Jennifer James, emerging market corporate credit manager, explores how China is key to driving emerging market (EM) opportunities and performance in 2022.

Key takeaways

- China’s communication of its power will surface in its rhetoric around the Olympics and the 20th Chinese Communist Party (CCP) congress next year.

- Progress has been made towards its policy objectives, the side effect of which has been market volatility but also undervalued opportunities.

- China’s growth trajectory, as well as monetary conditions, will be key to defining a divergence in EM performance in 2022.

China’s power to take centre stage

China was the first economy to recover from the COVID crisis, but 2021 marked a tale of two halves: it sharply rebounded in the first six months which then reversed with policy tightening across different sectors, contributing to market instability. We expect China to take centre stage again in 2022 as it becomes a pivotal year for the world’s second largest economy with its hosting of the Olympics and the confirmation of President Xi’s undisputed leadership for a third term. Both events almost bookend 2022 and so the spotlight will be on China and how it communicates its hard economic and soft power on the international stage.

The CCP will want 2022 to be a showcase year in communicating its economic objectives of “stability”, “sustainability” and “common prosperity”, the latter targeted at the sharing of wealth more equally. Despite pursuing its dual-circulation strategy that focuses on self-sustaining domestic growth, China still seeks to consolidate its position as a world leader. Over the long term, we believe this won’t mark a significant departure from the current modus operandi, but an evolution of strategic sectors to reshape economic growth from debt-fuelled investment to consumption.

Chinese officials are now willing to tolerate lower growth. As this reaction to slower growth diverges from the loose policy plasters of the past, investors were caught off guard this year and some are shying away from the opportunities in China. This was exacerbated by blunt policy tools used to target specific sectors – often without warning – which unsettled markets.

A fertile ground for undervalued opportunities

A recent target is the property sector, where policy tightening has resulted in the default of some companies, pushing up the expected default rate in Asia to 9% for 2021, with an average of 2.6% forecasted for EM corporate high yield1. Resultant market volatility has unearthed attractive value in some names in the sector, while steps towards policy coherence have emerged. Such fine tuning, in our view, could present a tailwind for the sector. Regulators have already eased access to land auctions and bank lending to the sector has resumed. Some developers are also selling down assets or re-capitalising through equity injections, and such efforts to shore up balance sheets could reassure investors.

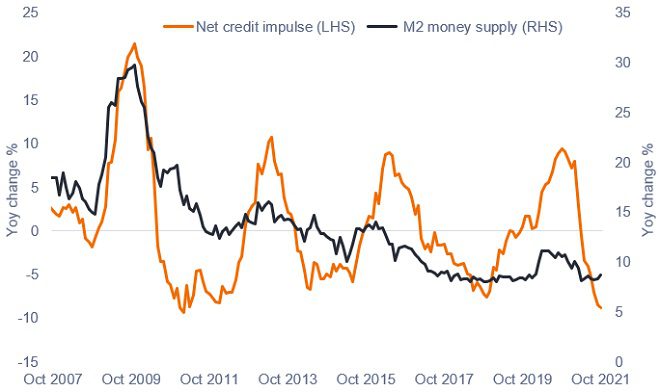

The attempt to rein in credit growth in the property sector – comprising 23.3% of GDP2 – to promote its healthy development is both significant to and emblematic of China’s growth trajectory. The combination of less favourable monetary conditions coupled with China’s growth, in our view, will be important to broader EM performance in 2022. Most markets outside and inside of EM are already or moving towards tightening their monetary policies, except for Turkey, which is cutting rates against conventional economic theory, and China, which has recently slightly loosened policy. Such counter-cyclical measures distinguish China from most of its EM peers, but their fortunes are inextricably entwined given China’s dominance as an export destination for commodities and raw materials. Some economies could therefore benefit from the bounce in China’s activity expected in the first quarter. As shown in the chart below, its credit impulse – a measure of the change in the growth rate of new financing (credit growth) as a percentage of gross domestic product – is currently negative but nearing lows; when it changes direction (inflects), this often heralds a change in the business cycle. The change in M2 – a measure of cash and deposits in the financial system – also appears to have troughed, potentially a positive sign for China’s economic fortunes going into 2022.

Credit impulse and money supply appear to be bottoming

Source: Bloomberg, 31 October 2007 to 31 October 2021.

No longer a rising tide lifting all boats

Economies and credit markets have been awash with liquidity to keep them afloat through the pandemic, which may now be receding into the horizon. In 2022, a rising rate environment is likely to be a challenge, as ramped-up fiscal deficits become costlier to fund and favourable trade balances start to erode. In addition, the unintended consequences of China’s growth path may be its impact on other emerging markets. We expect there to be dispersion in emerging market outcomes in 2022 and the depth of the asset class – 826 issuers across 59 countries3 – offers the potential for investors to capture diversification benefits while mitigating risks. At the same time, the opportunity in China could easily be overlooked and credit selection is critical to distinguish those companies with strong fundamentals, such as access to capital and ample liquidity, to navigate through choppy waters.

Footnotes

1 Source: J.P. Morgan, ‘EM Corporate default monitor’, 8 November 2021; default rates are par weighted and exclude 100% quasi-sovereign issuers.

2 Source: Goldman Sachs Economics Research, ‘China Data Insights: How big is China’s property sector’, October 2021.

3 As represented by the J.P. Morgan Corporate Emerging Market Bond Broad Diversified Index as at 31 October 2021.

Glossary

Monetary policy: Central bank policies aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Liquidity: The ability to buy or sell a particular security or asset in the market. Assets that can be easily traded in the market (without causing a major price move) are referred to as ‘liquid’.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.