Emerging markets often face a “perception shortfall” compared with developed markets when it comes to environmental, social, and governance (ESG) factors. The truth is emerging markets are driving global economic growth, and ESG factors have never been more important to investors looking to harness this growth. Many investors, however, cling to some false notions concerning ESG in EM that keep them from realizing the sector’s potential.

Here, we dispel five myths about ESG in EM.

Myth #1

Environmental, social and governance risks are higher in emerging markets (EM) than in developed markets (DM).

Myth #2

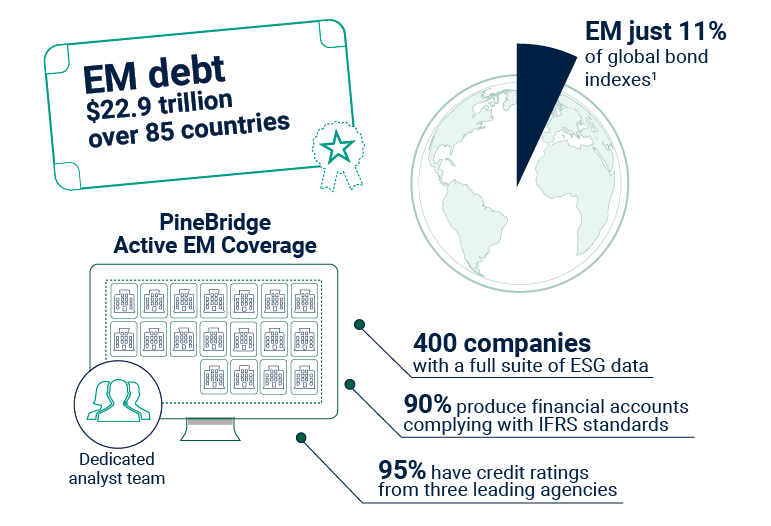

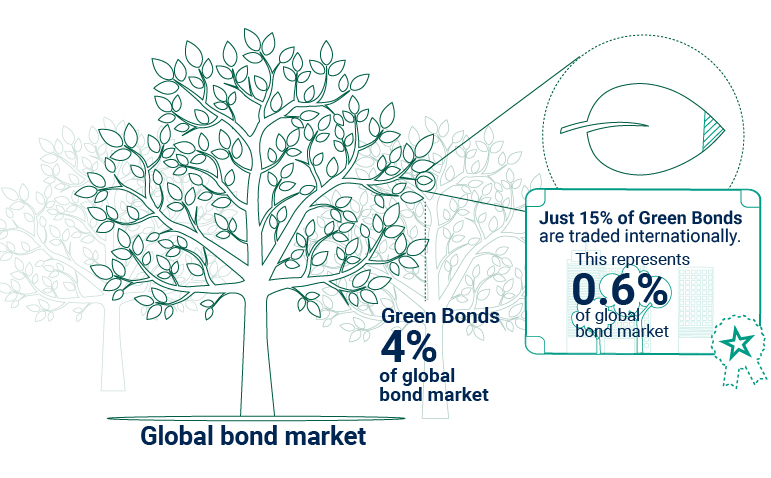

1Global bond indexes represented by Bloomberg Barclays Global Aggregate Index.

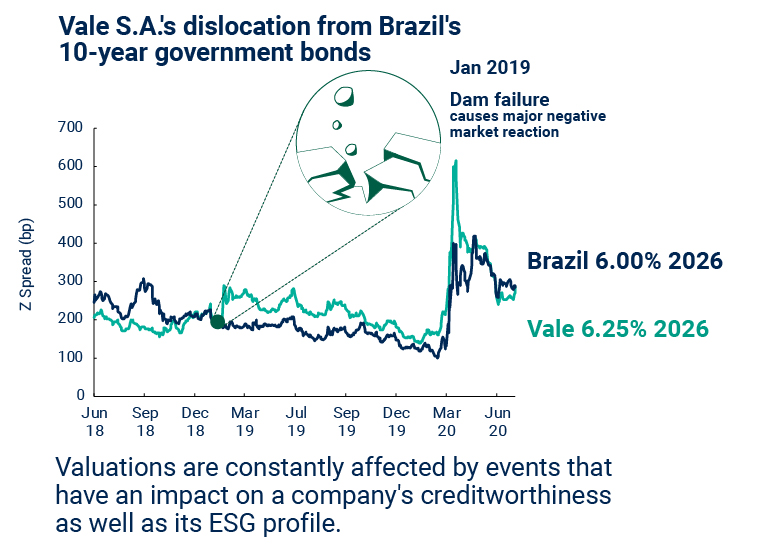

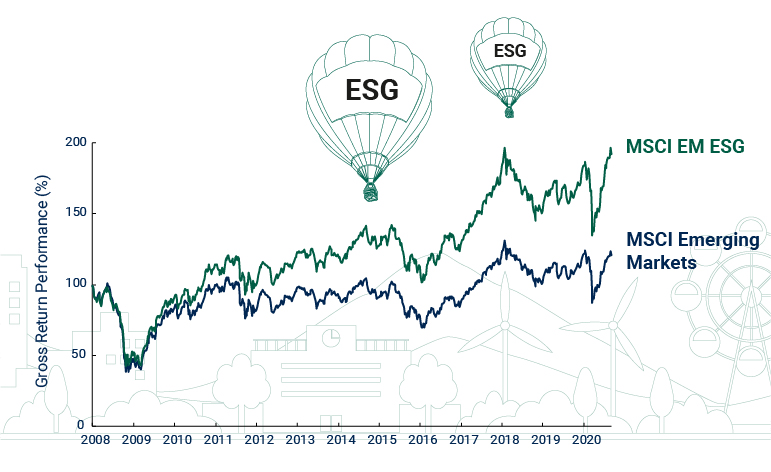

Source: IMF, Bloomberg, Barclays and PineBridge Investments as of 30 June 2020. For illustrative purposes only. We are not soliciting or recommending any action based on this material. Any views represent the opinion of the Investment Manager, are valid as of the date indicated, and are subject to change. Indices are unmanaged. An investor cannot invest directly in an index.

Myth #3

Myth #4

Myth #5

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any re-publication or sharing of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.