There’s only one way to summarise Q2: a world divided. In North America and Europe economic recovery exceeded expectations as successful vaccination programmes supported market reopening. Here in the UK we emerged from a bleak winter of strict lockdown desperate to spend our savings and enjoy life again. And it’s this pent-up consumer demand that has helped drive robust economic recovery in those economies that have once again opened up. Employment, too, is quickly on the road to recovery.

However, the rise of the Covid-19 Delta variant in Asia has led to renewed lockdowns in this region, either because vaccine rollouts have been slow – as is the case in Japan – and/or governments are still committed to zero-Covid tolerance policies. This has renewed pressure on economies there and led to Asian markets lagging both Europe and North America.

The inflation debate continued to rage over the quarter, too, as global shortages showed little sign of abating. In fact, the fresh Covid wave in Asia and ensuing lockdowns only further exasperated supply chain disruptions leading to input cost and price hikes. This has created some extreme anomalies in global markets, for example in the US used car prices for several models are now higher than their new car equivalents!

But unlike in Q1, the market has taken a more pessimistic economic view – fuelled by the rise of the Delta variant – that these strong demand trends will fade into year end and that high inflation is temporary. This resulted in the US 10-year bond yield retracing its lows and a subsequent rotation back into quality stocks which helped the strategy increase 8.4% over the quarter, outperforming the MSCI ACWI benchmark by 0.9%.1

Positively over the quarter, two of our companies2 held capital market days and spoke of accelerated sustainable investments:

- SGS, a testing, inspection and certification services company, laid out its vision for 2023 with a focus on the mega trends driving additional demand for its services. As a result, sustainability is increasingly feeding into its business alignment. Beyond 2023, SGS aims to generate more than 50% of its revenues from sustainability solutions, versus 45% in 2020, with a clear focus to grow both health and nutrition and environmental services. This in turn will help its customers become more ESG compliant.3 SGS, a testing, inspection and certification services company, laid out its vision for 2023 with a focus on the mega trends driving additional demand for its services. As a result, sustainability is increasingly feeding into its business alignment. Beyond 2023, SGS aims to generate more than 50% of its revenues from sustainability solutions, versus 45% in 2020, with a clear focus to grow both health and nutrition and environmental services. This in turn will help its customers become more ESG compliant.3

- Orsted, the world’s largest offshore wind farm developer and operator, introduced a target of 50GW of installed renewable capacity by 2030, significantly ahead of its previous target of 30GW set in 2018 and against its current 12GW installed capacity. This signals its high confidence in its ability to win renewable contracts over the next decade.4

There’s only one way to summarise Q2: a world divided. In North America and Europe economic recovery exceeded expectations as successful vaccination programmes supported market reopening. Here in the UK we emerged from a bleak winter of strict lockdown desperate to spend our savings and enjoy life again. And it’s this pent-up consumer demand that has helped drive robust economic recovery in those economies that have once again opened up. Employment, too, is quickly on the road to recovery.

Engagement highlights:

The Global RI Team attended the Exane ESG conference5 where the overriding message was that sustainability is increasingly a key driver of customer demand for products and solutions. We met with the management teams of several of our holdings, including:

- Croda, a specialty chemicals company which commented that it is in a strong position to gain share in all segments given its focus on sustainable outcomes. In its personal care segment, for example, it is seeing key customers such as L’Oreal, increasingly focus on clean and green ingredients in their beauty products. Croda’s aim is that by focusing on sustainability in all its product innovation and investment it can help reduce the environmental impact of consumers through the products they consume, as well positioning the company on the right side of environmental legislation.

- Sika, a leading construction chemicals and products company, noted that the sustainability element in buildings and construction is growing. It expects sustainability in construction will become even more dominant over time as government environmental legislation and customer sustainability demands increase.

- Schneider Electric, which provides energy management and industrial automation solutions, also noted an increased sustainability focus across governments, customers and investors. It is seeing ever higher levels of stimulus packages in the EU and the US focused on energy transition, smart infrastructure and industry digitisation supporting structural demand for its sustainable solutions.

1Columbia Threadneedle Investments, June 2021.

2 Mention of specific stocks should not be taken as a recommendation to buy

3 SGS, Sustainability Ambitions 2030, July 2021.

4Orsted, Realising our full potential as a global green energy major, June 2021.

5 Exane BNP Paribas, 23rd European CEO Conference, 3 June 2021.

2 Mention of specific stocks should not be taken as a recommendation to buy

3 SGS, Sustainability Ambitions 2030, July 2021.

4Orsted, Realising our full potential as a global green energy major, June 2021.

5 Exane BNP Paribas, 23rd European CEO Conference, 3 June 2021.

Germany was one of a number of countries around the world to experience extreme weather conditions this summer. Source: iStock.

Sustainable Theme Focus: The climate crisis becomes real

As I watched monsoon winds and rain lash our campsite over our summer break, flooding tents and fields, it is hard to deny that climate change is real, writes Pauline Grange. Part of climate change means more intense rains as well as more intense droughts – and we have seen both around the world in recent months.

The volume of extreme weather so far this year has been exceptional by any standards, from the record-breaking heatwave in Canada, which saw temperatures reach a record 49.6 degrees centigrade,1 to the disastrous floods in Europe’s Rhineland2 and China’s Henan Province3 to the huge wildfires raging from Siberia4 to California5 to Turkey6 and Greece.7 Images across media of destroyed bridges, roads and houses show the physical consequences of climate change.

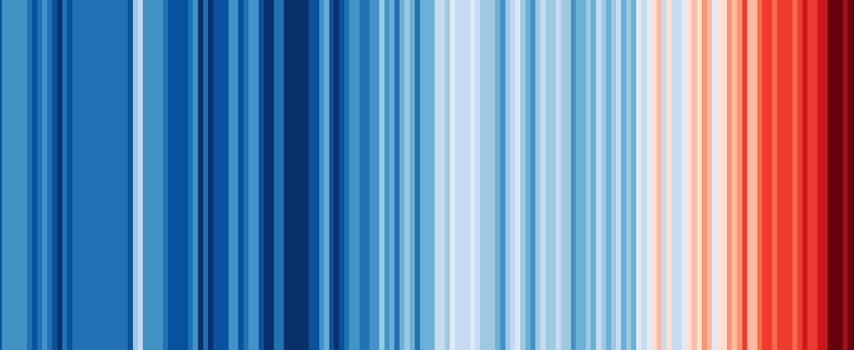

We are now at around 1.1oC warming, but are on track for temperatures to go much higher. Figure 1 clearly illustrates just how much the earth’s climate system has warmed since the pre-industrial period. It is hard not to agree with Greta Thunberg’s tweet: “We’re at the very beginning of a climate and ecological emergency, and extreme weather events will only become more and more frequent”.8

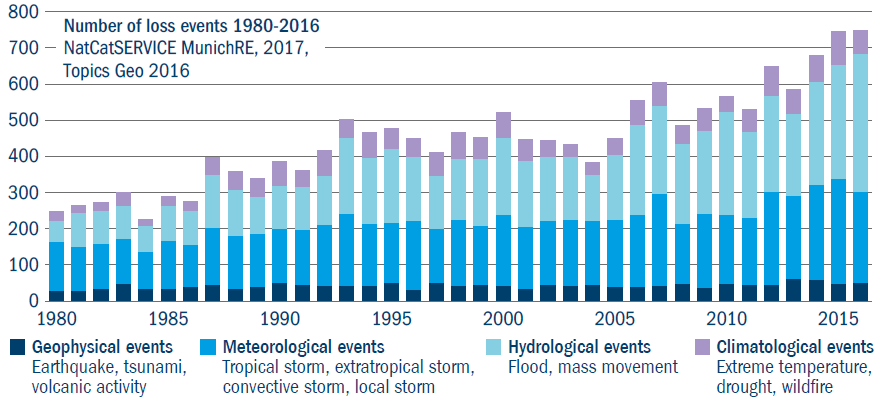

We are also seeing the effects of these increasing numbers of extreme events (Figure 2) in financial markets. For example, coffee prices have surged to levels not seen since 20149 after Brazil’s worst frost in two decades, coupled with droughts, impacted crop yields.

The heat waves and droughts on both sides of the US-Canada border this summer are also expected to hit crop yields, and flooding in China’s key pork producing region has increased the risk of animal disease. Meanwhile, the Texas freeze earlier this year cost some utility companies millions.10

Figure 1: Global average temperatures, 1850-2020

Source: https://showyourstripes.info/ Each stripe is one year, blue stripes are cooler years, red stripes are warmer years.

Figure 2: Increasing extremes

Source: https://www.metoffice.gov.uk/weather/climate/climate-and-extreme-weather

We now know that immediate and large-scale reductions in greenhouse gas (GHG) emissions are vital if we are to limit warming to less than two degrees – and it looks like the world is finally starting to wake up to this climate change emergency.

In May, the IEA (International Energy Agency) released a report detailing the pathway to a net zero energy system by 2050.11 Net zero means an overall balance between emissions produced and emissions removed from the earth’s atmosphere. The IEA’s key finding is that this transition requires an unprecedented transformation of how energy is both produced and consumed globally.

This in turn requires the immediate and massive deployment of all available clean and efficient energy technologies as well as a co-ordinated global push to accelerate innovation in new technologies such as advanced batteries, green hydrogen and carbon capture and storage. Another stark conclusion is that no new oil and gas developments are needed to meet our future energy needs, and in fact there should be no new investments in fossil fuels starting this year if we are to achieve net zero.

It shouldn’t come as a surprise, then, that climate change pressure on oil and gas companies is starting to build, not just from regulatory bodies but also investors and customers. In fact, there were some key investor milestones that coincided with the release of this IEA report:

- In the Netherlands a court ordered Shell to deepen its carbon emissions cuts by at least 45% by 2030 (versus a current 20%) compared to 2019 levels.12

- In the US, Exxon has notoriously lagged its European peers in its decarbonisation agenda. But in a surprise move, two members of the activist investor Engine No. 1, which only has a 0.02% stake, had two candidates with climate expertise elected to Exxon’s board of directors, with the public backing of other major investors.13

- At Chevron, meanwhile, investors passed a resolution in favour of cutting Scope 3 emissions, ie the emissions created by customers of Chevron’s products.14

The message is clear: if the autos and utilities sectors can successfully implement “green” transition plans, there is no reason oil and gas companies cannot do the same, with investor and government pressure on these companies starting to build both in Europe and in the US.

Although the rise of net zero targets has been remarkable over the past 18 months, with pledges from jurisdictions now covering 70% of global GDP,15 very little has so far translated into actionable plans. In fact, fewer than a quarter of these net zero pledges have been fixed into actual legislation or policy.

But in a positive step, Europe has started to put its net zero targets into action by unveiling its long-awaited “Fit for 55” package.16 This package, if passed, aims to align Europe’s various climate policies with its 55% carbon reduction by 2030 goal and in turn makes its existing climate policies both more rigorous and broader in scope.

One of the biggest policy changes is the expansion of the EU carbon emissions trading scheme (ETS). Climate change policy over the past 10 years has largely been focused on decarbonising the power sector, with other industries largely untouched. But this package seeks to change that as Europe expands the ETS to all carbon emitting industries, including transportation and buildings. Europe is committed to making carbon prices more reflective of the cost of decarbonising its economies with the aim being that as the carbon price rises, corporates will better incorporate climate factors into their investment decisions.

The package also introduces a new carbon border tax, increased support for sustainable fuels, greater growth prospects for renewables, a push in the acceleration of electric vehicles and renovating buildings to be more energy efficient. It will also see the introduction of more stringent fossil fuel taxation.

We believe we are only at the beginning of this decarbonisation mega theme. Political will to tighten emission targets will only rise from here as climate change accelerates.

The Threadneedle Sustainable Outcomes Global Equity strategy is well positioned to benefit from these changes.

We are invested in leading renewable companies which will benefit not only from the expected acceleration in renewable investment over the next decade, but also from greater demand for electricity as we electrify our economies.

We are also invested in those companies offering “green” solutions across mobility, buildings, industries and agriculture. We believe our focus on positive sustainable outcomes places this strategy in a strong position to deliver solid returns for investors over the next decade as we sit on the right side of both environmental customer demand trends and government regulation.

1https://www.bbc.co.uk/news/world-us-canada-57654133, 30 June 2021.2 https://www.bbc.co.uk/news/world-europe-57850504, 15 July 2021. 3 https://www.theguardian.com/weather/video/2021/jul/22/ henan-floods-aerial-images-show-flood-devastation-in-chineseprovince- video, 22 july 2021. 4https://www.theguardian.com/world/2021/aug/09/smokesiberia- wildfires-reaches-north-pole-historic-first, 9 August 2021.

5 https://www.theguardian.com/us-news/2021/aug/17/ california-wildfires-dixie-fire-damage-crews, 17 August 2021.

6 https://www.bbc.co.uk/news/world-europe-58057081, 2 August 2021.

7 https://www.bbc.co.uk/news/world-europe-58141336, 9 August 2021.

8 https://twitter.com/GretaThunberg/ status/1415600846356819971?s=20, 15 July 2021.

9 https://www.ico.org/show_news.asp?id=761

10 https://www.wsj.com/articles/texas-grapples-with-crushingpower- bills-after-freeze-11614095953

11 https://www.iea.org/reports/net-zero-by-2050

12https://www.bbc.co.uk/news/world-europe-57257982

13https://www.reuters.com/business/sustainable-business/ shareholder-activism-reaches-milestone-exxon-board-votenears- end-2021-05-26/

14https://www.reuters.com/business/energy/chevronshareholders- approve-proposal-cut-customeremissions- 2021-05-26/

15Energy & Climate Intelligence Unit, TAKING STOCK: A global assessment of net zero targets, March 2021.

16https://ec.europa.eu/commission/presscorner/detail/en/ ip_21_3541

5 https://www.theguardian.com/us-news/2021/aug/17/ california-wildfires-dixie-fire-damage-crews, 17 August 2021.

6 https://www.bbc.co.uk/news/world-europe-58057081, 2 August 2021.

7 https://www.bbc.co.uk/news/world-europe-58141336, 9 August 2021.

8 https://twitter.com/GretaThunberg/ status/1415600846356819971?s=20, 15 July 2021.

9 https://www.ico.org/show_news.asp?id=761

10 https://www.wsj.com/articles/texas-grapples-with-crushingpower- bills-after-freeze-11614095953

11 https://www.iea.org/reports/net-zero-by-2050

12https://www.bbc.co.uk/news/world-europe-57257982

13https://www.reuters.com/business/sustainable-business/ shareholder-activism-reaches-milestone-exxon-board-votenears- end-2021-05-26/

14https://www.reuters.com/business/energy/chevronshareholders- approve-proposal-cut-customeremissions- 2021-05-26/

15Energy & Climate Intelligence Unit, TAKING STOCK: A global assessment of net zero targets, March 2021.

16https://ec.europa.eu/commission/presscorner/detail/en/ ip_21_3541

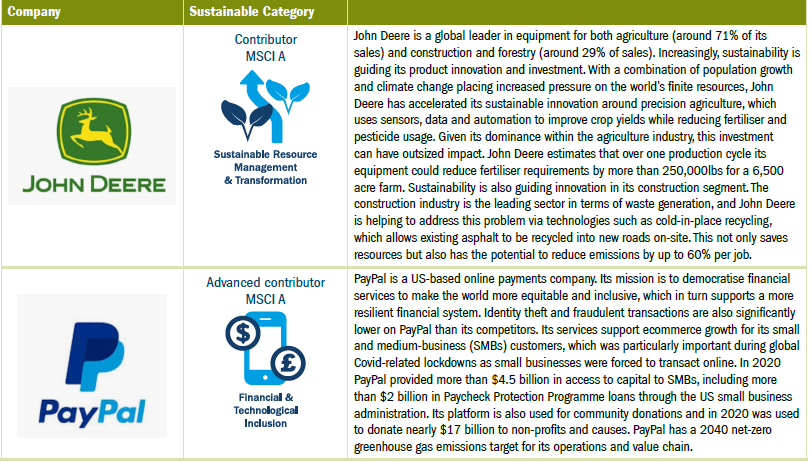

Company Q221 highlights

We have initiated new positions in the strategy:17

17The mention of any specific shares or bonds should not be taken as a recommendation to deal. All intellectual property rights in the brands and logos are reserved by the respective owners.

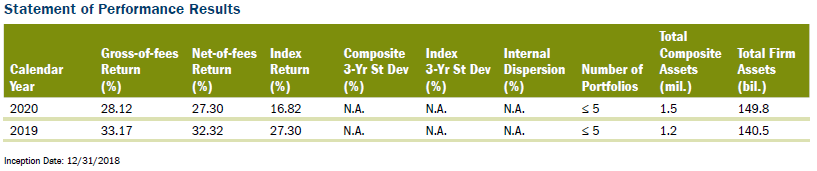

Threadneedle Global Sustainable Equity Composite

GIPS Report: Columbia Threadneedle Investments EMEA APAC

Reporting Currency: USD

1. Columbia Threadneedle Investments EMEA APAC ‘the Firm’ claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS Standards. Columbia Threadneedle Investments EMEA APAC has been independently verified by Ernst & Young LLP for the periods 1st January 2000 to 31st December 2018. The verification reports are available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

2. The ‘Firm’ is defined as all portfolios managed by Columbia Threadneedle Investments EMEA APAC (prior to 1 January 2021, the firm was known as Threadneedle Asset Management) which includes Threadneedle Asset Management Limited, (TAML), Threadneedle International Limited, (TINTL), Threadneedle Investments Singapore (Pte.) Limited, (TIS), and Threadneedle Management Luxembourg S.A. (TMLSA), excluding directly invested property portfolios. The firm definition was expanded in 2015 to include portfolios managed by then newly established affiliates of Threadneedle Asset Management in Singapore. TAML & TINTL are authorised and regulated in the UK by the Financial Conduct Authority (FCA). TINTL is also registered as an investment adviser with the U.S. Securities and Exchange Commission and as a Commodities Trading Advisor with the U.S. Commodity Futures Trading Commission. TIS is regulated in Singapore by the Monetary Authority of Singapore. TMLSA is authorised and regulated in Luxembourg by the Commission de Surveillance du Secteur Financier (CSSF). On 1 July 2020, Threadneedle Asset Management Malaysia Sdn. Bhd (TAMM) was removed from the firm. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. Beginning 30 March 2015, the Columbia and Threadneedle group of companies, which includes multiple separate and distinct GIPS-compliant firms, began using the global offering brand Columbia Threadneedle Investments.

3. A concentrated global equity strategy with a focus on high quality companies that seeks to deliver both positive sustainable outcomes, in accordance with the UN Sustainable Development Goals (SDGs), and superior financial returns. The composite was created November 30, 2018.

4. The portfolio returns used in composites are calculated using daily authorised global close valuations with cash flows at start of the day. Composite returns are calculated by using underlying portfolio beginning of period weights and monthly returns. Periodic returns are geometrically linked to produce longer period returns. Gross of fee returns are presented before management and custodian fees but after the deduction of trading expenses. Returns are gross of withholding tax. Net of fee returns are calculated by deducting the representative fee from the monthly gross return. Policies for valuing investments, calculating performance, and preparing GIPS Reports, as well as the list of composite descriptions, list of pooled fund descriptions for limited distribution pooled funds, and the list of broad distribution pooled funds are available upon request.

5. The dispersion of annual returns is measured by the equal weighted standard deviation of portfolio returns represented within the composite for the full year. Dispersion is only shown in instances where there are six or more portfolios throughout the entire reporting period. The Standard Deviation will not be presented unless there is 36 months of monthly return data available.

6. The three year annualised ex-post standard deviation measures the variability of the gross-of-fees composite and benchmark returns over the preceding 36 month period.

7. The following fee schedule represents the current representative fee schedule for institutional clients seeking investment management services in the designated strategy: 0.65% per annum. Gross of fee performance information does not reflect the deduction of management fees. The following statement demonstrates, with a hypothetical example, the compound effect fees have on investment return: If a portfolio’s annual rate of return is 10% for 5 years and the annual management fee is 65 basis points, the gross total 5-year return would be 61.1% and the 5-year return net of fees would be 55.9%.

8. The MSCI AC World Index is designed to provide a broad measure of equity-market performance throughout the world and is comprised of stocks from 23 developed countries and 24 emerging markets. Index returns reflect the reinvestment of dividends and other earnings and are not covered by the report of the independent verifiers.

9. Past performance is no guarantee of future results and there is the possibility of loss of value. There can be no assurance that an investment objective will be met or that return expectations will be achieved. Care should be used when comparing these results to those published by other investment advisers, other investment vehicles and unmanaged indices due to possible differences in calculation methods.