A unique set of circumstances has made Chinese firms highly receptive to change. As emerging market equity specialist Andrew Keiller explains, that can make them more innovative as well as among the biggest winners.

Turmoil in China’s markets has caused some to question the wisdom of owning stakes in its companies. But we believe there is still a very positive case to do so.

“To understand what’s powering the global rise of Chinese companies, we need to recognise that China now has at its disposal a resource that no other country has: a vast population that has lived through unprecedented amounts of change and, consequently, has developed an astonishing propensity for adopting and adapting to innovations, at a speed and scale that is unmatched elsewhere on earth.”

There are tens of thousands of results on Amazon UK when we search for books on how to manage change. Most of these books are designed to help us beat away resistance to change; how do we get rid of the phrase “because we’ve always done it like that”? I’d suggest there’s a good chance you’ve heard it used – or even used it yourself – in the workplace in the past year. I know I’m guilty…

In the UK, changes in our physical setting or probably even more so in our mental models, are very often met with huge resistance, especially when we don’t make the active decision ourselves. Maybe the change isn’t justified properly? Maybe we’re just creatures of habit? Or maybe we feel threatened in some instances? If we broaden our horizons though, we quickly understand this is far from the same everywhere.

China is one of the most interesting cases in openness to change. I don’t bring this up simply due to the regulatory change that companies are having to navigate during 2021, but instead because this might be a bigger driver of potential investment success in Chinese equities than we think. In fact, it may not be much more complex than saying that China is more used to having to adapt to change than anywhere else in the world, which means innovation is more effective.

Dychtwald has drawn on World Bank data to create the ‘lived change index’ to track how much economic change a population has experienced, and its calculation uses lifetime per capita GDP as a key input. Over the last 30 years, China registers over 30 times growth on this index, with every other top 40 economy in the world sitting below 10 times growth: the UK and the US are well below 5 times growth. Change has been driven by countless factors, but the CCP’s relentless desire for economic progress is clearly very important. This has led to rapid trial and error in both state and private spheres. As a result the barriers to adopting new products and services are low. Chinese citizens are very willing to try and to trust new technologies.

This is helping to position China as a leader in many areas that could be critical to driving returns over the next decade. 5G is one example. While most other countries have been dithering, China has got on and built more 5G base stations than the rest of the world combined. They are not stopping though, as they already launched a satellite in November 2020 to test airwaves for potential 6G transmissions.1, 2

Social ecommerce is another example. I define this as purchasing where social media, in any form, is the gateway to the transaction. In China, this has grown rapidly, especially as short-form video and blogging have become a critical tool (social media is the internet category that trumps all others for time spent, accounting for about 30 per cent of online hours here in China).3 In other countries, attempts to blend ecommerce with social have been far less successful and are only just starting to catch up. In the US, social commerce is expected to reach 4.3 per cent of total online sales in 2021, whereas it is already 13 per cent in China.4

There are countless more examples. In many areas, China has a clear will to embrace new technologies and behaviours. And there is a way. The way is what we try to invest in. For me, this is the crux of the investment case for many Chinese companies – brute force innovation (NOT imitation), coupled with an open-minded potential customer base, used to change. This was put much better by Dychtwald in the Harvard Business Review in May this year, as quoted at the start of this paper.

With this in mind, please forgive my frustration that almost all of the arguments in market commentaries on why you should invest in China seem to be converging to the same main thesis, which is limited. That is, that China is underrepresented in portfolios and benchmarks relative to its importance in the world. It contributes close to 20 per cent of global GDP, more still to GDP growth, yet it is only about 4 per cent of the MSCI ACWI.

To be clear, we’ve used this line argument many times. It is perhaps reasonable as the gist is clear: this feels like an anomaly that should converge. It is inevitably biased though, mainly by the fact that Chinese A shares (domestically listed Chinese companies) are yet to be fully included in investable indices. It can be manipulated very easily by both equity issuance and by index providers, and it is a very passive argument.

Big Winners

For active managers, there is another argument for investing in China, which I think is better. Put simply, there is strong evidence that it’s a great place for stock pickers. That is not only due to the fact the market is particularly short term and inefficient, but more importantly it is home to a significant number of companies with huge return potential, operating against a backdrop where change is normally a positive driver of growth.

To explain this, let’s consider ‘big winners’, defined as companies that can deliver at least 15 per cent per annum return (in US$ terms) over a five-year period.5 We use a global universe of stocks with market caps of over $1bn, and consider each of the five-year periods since 2010.6 Using this data set we have found that China was home to about 17 per cent of global big winners on average for a five-year period. For active portfolios focused on finding the top-returning companies, this shows us quite clearly that China is far too important to ignore. And we can see a scenario where this number continues to rise.

Amid recent news about regulation impacting several Chinese companies, we cannot forget that many of China’s top performers have been world-leading innovators. They have been allowed to flourish at a time when the country has been supportive to national champions due to a clear priority to move towards domestic consumption-led growth. To us, even with more focus on common prosperity, which is likely to be good for the country in the long term, it is not clear that this has changed. Regulation is catching up to innovation in many industries and a new equilibrium is being established. The fact that China has led the world in innovation is one argument for the need for it to lead the world in regulatory terms too. It is dealing with challenges faster than elsewhere.

Digitisation of the economy is still a key priority, and this will create many big winning companies in the process.

As President Xi himself wrote: “We should develop the digital economy and speed up digital industrialisation. We should encourage innovation driven by information technology to create new industries, businesses, and models, and promote development with new growth drivers. We should advance digital transformation… and release the full potential of digitisation in boosting the economy.”

Investors should get used to and be comfortable with the model of progress for China that has both regulation and innovation at its core. For a long-term investor, history would suggest that this actually puts companies on a more sustainable footing than totally unshackled market forces. It is nicely reflected in Angela Merkel’s sentiment that freedom and capitalism are the twin engines of progress, but neither is an absolute good, and both must be moderated to protect the individual. The challenge to us all is that China is now a leader not a follower.

Finding Great Companies

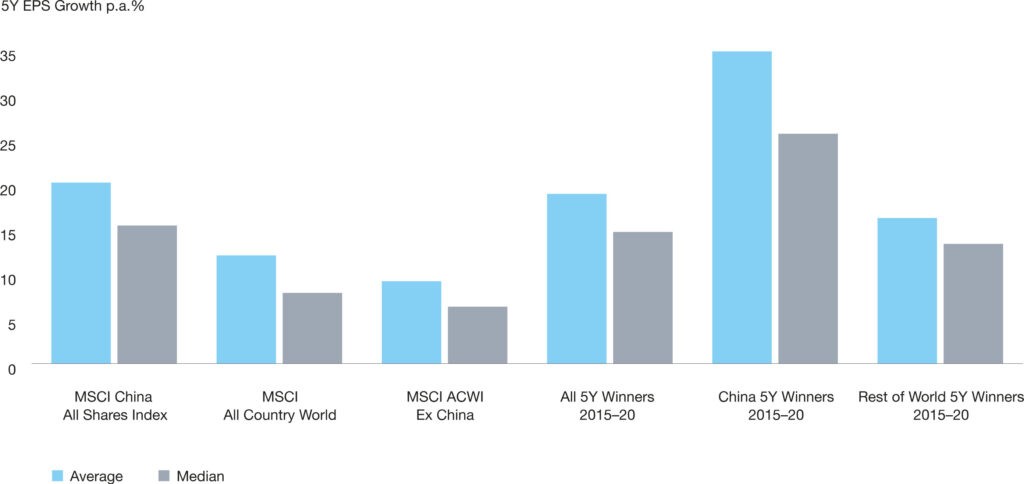

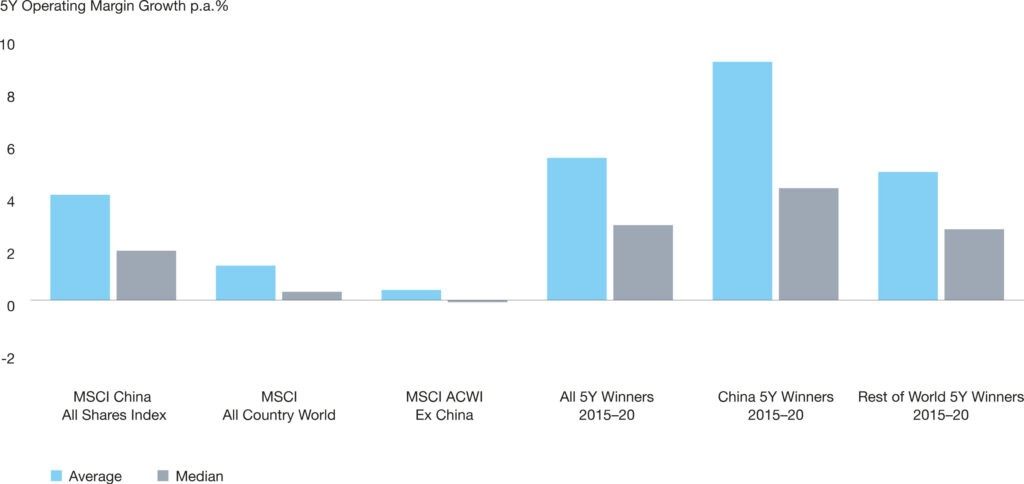

Both for the broader Chinese market as a whole and the big winners therein, we see further reason to believe that China is home to companies with characteristics that should be attractive to stock pickers, particularly those focused on growth. Consider earnings per share (EPS) growth and operating margin (OPM) growth as examples of this. In each of the below charts, we present this data for both a number of indices and for the big winners only.7, 8 We can clearly see that China dominates.

This should all leave us with a feeling of optimism in knowing that there is huge growth potential for Chinese companies and that those with the best growth do offer the best returns. This is set against a backdrop where sheer scale is an incomparable tailwind. This is surely the real case for China?

But if only it were that easy! In order to truly succeed as a long-term investor in China, we would suggest that a very deep understanding of Chinese innovation and future growth trends is required to identify these big winners. This understanding can be helped by building strong long-term relationships with leading Chinese companies and China researchers. To give ourselves the best chance of performing as our clients expect us to, we must blend the strength of such relationships with a tried and tested investment approach.

For us, this has always been about looking for companies that have a sizeable growth opportunity and the means to execute on this, where we can argue that the potential is yet to be reflected in the price. Thinking out five years and beyond is increasingly rare in a China context, so we have a great opportunity to be genuinely different in our approach to finding these winning companies.

By building portfolios with low levels of turnover, by not getting bogged down in the quarterly earnings merry-go-round, and by exploiting terrific market inefficiencies, particularly in the A share market, we believe we can provide a very helpful solution to the China opportunity.

1 Forget 5G, the U.S. and China Are Already Fighting for 6G Dominance – Bloomberg

2 China says it has built 700,000 5G base stations, more than rest of world combined – South China Morning Post

3 Chinese social media: what you need to know – sinorbis.com

4 US social commerce is following in China’s footsteps – emarketer.com

5 This equates to around a doubling over five years and this is in fact the minimum return hurdle for our China-focused portfolios

6 Using annual data frequency: 2010-2015, 2011-2016 etc, up to 2015-2020

7 Data going back to the five years ended December 2000, using rolling five-year periods, with annual data frequency

8 The most recent period has been presented: 2015-2020