In the realm of listed markets, the majority of transactions are secondary in nature, with the bulk of transaction volume stemming from the buying and selling of existing shares, as opposed to IPOs. This comes in stark contrast to the private equity world, where secondary markets accounted for only a bit more than 1% of the global private equity assets in 20241.

Yet secondary private equity markets have emerged and are growing, which suggests that they are becoming an essential tool for connecting buyers and sellers in order to trade private assets. This reflects the natural progression of a maturing market, moving towards how listed markets are today.

Secondary private equity transactions can take many forms. Investors may engage in a direct secondary transaction to trade direct stakes in a private company, or they may trade existing commitments in a private equity fund. For the latter, there are two key types of transactions:

LP-led transactions: These are the most common transactions and occur when a limited partner (LP) sells its stake in a fund (or stakes in several funds) to a secondary buyer, which then takes on the rights and duties of that limited partner in the existing fund. These transactions are initiated by an LP.

GP-led transactions: These transactions are initiated by a general partner (GP), typically to reorganize a company’s capital structure or to extend the investment period for selected assets in a fund. In this latter case, the selected assets are moved to a new vehicle and existing limited partners have the option to either roll over their holdings or sell to a secondary buyer at a set price.

An increasingly appealing segment, but why?

It was necessary and inevitable that secondary private markets would emerge and grow, especially given the long-term horizon and illiquid nature of private equity. Secondaries have become an important liquidity tool in an ecosystem where GPs are sometimes obliged to hold on to investments for longer than they initially intended as a result of higher interest rates, slower M&A activity, a light IPO market or simply the length of time needed to deliver on a business plan.

Even if the challenging exit environment improves on the back of falling interest rates and a recovery in M&A activity, demand for secondaries is well poised to remain robust; it will continue to be inseparable from demand for liquidity, which is highly secular and personal. Cash holds deep value regardless of the market climate or business cycle.

While liquidity was a key reason for the boom in secondaries and represents an important benefit for sellers, secondaries also provide benefits for investors:

Potential for attractive pricing and structuring: Secondary private equity markets let investors buy at a discount in exchange for the provision of liquidity in an inherently illiquid asset class. Secondary transactions also allow for the negotiation of terms such as payment times and whether leverage can be used to acquire a portfolio, offering the flexibility to find a win-win deal for all parties.

Access to established portfolios and diversification: Because these investments involve acquiring portfolios with known underlying assets, blind pool risk is reduced, and investors can carry out more in-depth due diligence in their investment processes. The underlying companies are typically further along in their value creation cycle; in addition, these portfolios are often highly diversified, offering broad exposure to companies of different sizes, sectors, vintages and geographies.

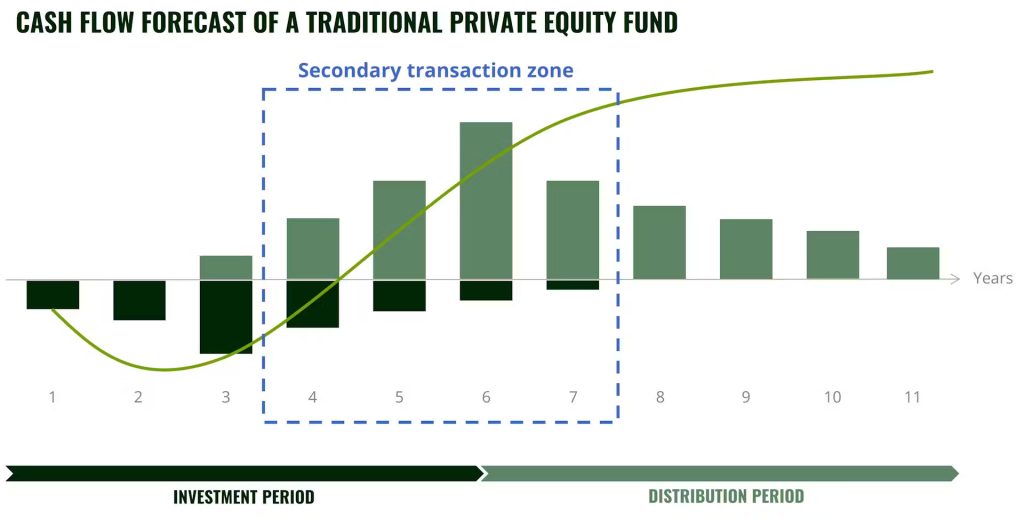

J-curve mitigation and faster return on capital: The J-curve illustrates the expected net cash flows from a typical private equity primary investment. As displayed in the graph, returns are negative in the capital call period. Those investing in secondaries can enter in around Year 4 to Year 7 of a conventional fund’s life cycle, implying exposure to more mature companies – hence cutting down the time until exits are made, and cash can be expected to be returned.

Capturing this segment’s potential: Carmignac Private Evergreen

Secondary private equity markets are clearly a vital source of liquidity for traditional private equity investors. Nevertheless, an important question remains: how can investors gain access to these transactions? We’re witnessing the beginning of a secondary buying opportunity in private markets, and we want our investors to be able to take part in this long-term trend, starting today. Secondary private equity markets have already experienced a robust growth trajectory, with transactions reaching an all-time high of $160 billion in 20242, and are expected to stay on an upward trend in the years to come.

Carmignac Private Evergreen, one of the few funds that focuses on pure private-equity exposure, has a substantial allocation to secondaries in order to fully benefit from the advantages this segment can offer to a traditional portfolio.

Carmignac Private Evergreen A EUR ACC

Recommended minimum investment horizon

5 years

SFDR – Fund Classification**

Article 8

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either ‘Article 8’ funds, which promote environmental and social characteristics, ‘Article 9’ funds, which make sustainable investments with measurable objectives, or ‘Article 6’ funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.