Investors had a brief reprieve from geopolitical surprises at the end of December, but 2026 started with a bang as the US arrested Venezuelan President Nicholás Maduro. The reshaping of the world order by President Donald Trump’s administration looks set to continue.

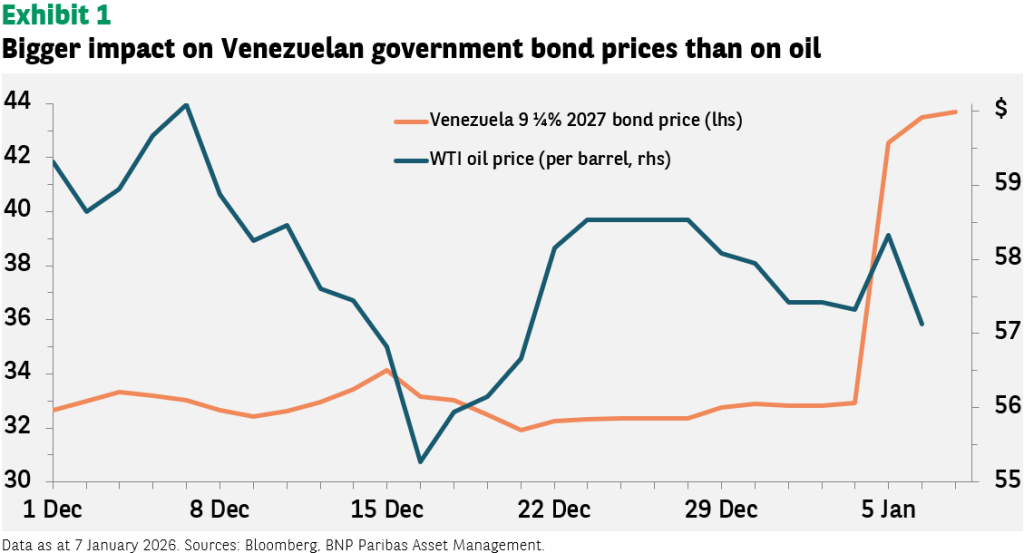

The market reaction to the news has been largely positive. Share prices of US oil majors have risen. Venezuelan government bonds have jumped sharply. Spot oil prices and oil futures have been volatile: near-term supply disruption and geopolitical risks battled market expectations for an increased supply of oil that could eventually follow from US investment in the sector (see Exhibit 1).

While Venezuela has the world’s largest oil reserves, its production has been relatively limited. Twenty years ago, production peaked at three million barrels per day; today, it is less than one million. A return to the previous level, which would in any case not be swift, amounts to just a 2% increase in total global oil production.

Economic data

Perhaps more relevant for investors has been the slew of recent data on the US economy – notably GDP, inflation and non-farm payrolls. Data releases have been catching up after the government shutdown-induced pause.

In contrast to analyst predictions of stagflation after the ‘Liberation Day’ tariff announcements, US economic growth has accelerated, while inflation has fallen after an initial jump.

GDP rose by 4.3% in the third quarter in inflation-adjusted terms (at the seasonally adjusted annual rate). The primary contributor to growth was consumer demand, again running counter to analyst predictions of a collapse due to the tariffs on imported goods. October’s retail sales data and anecdotal evidence from the holiday shopping season suggest consumers are still spending.

The second largest contributor to growth was net exports. This was to be expected given the significant increase in the import tariffs. In fact, imports declined by just 2% from the same quarter in 2024, while exports rose by 4%, boosted by a weaker dollar.

Waiting for signs of US manufacturing onshoring

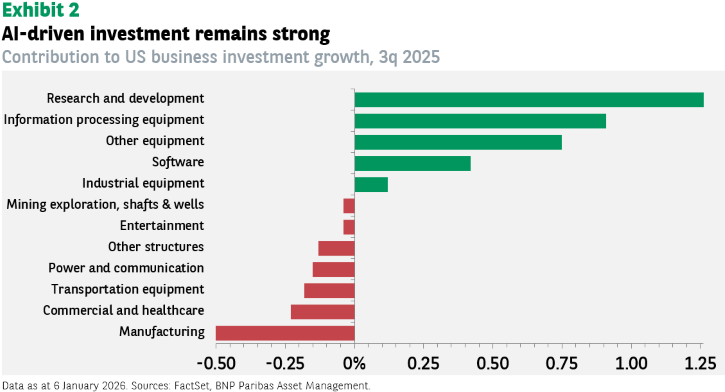

If there was any disappointment in the GDP figures, it was the contribution to growth from business investment: just 0.4% compared to an average of 1.1% in the first two quarters of 2025. This could be worrying as estimates of US growth are premised on continued business investment related to artificial intelligence (AI).

A look at the details shows that AI-investment has remained robust, however. The low headline figure was due to disinvestment in the manufacturing sector (see Exhibit 2). This aligns with the ISM manufacturing index data: the index came out at below 50 (indicating contraction).

The ISM average for Q4 was marginally worse. While this is not the outcome the Trump administration hoped to see, any boost to domestic production due to the import tariffs is likely to take time to materialise; a car factory is not built overnight.

A pause in US inflation

While GDP growth exceeded market expectations, inflation was below forecasts. The price increases that followed the imposition of tariffs were never as great as had been feared – headline inflation peaked at 3% – and it has fallen over the last two months. Core goods inflation in particular was subdued.

Any rejoicing should be tempered, however, as the data is distorted by the US government shutdown. Future data are likely to show inflation running at a faster pace.

The final major economic release of the year covered the US labour market in November (December’s data will come out on 9 January). The figures showed an unhealthy dependence on hiring in the healthcare sector, which has been the case for two years.

Private non-farm payrolls rose by 69,000, of which 64,000 in the healthcare and social assistance sector, which accounts for just 16% of employment.

The outlook is clouded by two contradictory forces: AI and immigration policy. AI is expected to suppress hiring, if not lead to actual job losses, while immigrant deportations should force employers to replace lost workers with legal ones. How this plays out over the course of the year will be a key factor affecting the US Federal Reserve’s decisions on its main policy rate.

Santa Claus rally and the equity outlook

Santa Claus did not bestow a year-end rally on investors: most major indices ended 2025 at below their October-November peak. One should not be too cross, however, as the returns for the year – let alone those from the post-‘Liberation Day’ lows – were very pleasingly in double digits.

The 2026 outlook is less bright for those who have noted that four consecutive years of gains for equities is rare. While true, this is more a statistical fact that an economic one.

Equity market performance will depend primarily on growth and, for now at least, we see the prospects as positive.

Returns are nonetheless likely to be lower than in 2025, and it would be a welcome sign to see the gap between tech and non-tech equity indices narrow.

In a sense, this is a requirement if the AI boom is to continue. Tech companies are investing massively in AI. They must ultimately recoup that investment by selling their products to non-tech companies, who will use them to increase revenues or reduce costs. If this does not transpire, analyst predictions of an AI collapse may prove prescient.