We launched Carmignac Private Evergreen one year ago, driven by our strong conviction in the potential of private equity to deliver attractive returns and serve as a powerful diversification tool for portfolios. Our goal is to give all types of professional investors a one-stop shop for investing in a diversified selection of high-quality buyout companies from day one.

Performance of the Fund

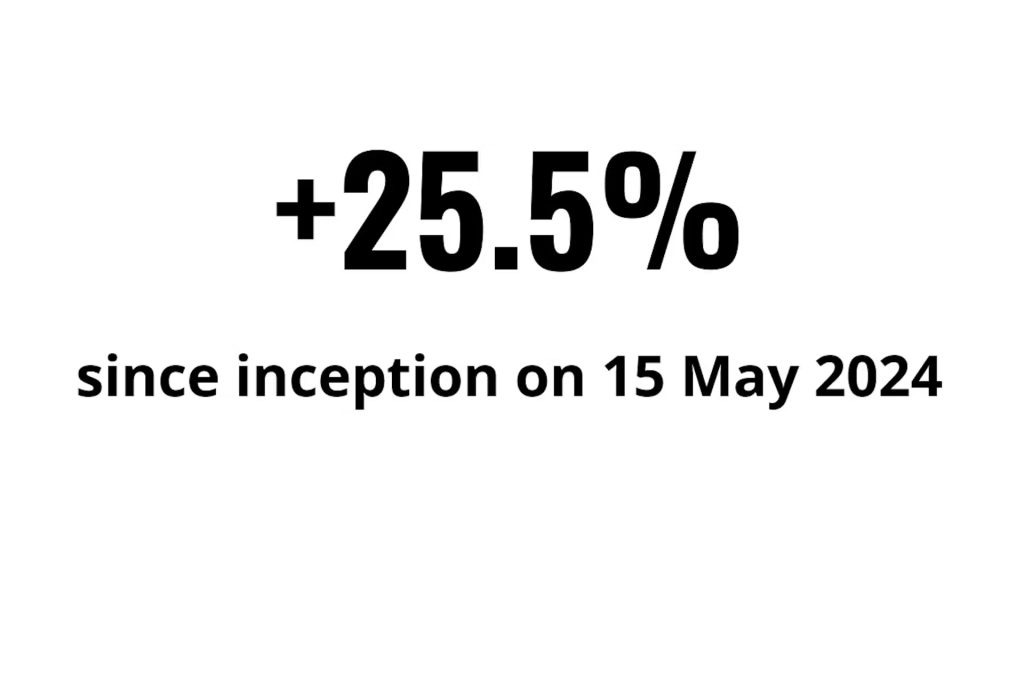

We’re delighted to report that our fund has delivered robust performance and created significant value for investors in its first year. Our fund management team has successfully built a diversified portfolio of quality assets consistent with our long-term strategy. Their hard work, coupled with our partnership with Clipway, has proven effective.

“Getting to this point is a testimony to our well-planned strategy, supported by capital from our balance sheet and our firm private equity convictions. After establishing a partnership with Clipway and forming an in-house private equity team in 2023, and then launching Carmignac Private Evergreen in May 2024, we’ve delivered an encouraging performance so far in 2025. This marks only the beginning of our foray into private markets. We’ll undoubtedly continue to enhance our product range. Our clients will be able to seize private equity opportunities through unique products that encourage widespread access to this asset class.”

Maxime Carmignac

Chief Executive Officer, Director of Carmignac UK Ltd.

Beyond performance: the Fund’s first year in figures

9

investments

5

secondary deals

40+

private equity funds*

380+

underlying companies*

3

direct investments

€138m

AuM

We began a strategic process of deal warehousing from the outset, which enabled us to secure attractive deals early on and offer investors a diversified, ready-made portfolio. This approach demonstrates our sourcing capabilities and gave us a robust foundation for capitalizing on market opportunities from day one.

Since then, our active management style has driven further value across our portfolio, whose nine investments provide exposure to over 380 companies in a number of sectors and geographies, with a focus on developed markets. Backed by a disciplined selection process, we’ve acquired high-quality assets at an average discount of 15% – significantly above the market average of 6%1 – underscoring our commitment to delivering consistent, long-term returns for investors.

What makes Carmignac Private Evergreen an appealing solution?

- We’ve invested over €2 billion of our own capital alongside our clients’ assets in the funds we manage, and this includes a substantial share in our private equity solutions.

- Our Evergreen fund draws on our established capabilities in risk management, company valuations, and cash management.

- We’ve formed a strategic partnership with Clipway, an innovative secondaries firm that provides access to co-investments with attractive terms typically reserved for large institutional investors.

- The fund is managed by a seasoned team of four dedicated portfolio managers who together have nearly 70 years of experience. They’re supported by Carmignac’s sector-specific knowledge and ESG expertise as well as 18 investment professionals at Clipway.

Our approach at a glance

We’ve adopted an evergreen structure to address the typical challenges of investing in private equity: an illiquid market, limited access to opportunities and top portfolio managers, and the complexities of cash management. This evergreen structure gives all professional investors:

- access to rivate equity, with a lower minimum required investment;

- quarterly windows for redeeming all or part of their investment;

- simplified administration procedures and compounding of dividends (through reinvestment).

With our investment strategy, you benefit from:

- a portfolio focused mainly on secondaries – a well-diversified asset class with long-term tailwinds;

- investments oriented towards European and US buyout transactions involving mature, profitable companies with strong track records;

- an SFDR Article 8 fund with ESG assessments embedded into the investment process.