central banks. In search of adequate returns, some of these funds have likely made their way into financial markets, resulting in the prices of certain stocks reaching levels that exceed their intrinsic value.

This wave of liquidity is not only making itself felt in financial markets. In the real economy, inflation has spiked, and while the higher prices associated with a release of pent-up demand may prove short-lived, inflation caused by nagging supply chain dislocations and higher wages may turn out to be stickier.

Investors must ask themselves how much of the good news has been priced in. If growth undershoots expectations, stocks solely riding the cyclical wave may be vulnerable. Similarly, increased regulations may become a headwind for certain industries. Furthermore, should inflation be more persistent than expected, companies that can pass on higher input costs should be better positioned than those that must accept margin compression in order to defend market share. In each of these cases, security selection – and avoidance – are likely to play increasingly important roles for investors.

Earning Affirmation

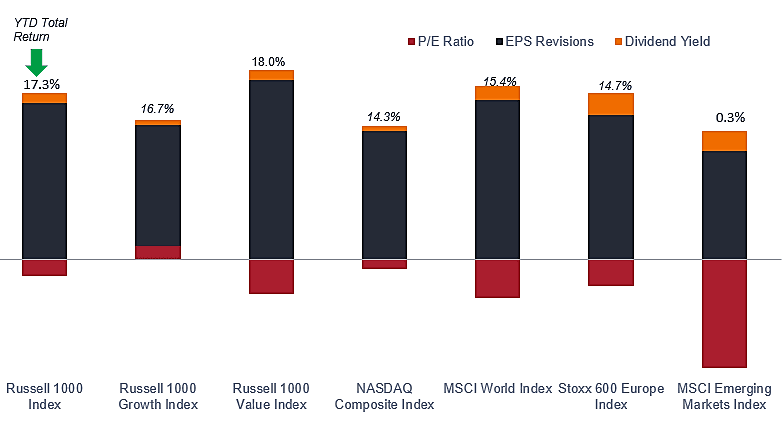

Equities began their recovery soon after policy makers opened the floodgates of accommodation. The late-2020 approval of vaccines fueled investor optimism. Consequently, in keeping with other cycles, early-recovery equity returns were mostly driven by multiple expansion. In contrast, 2021’s gains have been driven by earnings growth, with stocks consistently beating ambitious year-on-year estimates.

EQUITIES’ 2021 TOTAL RETURN DECOMPOSITION

Equity returns in 2021 have thus far been driven by positive earnings revisions

Eventually, favorable earnings comparables will fade. Yet some companies are likely to still find ways to exceed expectations. Rather than mainly benefiting from the rising tide of a global recovery, well-run companies with strong competitive positions and unique intellectual property – often associated with secular themes such as cloud computing, artificial intelligence and biotech – are likely to compound earnings growth at rates not fully appreciated by investors.

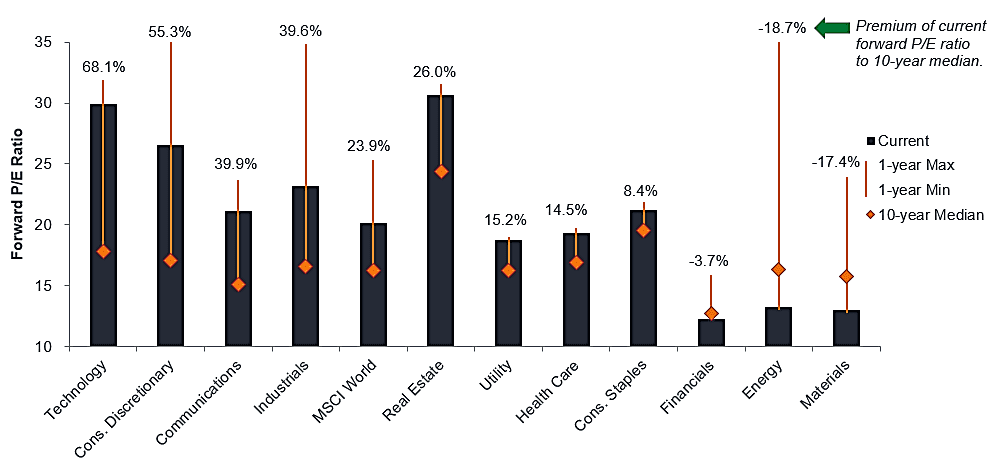

Elevated Valuations, but …

Increased business activity and easy financial conditions have contributed to rising stock valuations. As investors wring out all the optimism associated with economic recovery and policy inches toward normalization, valuations will have to stand on a company’s merits. Stocks that have largely been the beneficiary of buoyant markets may be exposed to a downgrade in macro expectations. Among these are highly cyclical companies and those that face secular headwinds but have rallied on the back of indiscriminate buying.

GLOBAL P/E RATIOS BY SECTOR

On index and sector levels, equities valuations are elevated, but attractive return opportunities still exist by identifying underappreciated companies

Although above average price/earnings ratios go hand-in-hand with a lower expected earnings yield, investors should recognize that the ratios most often referenced are on the index or sector – not the security – level. With the concentration of major equities indices having increased over the past half decade, the oft-quoted high valuations of indices do not imply that only meager future returns are on offer.

Opportunities for higher returns exist but are more likely to be found on the security level as many companies have underappreciated stories or have been miscategorized by the investment community. Constructing a portfolio comprised of those companies would most likely result in a composition – and potential return profile – different than major benchmarks.

Business Models, not Nomenclature

In our view, investors have done themselves a disservice by prioritizing investment style over an individual company’s business model. While the recent dominance of growth stocks has been rewarding for many, rising market caps have led to concentrated portfolios and increases the risk of multiple compression on long-duration growth stocks, should interest rates rise.

The P/E ratio of growth stocks within the Russell 1000 Index currently carry a 53% premium over their 10-year average. For value stocks, the premium is only 12%.3 Paying more for growth today has the downside – in some, but not all, cases – of lower future returns. But attempting to rotate toward value for “value’s sake” carries its own risks. Chief among these are gaining exposure to companies that are on the wrong side of the digital divide and placing hope solely on the economic cycle maintaining momentum. The early-year ill-fated rotation toward value illustrates the risk of substituting category for company.

GROWTH VS. VALUE

While economic reopening underpins rationale for value stocks, investors have returned to defensible positions of secular growers at any sign of shakiness

We believe that companies in each category likely have valuations not merited by their fundamentals. There are many deep-value companies that have a bright future due to them effectively repositioning for a digital economy or their ability to continue to consistently generate cash flow despite being in out-of-favor industries. Conversely, several high-growth stocks may not have a clear path to profitability regardless of investor enthusiasm. In each instance, we believe it will be the company, not the category, that will dictate these stocks’ future trajectory.

1All data sourced from Bloomberg and as of 30 July 2021 except where otherwise indicated.

2Russell 1000® Growth Index reflects the performance of U.S. large-cap equities with higher price-to-book ratios and higher forecasted growth values. Russell 1000® Index reflects the performance of U.S. large-cap equities. Russell 1000® Value Index reflects the performance of U.S. large-cap equities with lower price-to-book ratios and lower expected growth values. National Association of Securities Dealers Automated Quotation System (NASDAQ) is a nationwide computerized quotation system for over 5,500 over-the-counter stocks. The index is compiled of more than 4,800 stocks that are traded via this system. MSCI World Index℠ reflects the equity market performance of global developed markets. MSCI Emerging Markets Index℠ reflects the equity market performance of emerging markets. STOXX® Europe 600 Index represents large, mid and small caplitalization companies across 17 countries in the European region.

3As of 24 August 2021.