Thematic investments’ growth in Europe has slowed somewhat this quarter with only $10.9bn of flows compared to $21.6bn in Q2 and a staggering $48bn in Q1. For context, however, it is just $1bn short of the total flows for the whole of 2019. For the year, flows in European domiciled exchange traded funds (ETFs) and open-ended funds stand at $80.5bn, already $14bn above last year’s record.1 Performance-wise, in a difficult quarter for equities, many thematic themes have continued to outperform and deliver value to investors.

In this quarterly thematic review, we will look at the space and analyse the year’s third quarter through the lens of performance, flows, and new launches of thematic strategies. For all of our calculations, we will use the WisdomTree Thematic Classification that we have previously introduced in a series of blogs in which we discussed how to classify and select thematic funds.

Winners and losers

As we noted in our recent paper on Thematic investments, themes tend to rotate in flows and performance over time due to their narratives. 2021 is no different, and Themes that had done poorly earlier this year have been catching up recently.

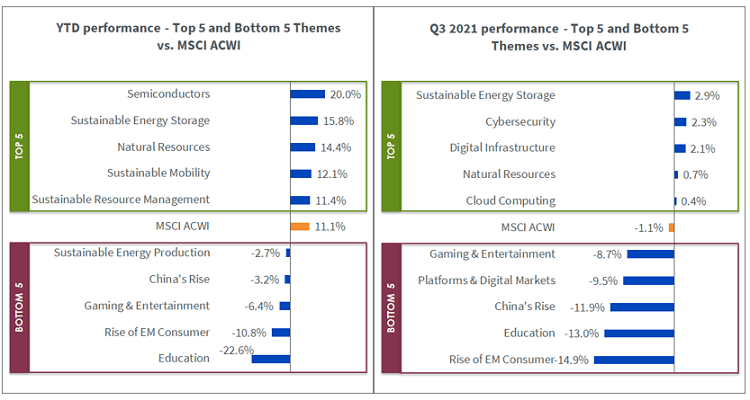

The third quarter has been relatively challenging for equities, with the MSCI All Country World (ACWI) losing -1.05%. Overall, 11 themes outperformed this quarter. Looking at that group’s make-up, we note that “Technological Shifts” themes are dominant, with five themes out of 11. Some high growth tech-focused themes that shone in 2020 and struggled in the value-driven cyclical recovery in this year first quarter continue to outperform, such as “Cybersecurity” (+2.3%), “Digital Infrastructure” (+2.1%) or “Cloud Computing” (+0.4%).

However, the best theme for the quarter is the energy transition focused theme: “Sustainable Energy Storage” with +2.9%. Battery technologies continue to make headlines worldwide, and companies in that industry continue to attract much interest.

On the other side of the table, 4 out of 5 themes “Gaming & Entertainment”, “China’s Rise”, “Education” and “Rise of the EM Consumer” have continued to suffer from deep underperformance in Q3 most likely impacted by the regulatory crackdown in China across several industries. As per way of comparison, MSCI China Net Total Return USD Index was down 16.7% year to date (YTD) as of 30 September 2021 and 18.2% in Q3 alone.

Figure 1. Q3 and YTD performance of Top 5 and Bottom 5 themes vs MSCI ACWI.

Historical performance is not an indication of future performance, and any investments may go down in value.

Year to date, equities markets are still up, with the MSCI ACWI gaining 11.12%. Five themes still managed to beat that high bar. Among those, four lie in the “Environmental Pressures” cluster, highlighting the fact that climate change and energy transition topics have taken centre stage for a lot of investors. “Sustainable Energy Storage” is the best of the 4 with +15.8%, but it is followed by “Natural Resources” (+14.4%), “Sustainable Mobility” (+12.1%) and “Sustainable Resource Management” (+11.4%). Having said that, the best performing theme in 2021 remains “Semiconductors” (+19.98%). This theme continues to be supported by the global chips shortage that started back in 2020 and does not seem to be waning in the short term future.

The five themes with the worst year to date performance remained almost unchanged with “Rise of EM Consumer”, “Sustainable Energy Production”, “Gaming & Entertainment” and “Education”. However, “China’ Rise” makes its entrance on the back of a -11.9% performance this quarter due, in part, to the woes of Evergrande and the whole construction sector in China.

Thematic flows are well ahead of record 2020

Last year saw record flows in Thematics funds and ETFs with $66bn in Europe. This year flows are already well ahead of this record, with $80.5bn raised.

Across all wrappers, themes from the cluster “Environmental Pressures” have seen an obvious increase in interest, as climate change and energy transition narratives have firmly captured investors’ focus within thematics this year. ETFs in that cluster have raised $6.4bn year to date, and open-ended funds have raised $30.5bn compared to $25bn in both wrappers for the whole year 2020. Meanwhile, “Technological Shift” attracted $4.6bn in ETFs and $16.6bn in open-ended funds.

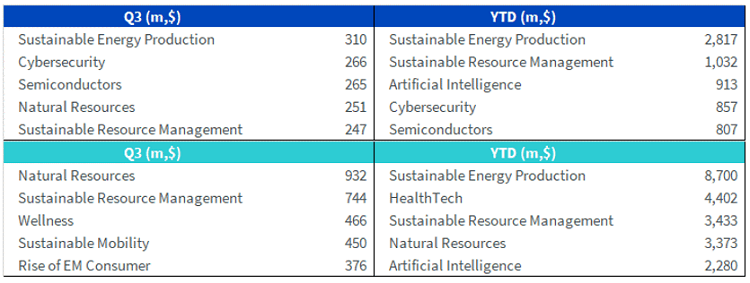

Figure 2. Top 5 Flows in Europe – ETFs (dark blue) vs Open-ended (OE) funds (teal)

Historical performance is not an indication of future performance, and any investments may go down in value.

Q3 figures continue to point to an increasing focus on sustainable themes. However, flows have slowed down this quarter with “only” $10.9bn overall. This is almost as much as the whole of 2019 but significantly less than in Q1 and Q2 this year. This quarter, “Natural Resources” and “Sustainable Resource Management” are in the top 5 for flows in both ETFs and open-ended funds. “Sustainable Energy Production” is in the top 5 for ETFs, and “Sustainable Mobility” is in the top 5 for open-ended funds. However, European ETFs unlike open-ended funds also feature technological themes within their top 5 flows in Q3, with “Cybersecurity” and “Semiconductors” having gathered around $270m each. In contrast, open-ended funds stand out with the flows they gathered within “Wellness” and “Rise of the EM Consumer” that represent “Demographics and Social Shift” cluster with +$466m and +$376m of flows across two themes respectively. It is worth noting that while many themes saw flows slow down, both of those themes had raised a similar amount last quarter but did not figure in the top 5 due to better performing themes. Also “Wellness” was helped by the fact that 3 products launched this quarter and raised 200m almost immediately.

Launches point to steady growth

Strong flows data YTD is further supported by the number of launches in the thematics space. Year to date, we have already seen 21 new thematic ETFs, and 95 new active funds. For the whole of 2020, only 22 ETFs and 83 active funds were launched. Notable, the launches within open-ended funds are also more diverse with new products YTD offered across 23 themes and 12 themes in Q3. The same figures for ETFs stand at 12 themes for YTD launches and only 5 themes in Q3. Despite this apparent diversification, “Sustainable Energy production” represent in fact 6 ETF launch in 2021 out of 21. Most of those launched focus on solar energy and hydrogen.

While this is a high level of activity from European asset managers, this is nothing compared to the 195 ETF launches in Asia. In Europe, the majority of launches continue to be focused on the “Environment Pressures” cluster. In Asia, however, half of the launches are in the “Environmental Pressures” cluster, and half are in the “Technological Shifts” cluster.

We will be closely watching the space in Q4 and will summarise our findings in the next WisdomTree Quarterly Thematic Review that will include the insights for the full year 2021. Stay tuned.

Footnotes

1. Performance of a theme. For any given theme, we consider each month all the ETFs and open-ended funds classified in that specific theme that have published a monthly return for that month in Morningstar. We then calculate the average of all those monthly returns to compute the average monthly return for that theme. So, the monthly return for January 2020 for the theme may include 19 funds, while the February 2020 return may comprise 21 funds (if two funds classified in that theme have been launched in the meantime). By collating monthly returns for the theme, we get the theme’s average historical performance. Therefore, the theme’s average historical performance incorporates every ETF, and open-ended fund focused on this theme. The theme’s average historical performance is not biased towards surviving funds or successful funds. Every fund alive in a given month is included irrespective of its future survival or success. Investments that try to focus on multiple themes and, therefore, classified either at Cluster or Sub-Cluster Level are not included.

Source

1 Morningstar, Bloomberg. All data as of 30 September 2021

Related blogs

+ How to organise the thematic universe? Introducing the WisdomTree thematic classification

+ Why thematic fund Selection is particularly susceptible to fear of Missing Out “FOMO”?