With the global high yield market showing initial signs of a return to some level of issuance, could this be the one swallow that does foretell more summery times ahead?

In April, I wrote a blog hypothesising that a new dawn could be on the horizon for high yield markets, which have been in a state of part closure since last year. It’s still early days, but the signs are now increasingly positive on this front, in my view.

Over the past few weeks, I’ve noted that the European high yield market has been printing several new deals. And what’s more, this issuance can be seen right across the high yield risk spectrum. From the beginning of May, the US high yield market also started to issue some new bonds.

While the level of issuance we’ve seen is not material yet, it is notably different from what we have witnessed in the past eight months. As a rough guide, our analysis suggests that the market needs to see material new issuance for the remainder of the year, otherwise the refinancing burden for 2024 could start to become overbearing.

In addition, many companies are now seeking to build up their cash reserves; they also have low levels of bank lending, which has been reduced ever since the 2007-09 global financial crisis. This combination means that high yield companies have relatively low dependency on credit from banks. Instead, the principle of ‘amending and extending’ existing capital resources is keeping companies at the more ‘stressed’ end of the high yield spectrum functioning, while the equity market is stepping up with capital infusions.

Summer’s around the corner

Although some way off ‘normal’, this isn’t an awful environment for high yield companies. We do need to see a material pick-up in issuance, but it is certainly possible that the reopening of the market could be the one swallow that foretells more summery times ahead.

While clearly there are no guarantees, I would estimate that that issuance is likely to continue provided the US equity market does not drop materially and the US five-year treasury yield remains below 4%.

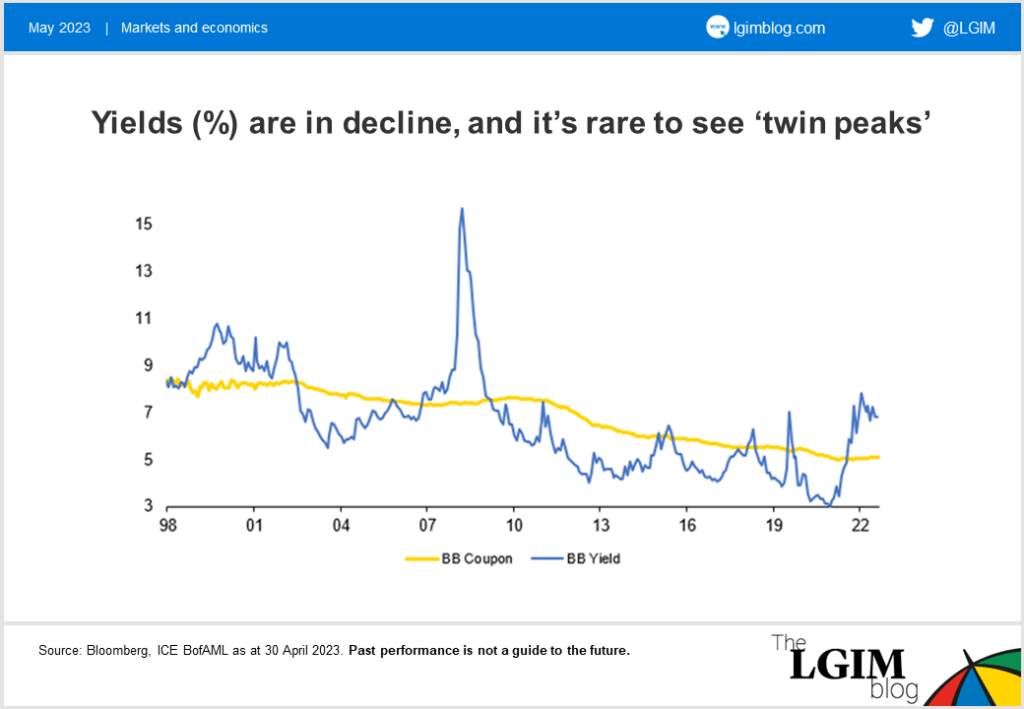

As the chart below shows, the yield on US high yield rated BB was well over 7% in September but has since retreated. With the aforementioned more positive backdrop, we believe it’s possible we’ve seen the peak in yields for this cycle. Historically, it has been very unusual for yields to ‘double spike’.

Although spreads could rise as defaults rise if the global economy enters recession, in that scenario the underlying ‘risk-free’ rate would be likely to fall, in our view, meaning that overall yields in high yield could remain around the same levels.

While clearly forecasting market moves is tricky, if we are going to have a meaningful economic slowdown, then historically spreads can move by around 2% and then potentially peak six months after the recession starts. They typically can then return to where they started within 12 months of the start of the recession (at which points default rates, which tend to lag moves in yields, could be peaking).

So even the spectre of recession isn’t necessarily a reason to shy away from high yield. In our view, now is a time to remain positive and keep an eye on how issuance trends progress. Just occasionally, one swallow can make a summer.