What do you get if you launch GB Energy, a National Wealth Fund, leverage the Crown Estate, throw in Mission Control, set up a task force for onshore wind, and reactivate the solar taskforce with industry experts?

Hopefully, the UK reaching net zero by 2030.

Here, Shayan Ratnasingam, senior research analyst at Gravis, discuses the plans for GB Energy, and the challenges the new government may face.

What is GB Energy?

Well, it’s not going to be a utility company, but rather an owner of renewable generating assets.

If you listen to the marketing rhetoric from Labour and consider the – in my view – somewhat meagre £8.3bn of funding, it sounds like it’s primarily solving the issue of the state ownership of energy assets and, as a by-product, supporting the target of reaching net zero by 2030.

GB Energy has the following five key functions:

- Project development – leading projects through development stages to speed up their delivery, whilst capturing more value for the British public.

- Project investment – investing in energy projects alongside the private sector, helping get them off the ground.

- Local Power Plan – supporting local energy generation projects through working with local authorities, combined authorities and communities.

- Supply chains – building supply chains across the UK, boosting energy independence and creating jobs.

- Great British Nuclear – exploring how Great British Energy and Great British Nuclear will work together, including considering how Great British Nuclear functions will fit with Great British Energy.

Reading between the lines of the Founding Statements, though still vague, two areas jump out:

Firstly, project development. The partnership with the Crown Estate will see GB Energy go further than just throwing cash at the problem. It will get involved in early-stage development work by unlocking projects on public land, prioritising strategic sites for development, and pre-packaging projects by conducting activities from land assessments and environmental surveys through to securing planning consent and grid connection.

The Crown Estate will use its data and spatial capabilities to identify suitable seabed sites for development for marine energy projects – essentially, de-risking the development stage so the private sector can focus on construction.

What about the Local Power Plan?

The Local Power Plan aims to roll out up to 8GW of small and medium‑scale renewable energy projects, using established technologies. Ed Miliband has previously announced his desire for a “solar rooftop revolution”. This will be achieved by providing funding, including shared ownership between local authorities and the private sector, and also provide commercial, technical and project‑planning support, to build a pipeline of local projects.

GB Energy will be an operationally independent company owned by the Secretary of State for Energy Security and Net Zero, which will be led by CEO, Juergen Maier, the previous CEO of Siemens UK, and overseen by an independent fiduciary Board, rather than Ministers, and trade union representation.

Partnering with the Crown Estate

As revealed in the King’s speech, Labour has put forward the Crown Estate bill, which plans to give it borrowing powers to support efforts to quadruple offshore wind. It is expected to unlock 20-30GW of new offshore wind seabed leases by 2030 – enough to power 20 million homes. In its 2023 Wind report, the Crown Estate – which has a £16 billion portfolio of land and seabed – highlighted it has up to 93 GW of potential capacity, including operational wind farms (15GW) and those either under construction (13GW), committed, or in pre-planning from current leasing rounds.

How will it be funded?

GB Energy will be capitalised with £8.3bn – not from day one, but over the term of parliament. The funding coming from the extension of the ‘Energy Profits Levy’ on oil and gas companies. Labour is also looking to court £60bn of private investment through its partnership with the Crown Estate.

The UK Infrastructure Bank (“UKIB”) has proven its ability to court private capital. The UKIB recently reported that it invested £3bn over the past three years and managed to unlock £11bn in private investment.

What will GB Energy invest in, and how do we get to Net Zero?

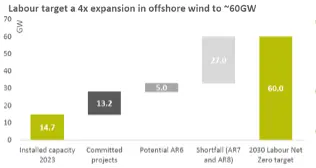

The bulk of the UK’s low carbon generation will come from mature technologies such as offshore wind and solar. Labour has set very ambitious targets to triple solar capacity to 50GW (lower than the 70GW target by 2035 proposed by the previous government), double onshore wind capacity to 30GW, and quadruple offshore wind capacity to 60GW by 2030 – that’s all in just six years!

GB Energy will play a role in supporting emerging technologies such as floating offshore wind, tidal, hydrogen generation and storage, nuclear, and carbon capture, and further support community schemes. Though the ambition is clear the role these technologies will pay in the future energy system has not been defied and the required capacity the government is targeting. For instance, the role of hydrogen in our heating systems will determine the required capacity. We also need to understand how GB Energy and the National Wealth Fund will work alongside other active schemes such as the government’s Hydrogen Allocation Rounds (HARs) which provides revenue support funding for low carbon hydrogen production across the UK.

The UK already has a functioning mechanism to encourage private investment into mature renewable technologies -the Contract for Difference Scheme (“CfD”) – which supports renewables such as wind farms with a fixed price for the electricity it generates.

A recent report released from the energy think tank, Ember, highlighted that, in order to meet the previous government’s target of 50GW in offshore wind by 2030, installations targets of 10GW of projects will need to be commissioned in 2024 and 2025 allocation rounds vs. the 3-5GW expected to be supported in recently closed Allocation Round 6 (AR6). In previous auctions, AR3 and AR4, 6.4GW was procured in each round. There is a serious risk the UK could miss its 2030 offshore wind target.

Ember estimates “every 1 GW of offshore wind installed would displace annual fossil gas consumption by enough to heat 630 thousand homes”. On more updated analysis, Greencoat UK Wind highlighted in its recent 2024 interim results, that in order to meet Labour’s new 60GW offshore wind target there is a 27GW shortfall to be addressed at future auction rounds. Greencoat also estimates that if Labour’s targets were achieved, the entire wind market – offshore and onshore – would be valued at £275bn by 2030 vs. the estimated £100bn at the end of 2023.

At over £1bn, the AR6 budget was the largest ever announced with a £800m pot for offshore wind. Labour will need to take a serious look at the budget for future CfD auctions, and prioritise an appropriate budget and strike price, rather than looking to drive down the cost of procuring renewable capacity which saw no offshore wind projects bid into Allocation Round 5.

What’s next?

The bill must still go to through the House of Commons, and may suffer setbacks, which means it could take some time before we see the investment on the ground.

There are also challenges around onshore renewables and community acceptance. The Prime Minister’s control over his party may be tested again, as we saw with the recent vote on child benefit caps.

The lifting of the de facto ban on onshore wind in England was an important first step, and there is a consultation as to whether to include larger onshore wind projects in the Nationally Significant Infrastructure Project (NSIP) regime, which would fast-track consenting by making project decisions at a national level rather than local.

Labour’s new Mission Control, led by former Chief Executive of the Climate Change Committee, Chris Stark, is set to include key stakeholders, including the regulator Ofgem, National Grid, and the Electricity System Operator, alongside GB Energy, and should remove obstacles to speed up the connection of new power infrastructure to the grid.

There are also challenges around the required labour force to build these assets, which will be competing with a drive for national home building.

Conclusion

While there are undoubtedly challenges ahead for GB Energy to succeed, the clear ambition and government signals supporting private sector investment should give investors cause for optimism.